Introduction

After what appeared to be a lull in the roller-coaster ride of the medium and small-scale gold miners, the fraternity is once again questioning the good faith of those who control the ride’s levers, and is in mortal fear of its own survival. In February 2010, Bartica, the gateway to the interior was shut down by that community amidst fears that the industry was being made a hostage to the Low Carbon Development Strategy (LCDS), and more particularly the Guyana-Norway Memorandum of Understanding (MOU). The industry or rather the sub-sector was concerned that its operations were becoming subject to the Guyana Forestry Commission, with a six-months waiting period for approval for mining in any new area and the reduction in the claims any one person could hold.

Damage control

The government and its ministers were not to be left out. They made flying visits to Bartica to reassure the community of the government’s commitment to gold mining. In his characteristic fashion, the President whose signing of the MOU without consultation with the wider mining community was the trigger, met the miners at the Convention Centre and promised to look into their problems. He appointed a Special Land Use Committee headed by Minister Robeson Benn to make recommendations to him. Those recommendations are now the latest casus belli.

The GGDMA had earlier criticised the report of the committee as not a true reflection of the agreement reached between the representatives and the GGDMA. Disputed issues included the six months waiting period, the allocation of areas for mining and environmental concerns. From a paper I have prepared for the GGDMA, it is clear that there is no land use policy for the mining sector. The figures which one hears, depending on whether one speaks to the Geology and Mines Commission or to participants or representatives in the mining sector, vary so widely and wildly as to be unreliable to the point of being useless.

Data deficiencies

In fact, the paucity of reliable data in the sector, whether of the acreage actively mined in any year, the number of active miners, the number of persons employed in mining, the quantity of gold mined (as opposed to declarations), the number of Brazilians who have literally invaded some of the lucrative gold mining locations in the country, often illegally, and the contribution of the sector to the national economy, both direct and indirect, should have been a sufficient cause for more sober consideration.

Decisions of such magnitude, with consequences that go beyond economic and social considerations; that amount to a fundamental re-configuration of the National Development Strategy; and that affect the lives and communities of coastlanders and hinterland communities alike, would normally deserve more than the epiphany of a single individual. But that assumes a certain logic that has been missing from our national debates and decisions.

Appeal to reason

Even with all the uncertainties mentioned in the previous but one paragraph, there are sufficient data contained in the official statistics that would have informed a more rational approach by the government to the sector. The problem is that what is rational for the mining community – the ‘goose’ referred to in the caption – may not be the same for the gander: the government as legislator and regulator.

Rationality may depend on motives as well. If compliance with legislation was dear to the heart of this government, then it would have some explaining in justifying the revival of a claim which under the Mining Act was long dead. Very few Guyanese would be convinced that it was anything but to help one of its own, someone who incidentally is a member of the very committee that is looking into cleaning up the regulatory framework.

The government may consider the mining community too independent for its own liking. Why can’t they, like FITUG, the religious organisations, the consumers and the rice industry, keep quiet, not rock the boat and not embarrass the government?

If there is one industry that has benefited from the financial mess since the latter part of 2008, it is the gold mining sector. It is as the title of a report prepared for the GGDMA by Professor Clive Thomas, Too Big to Fail.

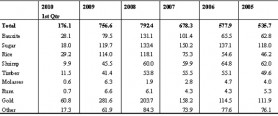

The data are compelling. Take for example the export statistics since 2005 as published by the Bureau of Statistics.

(US$ Million)

It needs no analysis that since 2007 gold has been the major earner of foreign exchange for the country. It won the right to that claim when it replaced sugar as the country’s number one export earner. In 2009 it earned three-and-a- half times bauxite earnings, just under two-and-a- half times the earnings of sugar, two-and-a-half times rice, and more than one-and-a-half times the combined earnings of all other exports.

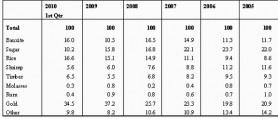

As the next table shows, the percentages are striking. Gold is king, or as Mr Robin Stoby, SC, Chairman of the Guyana Bank for Trade and Industry said in the bank’s 2009 annual report, “…the shining star of the economy was the production of 300,000 ounces of gold in [2009]. The incentive for greater production was the high price for gold which topped US$1,000 in the year, no doubt, the beneficiary of the loss of confidence in other stores of value.”

Exports earnings in percentages

Sources: Bank of Guyana and Guyana Bureau of Statistics

The gold price has now reached US$1,200 but with the uncertainties following the “six months waiting period,” production took a dip. Even so, buoyed by the high price, and the lull in the roller-coaster, it is reported that production has bounced back and perhaps optimistically, was projected to reach 500,000 ounces for this year. That projection has been revised downward by 20% to 400,000 ounces. It remains to be seen whether this will materialise. What sources tell me, however, is that there were also good signs in the second quarter and that export earnings in the first half of 2010 as a percentage of total export earnings actually exceeded those of 2009.

Conclusion

With so many other sectors still to rebound, gold should be treated like a queen, not subject to threats, and as if it is an unwanted orphan. But that is how the industry is being treated. It just makes no sense.

It reinforces the impression of many that if friends of those in high places cannot benefit directly then pressure will be brought to bear.

But then economic logic and political considerations are antagonistic forces, mutually exclusive and self-contradicting.

I suggested last week that the reason for the government’s action against the industry is based entirely on political logic rather than rational economics. The LCDS is preferred to the small and gold mining sector because the money from the LCDS goes to the government for it to spend as it sees fit.

The money from gold goes first to the GGMC by way of a sliding scale royalty that tops at 5%, then to the GRA by way of a 2% gross tax, and the balance to the operators. In the case of corporate gold operators the 2% does not apply and is replaced by a 35% corporate tax on net profits.

To be continued