The Eastern Caribbean Central Bank (ECCB) and the Government of Antigua and Barbuda announced on Saturday that the ECCB has assumed control of the ABI Bank after it had encountered difficulties conducting its normal operations due to an inadequacy of liquid assets.

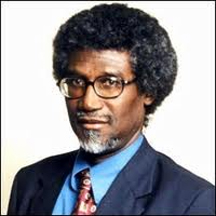

In a press statement, Governor of the Eastern Caribbean Central Bank (ECCB) Sir Dwight Venner said close monitoring of the Bank revealed the said difficulties due to an inadequacy of liquid assets and an inability to meet the statutory reserve requirement. After consultation with the government, the Board of Directors of Antigua and Barbuda Investment Bank (ABI) Bank and the banking community in the Currency Union, the ECCB recommended to the Monetary Council that in order to restore the Bank to normalcy as quickly as possible, the ECCB should assume control.

The Monetary Council approved the recommendation which has been implemented as of July 22. In taking the decision, it took into consideration the continuing impact of the global recession, the CLICO/BALCO issue, the rescue of the Bank of Antigua and the top priority assigned to financial stability in the Currency Union, the release said. The affairs of the Bank will now be carried out by Central Bank staff and current ABI Bank staff with support from “a dedicated group of bank specialists who together would give their undivided attention to the restoration of normality at the ABI Bank.”

Sir Dwight said role of the ECCB under the powers granted to the Central Bank is to protect depositors and creditors and he urges them to persevere while the EECB addresses the problems currently challenging the ABI Bank. He also recalled that through ECCB intervention at the Bank of Antigua, no person lost their deposits and the institution which replaced it is now functioning normally. “On that occasion, I pointed out that banks are not warehouses where your money is permanently stored. The money needs to be lent out so that the bank can earn a sufficient return to pay interest to the depositors, compensate staff and earn a profit,” he said. Sir Dwight also noted that if demands for money are made by everyone at the same time it will be impossible to meet them all.

Antigua and Barbuda Minister of Finance and Economy Harold Lovell said in agreeing with the takeover, the government was particularly mindful of the current economic conditions obtaining in the island nation and the need to maintain financial stability there, and, by extension, within the Currency Union. The government also took into consideration the successful rescue of the Bank of Antigua and will continue to work with the ECCB to ensure that all steps are taken to protect the interests of depositors and creditors of the ABI Bank. “We are confident that our collective actions will restore the bank to normality, and maintain stability within the banking system,” Lovell said.

In addition, Antigua and Barbuda Prime Minister Baldwin Spencer also expressed confidence that as had been demonstrated with the successful intervention with the Bank of Antigua the issues at the ABI Bank can be resolved. He said the government was fully committed to preserving the safety and soundness of the country’s banking system and it is confident that the collective action it has taken, along with the Central Bank, will serve to maintain the soundness in the banking and financial sector as a whole. Spencer said he had also consulted with Leader of the Opposition Lester Bird and Chairman of the Antigua Labour Party Gaston Browne on the issue and received broad support for the intervention in returning normalcy and stability at the ABI Bank and in the banking system generally.