Business Page today continues its review of the annual reports of companies for the year 2011 by covering two of the public companies in the Beharry Group – the Guyana Bank for Trade and Industry and Sterling Products Limited. GBTI held its 24th.

GBTI Highlights

The Bank has nine branches including one at Lethem, making it the first and only banking service outside of the cities and towns of Guyana. Over the past five years, GBTI has witnessed truly impressive growth winning the favours of the government in a number of foreign and locally financed lending schemes, some of which come with tax breaks. In 2006 it was awarded a contract “to carry out the implementation of a Financial Facility to improve the competitiveness of the Rice Sector in Guyana,” and in 2011 it entered into a contract with the Ministry of Finance in respect of “loans to non-traditional agricultural exports, aquaculture, fruits and vegetables and livestock.” Financing for this comes from the IDB and the interest on the loans is exempt from corporation tax. Taking advantage of a number of tax shelters the Bank’s effective tax rate is less than 30%, compared with the nominal rate of 40% on the profits earned by commercial banks.

Asset structure

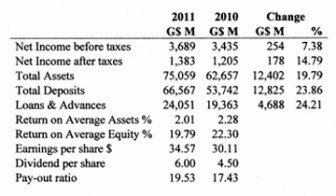

The Bank’s total assets at the end of 2010 were $75B, reflecting a growth of $12.4B (20%) over 2010 and accounting for 23% of Total Commercial Bank Assets in Guyana. The Bank’s assets as a percentage of commercial bank assets grew by 2 percentage points over 2010. Of the Bank’s assets, some $8.3 billion, or more than 10% was held overseas “so as to benefit from more attractive returns from yet safe instruments.”

At December 31, 2011 loans and advances amounted to $24,051 million, a 24% increase over 2010. The report states that loans to all sectors of the economy increased in 2011and that lending to individual customers increased by $3.1 billion while lending to business enterprises increased by $13.6 billion, which in total exceeds the $4.7 billion increase in total loans and advances. There is a similar discrepancy in the information on loans in the Agriculture Sector which in one case is shown as increasing by $2.8 billion and in another by $1.1 billion. In yet another table, loans and advances to the Agriculture Sector are shown as $2.342 billion while in a narrative they are stated as $9.7 billion.

Income statement

Neither the Chairman nor the CEO discusses lending and deposit rates in the absence of which only very rough calculations can be computed. These show that the average rate paid on savings accounts was 2.03% and on term deposits 1.91%. Taking all deposits into account the average interest paid by the Bank is about 1.5%, compared with the average rate on lending of close to 12%.

GBTI has always earned significant commissions and foreign exchange gains and in 2011 the amounts earned exceeded the Bank’s entire salaries bill. As a consequence of the operating performance, earnings per share (EPS) rose by 5.3% to $34.59, encouraging the directors to increase dividends per share from $4.50 to $6.00 giving a payout ratio of 19.53%.

GBTI continues to be one of the country’s strongest banks and has several committees designed to enhance better governance and better results. Its high quality annual report is upbeat and positive, justified by the results it has been delivering. There are however some technical areas for improvement in meeting IFRS and other regulatory requirements.

Sterling – Highlights

Statement of Income

For the first time in the company’s history, turnover topped the G$3.0 billion mark, although this has come with a reduction of G$9.7 million in after-tax profit, down 5.6% to $162.1 million from $171.9 million in 2010. Chairman Dr Leslie Chin attempts to explain this as “due to sales and marketing expenditure directly associated with enhancing distribution of our products. With additional spending in the area of marketing and distribution the company saw the relative return on investment as a total business expanded,” which must have confused the shareholders in attendance.

The Chairman also reports that export sales grew by 5.5% or by G$9.9M over year 2010 sales without stating the level of export sales, which too is not shown in the financial statements. From note 22 dealing with credit exposure it is apparent that the company does business with Grenada and Trinidad and Tobago, with two of the top balances being with customers from those countries.

He does however report that the company has seen “growth in some Caribbean Countries, whilst others present problems with respect to competitiveness.” Sterling is potentially one of Guyana’s manufacturing exporters and for years it has sought to “explore ways and means to have our products on the shelves of businesses in the Caribbean.”

Gross margin has declined from 25.3% to 22.6% while other income has also fallen, from $34.9 million to $22.3 million even as distributing and marketing expenses have increased by $25 million. Once again the company incurs finance costs from an overdraft, even as it holds more than two hundred million dollars in fixed deposits.

With the reduction in the tax rate from 35% to 30% the company’s tax charge has declined by $29 million, of which a significant portion is due to the tax effect of depreciation. Basic earnings per share increased from $6.18 to $7.42 while dividend per share has increased from $3.30 to $3.50. The increase is not reflected in the table above as dividends are only recognised in the financial statements when paid.

The balance sheet of this company is strong with both adequate working capital and healthy liquidity. One of the commendable features of this company is that it has maintained its defined benefit schemes for its employees while so many others are switching from defined benefit to defined contribution scheme. Hopefully, it keeps it that way.