Growth in the global economy is expected to be 3.9% in 2010. led by improvements in the financial sector by emerging and developed economies are projected to grow by 6% dominated by China and India.

It is estimated that the Caribbean economies contracted by 2.2% in 2009 and areis projected to grow by 1.8% in 2010.

The Domestic Economy

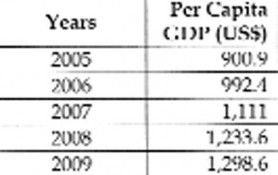

Half-year decline in real GDP was reported by the Minister of Finance during November at 1.4%, with dismal performance in the agriculture and mining sectors.

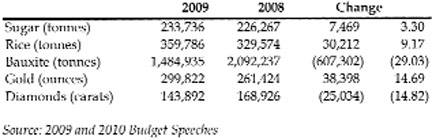

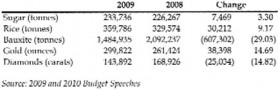

Sugar production increased by 7,469 tonnes or 3.3% over 2008. Production for the first half of 2009 fell short by 19,923 tonnes or 19.3% below the corresponding period in 2008. The second crop produced an increase of 27,392 tonnes over the corresponding period in 2008. In rice, 53,633 tonnes were produced in excess of the projected 306,156 tonnes, attributed to favourable weather conditions and Government’s fertiliser assistance and training programmes.

Mining and quarrying continued with positive growth of 0.7%. Influenced by high international gold prices and suitable weather conditions, raw gold declarations were 299,822 ounces, exceeding the previous year by 14.7%. Diamond declaration however fell by 14.8% to 143,982 carats. Bauxite decreased by 29% continuing from a similar decline in 2008 of 6.7%.

Source of information – Budget Speech

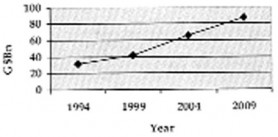

Domestic Debt

Source of information – BOG Statistics – All shown at December except 2009.

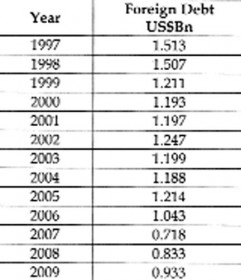

External Debt

Source of information – BOG Statistics and Budget Speech – All shown at December

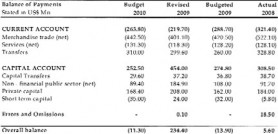

Balance of payments

Source of information – Estimates of the Public Sector

The reported private transfers representing remittances and in-kind transfers, amounted to US$299.6Mn in 2009.

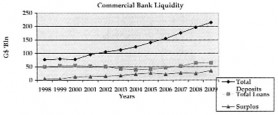

Banking and Interest Rates

There was stability in the 91-day Treasury bill rate at 4.18% and the weighted average prime lending rate at 14.54%. On the other hand, the small savings rate declined from 3.04% to 2.78%.

The following table shows the spread earned by the commercial banks as the financial rates continue to decline.

Source of information – BOG Statistics

The Exchange Rate

There was a slight appreciation in the value of the Guyana dollar to the US dollar from G$205.25 to G$203.25 per US dollar, or 0.97%.

Ram & McRae’s Comments

Source: 2009 and 2010 Budget Speeches

● The results of the diversification of the economy are still not evident two decades after the ERP began. As a result, when agriculture declines, the economy suffers. Transforming the economy cannot mean diverting increasing sums to agriculture each year.

● The two sectors most affected by the global downturn are manufacturing and bauxite, the latter having several years of swings in performance. For a true turnaround in the economy, manufacturing has to show positive gains.

● With industrial action, weather patterns and cash flow difficulties affecting the Guyana Sugar Corporation, it is relying increasingly on budgetary support for its survival.

The reduction in diamond output for five consecutive years is perhaps due to resources being sifted to gold, attracted by by higher prices.

● It appears that the view in the bauxite industry is that the unions are a hindrance to the industry’s success.

● While the exchange rate of the US has improved marginally, the average rate of the major currencies declined.

● The Government continues to ignore employment data. NIS actual contribution data indicate no growth in employment, even as about ten thousand youths leave school annually. In the past five years the number of employed persons increased by 4,632 while the number of self-employed persons decreased by 771.

●Like in the US, the financial sector is outperforming the other sectors. Like in the US, the financial sector benefits form tax shelters so that their effective tax rate is far less than the nominal corporation tax rate of 45%.