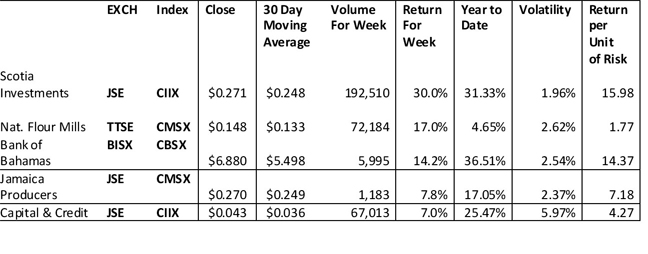

For the week ended April 27 2011, 8,409,346 shares, valued at $1, 867,405, crossed the floors of the six stock exchanges across Caricom, with 27 stocks advancing, 14 declining and 80 remaining unchanged. Salada Foods was the volume leader with 2,002,200 shares being traded, Scotia Investments posted the largest gain of 41.20% for the week, while on the losing end, Finance Corporation of the Bahmas fell 4.1%. For the week, twelve of the CSX 30 stocks advanced, four declined and fourteen were unchanged. The CSX 30 gained 9.43 points to close the week at 1,1191, up 4.82% year to date. On the junior market, four stocks advanced and six were unchanged. The CJSX advanced 7.76 points to close the week at 1,118.8, down 3.42% for the year. The CJSX was led by Lasco Manufacturing which posted a gain of 2.17%. Table 1 provides a summary of the broad market indices for the week as well as some international reference points.

Table 1: Broad Market Indices April 20 to April 27, 2011

Sector Analysis

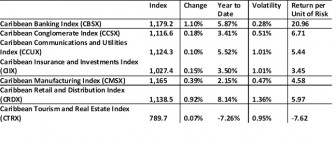

Table 2 provides a summary of the sector indices, followed by details on the performance of the stocks in each sector.

Table 2: Sector Indices April 20 to April 27, 2011

The CBSX registered the largest gain for the week (1.10%) as seven banking stocks advanced, two declined and thirteen were unchanged. Solid gains by Bank of Bahamas (14.18%), Capital and Credit Financial Group (7.03%), Scotia Group Jamaica (6.72%), National Commercial Bank of Jamaica (6.30%) and Bank of Nevis (4.55%), overpowered losses of 4.13% for Finance Corporation of the Bahamas and 4.00% for Demerara Bank Limited, to see the CBSX advance 12.85 points for the week. The CRDX posted the second largest gain for the week (0.92%) as two retail and distribution stocks advanced, one declined and seven were unchanged. The CRDX was led by a string gain of 5.44% in Cave Shepherd shares. The CMSX was next with a 0.39% gain. For the week six manufacturing stocks advanced, four declined and twenty were unchanged. Solid gains were posted by National Flour Mills (16.97%), Demerara Distillers (3.77%), Desnoe & Geddes (3.01%) and Berger Paints Jamaica (2.65%). These gains saw the CMSX advance 4.47 points to close the week at 1,165.

Performance continued to be mixed in the Insurance and Investments sector where three stocks advanced, five declined and nine were unchanged. Scotia Investments and Jamaica Money market Brokers posted gains of 30.03% and 2.11% respectively, while Doctors Health Services, Mayberry Investments, Insurance Corporation of Barbados and First Jamaica Investments posted losses of 3.57%, 2.44%, 1.64% and 1.30% respectively. The net result was that the CIIX advanced 1.57 points for the week. The other sector indices were generally flat with Radio Jamiaca of the CCUX posting a 6.38% gain for the week.

stocks advanced, five declined and nine were unchanged. Scotia Investments and Jamaica Money market Brokers posted gains of 30.03% and 2.11% respectively, while Doctors Health Services, Mayberry Investments, Insurance Corporation of Barbados and First Jamaica Investments posted losses of 3.57%, 2.44%, 1.64% and 1.30% respectively. The net result was that the CIIX advanced 1.57 points for the week. The other sector indices were generally flat with Radio Jamiaca of the CCUX posting a 6.38% gain for the week.

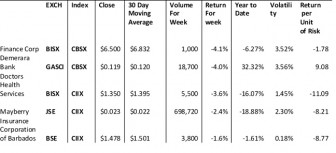

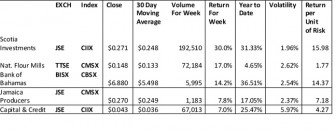

Stocks On The Move

Tables three and four provide some widely used financial metrics on the biggest movers for the week. The five biggest gainers and losers for the week are highlighted. Readers should note that prices are in US dollars.

Investing School ( Value Stocks and Value Investing )

A value stock is typically defined as a stock that tends to trade at a lower price relative to it’s fundamentals (i.e. dividends, earnings, sales, etc.) and thus considered undervalued by a value investor. Common characteristics of such stocks include a high dividend yield, low price-to-book ratio and/or low price-to-earnings ratio. A value investor believes that the market isn’t always efficient and that it’s possible to find companies trading for less than they are worth.

Department of Management Studies, UWI Cave Hill. Justin.Robinson@ uwi.cavehill.edu