Loan Portfolio

The most recent quarterly statistics from the Bank of Guyana show a mixed picture of the lending patterns of the commercial banks in Guyana. Two years ago, the three foreign-owned banks operating in Guyana saw value in doing business with Guyanese households and had consumer lending as against business lending as a substantial part of their loan portfolio. The report that covers the quarter ended in September 2010 revealed that the banking sector in Guyana made about 16 percent of its loan portfolio available to Guyanese consumers, even though the disposition in lending varied widely among banks. The contrast between the foreign and local banks was stark and revealed differing approaches to utilizing deposits of customers and the strategy for generating future growth in the industry. In the third quarter of 2010, the foreign banks had given an average of 24 percent of their loans to Guyanese households while the local banks had given an average of eight percent. As of September 2012, that pattern had not changed much and the foreign banks as a whole had given 17 percent of their loans to households compared to six percent for the locally-owned banks. The bank bucking the downward trend is Republic Bank which has been constantly growing this part of its loan portfolio.

Double-Digit Shares

In contrast to two years ago, only two of the three foreign-owned banks gave more than 10 percent of their loans to Guyanese families. The biggest support for household financing had come from the Bank of Baroda, which had used 30 percent of its portfolio on Guyanese households. Republic Bank also set aside a sizable portion of its loan balances for Guyanese consumers during that period, using 27 percent of its loans for that purpose at that time. Today, one local bank, Demerara Bank Limited (DBL) has moved to build up its portfolio to household borrowers while the Bank of Baroda has drastically reduced its exposure to this category of borrowers. Compared to two years ago, DBL has increased its share of loans to households by five percent in contrast to the BOB which reduced its household portfolio by 78 percent. The Bank of Nova Scotia (BNS) which had over 15 percent of its portfolio in household debt two years ago also seems to have cooled towards the consumer market. The 2012 data show a 10 percent decline in the share of household loans in the BNS portfolio.

The Trend

Even though Demerara Bank and Bank of Baroda have increased their share of consumer lending within the last year, the movement has been unsteady. Notwithstanding the performance of individual banks, the industry trend is not promising. The numbers indicate a declining supply of loans to households from 2009 to 2012. In 2010, loan balances to households as a share of total debt were down by 13 percent compared to the last quarter of 2009, at which time the three foreign banks held an average of 24 percent of their portfolio in consumer debt. The downward movement was noticeable in the industry as a whole in 2011. The industry average has declined from 16 percent in 2010 to 15 percent in 2012.

Despite its relatively small share of the consumer market, the BNS remains the bank that seems interested in making full use of its assets and deposits. Sixty-six percent of the assets and 77 percent of the deposits of the BNS were in the form of loans at the end of September 2010. This was twice as much as each of the other banks, foreign and local, with the exception of Citizens Bank that held about 45 percent of its assets and 56 percent of its deposits in loans. That pattern has changed slightly in the last two years. Not only have the locally-owned banks improved their loan-to-assets and loan-to-deposits ratios, Citizens Bank has virtually caught up with BNS in this regard. It now carries a 68 percent loan-to-deposits ratio and a 57 percent loan-to-assets ratio.

Smaller Variability

There is no doubt that the banks should be concerned about the structure of their portfolio and how it is managed since the financial performance of these banks changed noticeably from 2010 to 2012. Two banks, one local and one foreign, were above the industry average with respect to their return on assets. Even though the industry average declined from 75 cents on every dollar of asset in 2010 to 56 cents in 2012, an increasing number of banks outperformed the average.

In 2011, three banks outperformed the average return on assets and in 2012 four of the six banks exceeded the industry average. However, only one of those banks was a foreign bank. Despite the smaller variability among the performance of the banks, one has to wonder about the way the assets of the banks below the industry average are performing.

A similar trend was observed with respect to return on equity. According to information from the national budget, the financial services industry grew by about 9 percent in 2010 and 10 percent in 2011. Yet, the important performance ratios of the commercial banks have displayed unfavourable tendencies.

In 2010, four of the six banks found their return on equity below the industry average. Only the BNS and Demerara Bank had returns above the industry average. The situation improved in 2011 with only two banks, the BOB and Republic, falling below the industry average. In 2012, the performance of the banks, once again, has shown unfavourable movement. Not only has the industry average continued its decline, four of the six banks once again recorded returns that were below the industry average. In this instance, it was only GBTI and DBL that stayed above the industry measure. This behaviour of the profitability indicator raises questions as to how well firms are leveraging the deposits in their possession.

It is not clear what is causing the variable performance among banks. What is noticeable however is that the bank with the largest share of household loans in its portfolio has consistently performed below the industry average. The same thing can be said for the bank that has the highest share of business loans in its portfolio. These two banks most likely will have to keep a watchful eye on the composition and performance of their portfolios.

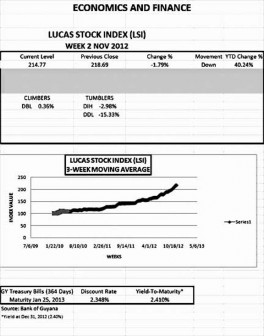

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined by 1.79 percent in the second week of trading in the month of November 2012. The decline occurred despite no changes in the stock price of Guyana Bank for Trade and Industry (BTI) and that of Demerara Bank Limited (DBL) which rose one-third of one percent to regain the value that it had lost in the previous trading period. The negative impact was caused by the stocks of Banks DIH (DIH) and Demerara Distillers Limited (DDL) which declined 2.98 and 15.33 percent respectively. Despite the decline in value, the LSI remains more than 40 percentage points above the yield of the 364-day Treasury Bills.