Rawle Lucas is a Guyanese-born Certified Public Accountant and Assistant Vice-President of the Lending Services Division.

Mr. Lucas has agreed to serve as a columnist with the Stabroek Business and will be contributing articles on economic, financial and development matters.

Lofty Aspirations

Every year, youths around America dream of going to college. Spurred on by motivated parents at home or disappointing incomes from unskilled jobs in the community, these students study hard and shoot for the top, hoping to land an education that would let them move forward with their hopes and dreams, whatever they may be. Also, since everyone from parents to politicians has stated that much of the conflict in the world stems from ignorance, college provides students the opportunity to meet people of different backgrounds and learn about how they live and how they view the world. However, the pursuit of these lofty aspirations might be leading to what some financial managers are calling a “higher education bubble.”

Financial Aid

Typically, one stands to benefit quite a bit from a college education. Prompted by the ideal of an educated society, the federal government pumps billions of dollars into programmes which are intended to make college affordable, especially for students from low-income and underprivileged backgrounds. Federal financial aid is an important vehicle for achieving this goal; it is made up of grants to students and loans that could be taken out by both students and parents. As evidence of its importance, the number of undergraduate students who received federal financing for their college education keeps growing. Within the last 10 to 15 years, the share of students receiving federal financial aid grew from 37 percent in 1995 to 48 percent in 2008, and many colleges have pegged their tuition to this money.

Education Loans

Still, an increasing number of students are unable to fully fund their education with scholarships and federal money, so a growing percentage of them are taking on a large amount of debt to finance their education at both public and private universities and colleges. Private education loans represent a small share of the education loan market, but this segment has grown rapidly. For example, data in the Digest of Education Statistics indicate that in the school year 1999-2000, the share of students using private education loans amounted to four percent. By 2008, the market share amounted to about US$24 billion, representing a near fourfold jump to 15 percent of the undergraduate market. The trend in private financing of education has alarmed some experts who now believe that, in light of current economic conditions, an education bubble exists and that that bubble is likely to burst.

The trend in borrowing exposes a radical shift in the dependence on private loans for education; about 10 years ago, only 29 percent of undergraduate students borrowed money from any source to pay for their education. Now, that figure approximates 40 percent. Within that dynamic, private lending has undergone dramatic change. A staggering 92 percent of students attending for-profit universities rely on loans from private lenders to finance their education. The growth in borrowing has also jumped among students attending public universities and non-profit institutions. In the case of the private non-profit institutions, nearly half of its students depend on loans from private lenders to complete their education.

Uptick

Like a horse and carriage, the increase in borrowing has been accompanied by an increase in default. According to the Department of Education’s most recent data, students were currently defaulting on their debt at a rate of at least 7.2 percent in 2008, up from 6.7 percent in the previous year, and analysts who study these issues expect the rate of default to climb. This is one reason why some experts feel that the education bubble could burst. Students go to college expecting to earn substantial amounts of money after getting their degree since they heard that graduates earn better incomes than non-graduates. Despite the truth of that statement, recent college graduates have entered into a very harsh job market despite a recent National Association of Colleges and Employers (NACE) report noting a 5.3 percent uptick in hiring. Graduates usually enter the job market owing between US$30,000 to US$40,000 to lenders. The harsh environment is making it difficult for students to find jobs that let them keep up with their debt payments. It is another reason there is a feeling that we are on the cusp of an education bubble.

Loss of Business

Some economists have likened the “higher education bubble” to the housing bubble. With the housing bubble, banks gave loans to borrowers who were very risky prospects due to their low incomes and blemished credit history. With education, even though low income students get money through federal and state needs-based programmes, many still end up having to rely on private lenders to fill gaps in education funding. This seems particularly true for those students who see the need to attend high-priced private universities and colleges. Some of these students also obtain degrees of questionable value, thus making it difficult for them to land well-paying jobs and to repay their loans with ease. With the current economic challenges in the USA, the growth in student debt is approaching the point where it could begin to negatively affect the investments and revenues of lenders. In addition to the increasing default rate, lenders might be seeing the emergence of a threat to their investments with a 50 percent decline in borrowing by students for the 2009-10 school year. The loss in business hurts the bottom line but lenders must be comforted by the knowledge that student loans are not easily discharged through bankruptcy.

Female Gender

An interesting aspect of this issue is the extent to which the female gender might be impacted. During the period of growth in student borrowing, there has been a growth in female enrollment in universities and colleges. Currently, women make up 57 percent of all college enrollees, and a higher proportion of them rely on student loans for their education. Repayment of such debt by women is made more difficult by the disclosure that they tend to receive lower wages than men. Recent estimates show that, on average, women earn about 20 percent less income than men, and could find it difficult to repay their student debt.

In conclusion, the higher education bubble has only shown early signs of stress as the default rate climbs slowly but steadily. While a college degree still retains great value despite the increased supply of graduates, the bubble continues to inflate as many a starry-eyed student dream of a chance at college to get a degree that ought to lead them to gainful employment.

However, a bursting education bubble wreaking havoc on the economy like the housing bubble did is low since borrowers cannot walk away easily from their student loans.

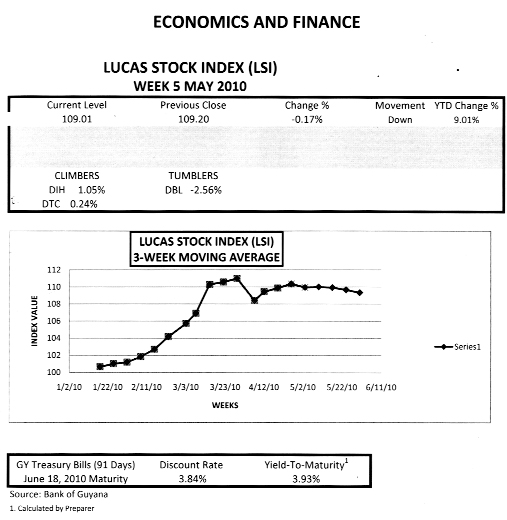

LUCAS STOCK INDEX

In week five of May, the Lucas Stock Index (LSI) experienced a further decline by nearly two tenths of one percent. The stocks of five companies were traded on the Guyana Stock Exchange and their variable performance was enough to push the LSI lower. The stocks of DIH climbed 1.05 percent helping it to reverse its losses of the previous week. Also climbing were the stocks of DTC which gained a quarter of one percent in the week’s trading. At the same time, the stock price of DBL fell for the second straight week by more than 2.5 percent while the stock price of DDL and CCI remained unchanged. The pressure from DDL caused the LSI to decline for a second straight week, placing the returns at 9.01 percent for the year. Notwithstanding the decline, the LSI remains in positive territory for the year and significantly above the yield on the risk-free Treasuries that will mature in June 2010.