Is El Dorado “the lost city of gold” in Guyana? Is El Dorado “the lost city of gold” in Essequibo, the Cinderella county of Guyana? Throughout the centuries, many adventurers were driven by the passion that surrounded the enduring tale of a city of gold. In the 16th and 17th centuries, Europeans believed that somewhere in the New World there was a place of immense wealth known as El Dorado. Their searches for this treasure wasted countless lives, drove at least one man to suicide, and put another man under the executioner’s ax. This dream city of El Dorado shifted geographical locations until finally it simply meant a source of untold riches somewhere in the Americas.

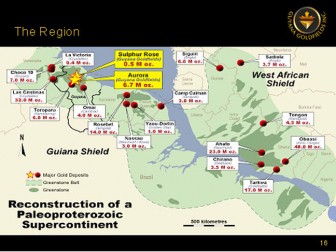

On Thursday March 24, 2011, a Canadian company, Guyana Goldfields, listed on the Toronto Stock Exchange made a presentation that might provide an answer. To a standing room only audience of government officials, diplomats, the private sector and civil society at the Pegasus hotel, Guyana Goldfields, under the banner of “Creating Opportunities, Helping Communities, Caring for the Environment, Proudly Building a World-Class Mine” unveiled a gold find of more than 6.7 million ounces at their Aurora site next to the Cuyuni River. The company which has been exploring in Guyana since 1996, having spent over US$ 86 million dollars during the last 15 years, in a very graphic power point presentation highlighted that the gold find was predominantly underground. The significance of this is that this would be the first underground mine in Guyana and in South America. Presenting the map pictured, the company showed where various deposits have been found and by doing so raised the question in the audience’s mind about the possibility of El Dorado.

1. The Aurora Project brings tremendous benefits to Guyana that are unsurpassed by few in addressing and validating the government and the president’s position of “Reconciling the need to balance the economic value and employment generated by these sectors with the desire to limit forest-based emissions is one of the most important and complex challenges in implementing REDD+ and the LCDS.”

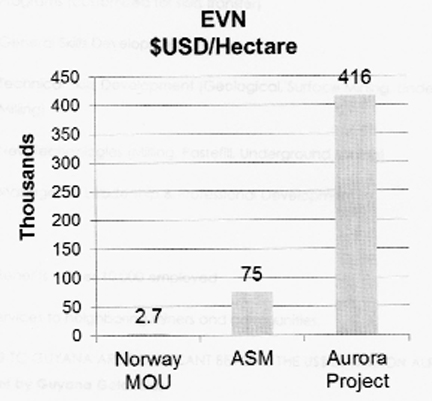

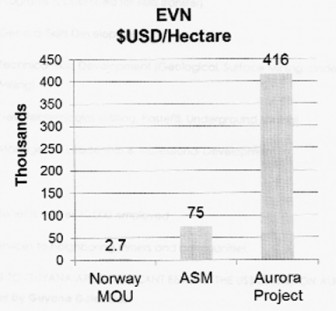

2. Aurora maximizes the Economic Value to the Nation (EVN). The Norway agreement providing US$27,000 EVN per hectare, local miners US$ 75,000 and Aurora US$ 416,000 per hectare.

3. At Aurora there is minimal deforestation because 2/3 of the mine is underground.

4. Guyana Goldfields would minimize carbon emissions through potential use of hydropower (green technology). Feasibility studies have already been done for a 15 MW plant.

What does this project mean to Guyana?

◊ Employment

► During exploration and pre-development (2011) – over 250 staff and workers

► During development & construction (2012-2013) – up to 700 staff and workers

► During operations (2014 and beyond) – 400-500 staff and workers

► Workforce target 90 – 95 % Guyanese Nationals

◊ Employee Programmes

► Benefits (Health, Medical, etc.)

► Training programmes (customized for skills transfer)

● General skills development

●Technical skills development (geological, surface mining, underground mining, milling)

● New technologies (milling, pastefill, underground mining)

● Managerial, leadership & professional development

◊ Others

► Indirect benefits – over 10,000 employed

► Health Services to neighbouring miners and communities.

Financially, the benefits to Guyana are significant beyond the US$86 million already spent

● Capita investment by Guyana Goldfields

► Exploration (1996-2010) – G$17 billion (US$86M)

► During exploration and pre-development (2011) – G$8 billion (US$40M)

► During surface development & construction (2012-2013) – G$65 billion (US$325M)

► During underground development & construction (2014-2015) – G$35 billion (US$175M)

► During operations (2014-2030) – G$20 billion (US$100M)

► On-going Exploration over 10 years (2012-2021) – G$20 billion (US$100M)

► We believe this will be the largest foreign investment in Guyana in the mining sector

● Direct financial revenues to government

► 5 % Royalty – projected value of G$32-50 billion (US$160M-250M)

► 30 % Corporate Income tax – projected value of G$37-100 billion (US$250M-400M)

► Payroll taxes – projected value of G$44-50 billion (US$220M-250M)

► Other direct and indirect benefits

► Attracting new investors (retail and institutional)

► Helping put Guyana on the map for Foreign Corporate Investments

SUMMARY

Guyana may well indeed have its own El Dorado. Guyana Goldfields believes there are many more ounces of gold at its Aurora site and are aggressively drilling at the location. The reality that most of the gold is underground is significant. With the IFC as an equity partner and with the World Bank (of which the IFC) is a member, environmental issues and Guyana’s LCDS plan will ensure environmentally sustainable mining.

Guyana has a lot to look forward to if indeed this project is licensed through a now being negotiated mineral agreement with the Government of Guyana which will indicate royalties, takes and other fiscal arrangement as well as environmental and social obligations.