Agony and debt

In last week’s column I sought to direct readers’ attention to the debt stress that is engaging our economy and the distress this portends. Those of us who lived through the agonies of structural adjustment during the 1980s would have survived one of the greatest peace time policy-driven assaults on the livelihoods of the poor and powerless anywhere. Draconian policies were pursued in the blind belief that, not until Guyanese were reduced to what was euphemistically termed as ‘living within their means,’ would development and well-being be restored. This took an incalculable human toll on us all, not least through the drastic erosion of economic conditions and the very fabric, vitality, and creativity of our social, psychological, and cultural life. To this day these bitter legacies remain.

Thus, they blithely disregard the huge statistical misguidance created over the past five years, through using for economic assessment a set of national accounts aggregates, which have in one fell swoop increased by between two-thirds and three-quarters every year since 2006, only because of their so-called “better measurement”! Not a word of caution is offered when these data are used for comparisons prior to 2006. Indeed no strong reservation is even expressed when it is found that, despite the significant statistical benefit from using the macroeconomic data after 2006, there remains econometric evidence of moderate debt stress in Guyana.

Price inflation

Last week’s column also revealed the monetary authorities have been allowing monetary expansion in support of the slippage in government debt. The unsurprising consequence of this has been pressure on the domestic price level. Last Sunday’s column displayed a table and graph indicating the annual changes in the Consumer Price Index (CPI) since 2001.

Readers, however, know full well that there has been much controversy over the reliability of the CPI. I will not engage the controversy here, except to make two observations. First, during the 2000s, two different base periods have been constructed for the CPI namely, January 1994 = 100, which was later replaced by December 2009 = 100. Secondly, the CPI is based on coverage of Georgetown alone. Rural and hinterland areas are not covered although price behaviour in these diverse areas is clearly not the same.

GDP deflator

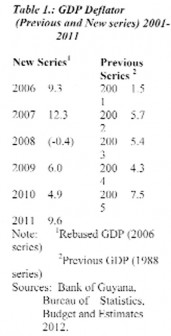

To partially address concerns over the CPI, economists construct the implicit GDP deflator as an alternative measure of price inflation. What is this? Readers of this column would have noted my frequent references to GDP either at current prices (nominal GDP) or GDP at constant prices. The principle that distinguishes the two is very simple. Nominal GDP or GDP at current prices measures GDP at prices prevailing in the market. Thus if prices increased by 10 per cent, the value of GDP at nominal prices would increase by 10 per cent even if there is no change in output. If in this example we take away the price change of 10 per cent, we are left with no change to the constant GDP. The index of the price changes captured in GDP measures is therefore, termed the GDP deflator. This shows by how much a change of GDP at nominal prices reflects changes in prices. The GDP deflator is presented in Table 1, where the one calculated from the rebased 2006 price series is shown separately from that of the previous price series (1988).

Exchange Rate Policy Stance

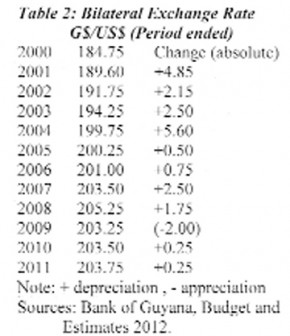

Several economists believe that there is not enough use of the exchange rate as an instrument of macroeconomic management of Guyana, particularly as a buffer against external stocks. The Government’s policy stance has been to maintain a stable long term nominal bilateral rate with the US dollar, after allowing for a minor annual marginal rate of depreciation (see Table 2 below)

Next week I shall continue the discussion of this topic.