Part 1

Foreword

Owing to newspaper space constraints, last week’s column was not carried in full. Before I embark on the challenges and threats to economic stability, therefore, here is the final segment on ‘Macroeconomic performance and slippage in public debt:

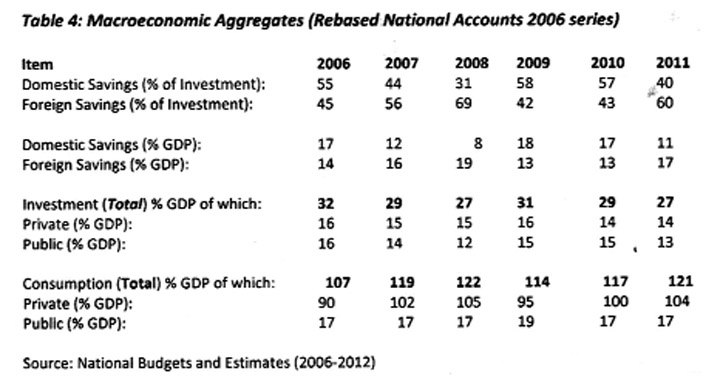

Finally, the behaviour of the standard macroeconomic variables tells their own tale. These variables include: the saving (domestic and foreign)/GDP ratio; investment (private and public)/GDP ratio; consumption (private and public)/GDP ratio and the shares of domestic and foreign savings in financing investment. These are shown in Table 4.

Sev

Introduction – ‘Challenges, threats…’

In Guyana, as indeed elsewhere, government revenues that are spent on debt repayments could alternately be spent on such items as public infrastructure investment and upkeep, the provision of basic services, public utilities, and social safety nets for the poor and vulnerable. Apart, therefore, from the economic uncertainty and private financial risk rising sovereign indebtedness generates, it also competes for scarce public resources, thereby threatening the prioritization of developmental actions. These are the basic considerations which lie behind my focus on the increasing government debt to GDP ratio in Guyana in recent times.

Last week’s review of the country’s recent economic performance revealed that, despite the slippage of the government debt to GDP ratio by 10 percentage points since 2008, macroeconomic performance has been steady. On my part this gives cause to concern for two basic reasons. First, if the slippage occurred when there have been such favourable economic circumstances, what does this suggest for prudent debt management if the economic situation gets tighter? In this regard, readers should be aware that the debt burden is rising at a time of unprecedented low repressed interest rates!

Second, the period under consideration in this analysis coincides with the official adoption of the rebased 2006 price series national accounts aggregates. I personally find it difficult to accept these new official data unconditionally because, as the Bureau of Statistics which prepared them has pointed out, when it made simulated comparisons using the previous 1988 price series and the new 2006 price series, the latter revealed both larger national accounts magnitudes (by between two-thirds and three-quarters) and higher growth rates.

In my view such large changes in the size of the national accounts aggregates should produce, as a practical matter, prudence.This in turn requires officials in the Ministry of Finance to perform and report to the public their own in-house iterations of the national economic balances using simulated national accounts data. They should not rely solely on the new price series data until they have established reasonable internal consistency in both the measurements and methodology. This would require time and consistency testing.

Challenges, threats

The main purpose of this week’s column, however, is to start cataloguing the major threats and challenges threatening near to medium-term macroeconomic stability in Guyana today. My indication of these will be brief and when completed in a week or two, this will bring to an end my weekly columns on the National Budget 2012. The listing I provide is not in order of importance. However, I readily admit that because of my deliberate brevity, all the items catalogued deserve fuller discussion than I am offering here. What I promise readers is that, from time to time, I shall engage some of the catalogued items in independent columns, where they will be more fully considered. For ease of reference, I have grouped the items under four headings where they are addressed in turn. These are the global context; national economic management; socio-political issues; and, economic-structural considerations.

Global context

Under the first heading I refer to four separate challenges/threats. These are 1) global economic developments; 2) aid volatility; 3) the European Union (EU)/ACP Sugar Protocol and the European Community (EC) Economic Partnership Agreement (EPA); and the changes this led to in the marketing of GuySuCo’s sugar; and 4) the global financing of Avoided Deforestation under REDD-plus.

To be sure the 2012 National Budget acknowledges “the potential domestic consequences of global economic and financial events … given the extent of today’s interconnectedness.” It basically admits to the asymmetrical global economic situation which Guyana faces. It also recognizes that, while Guyana needs to shore up its resilience to external economic shocks, it cannot successfully do this if it simultaneously pursues policies which expose the country to adverse market reactions. One sure way of allowing this to happen is if sovereign indebtedness rises to levels that give rise to apprehension among private investors.

Guyana’s economy is extremely open to global economic shocks. There are several channels in the economy that allow external shocks to reverberate on domestic incomes, wealth, and employment. Chief among these transmission channels are 1) the price and volume of export sales; 2) the price and volume of import purchases; 3) the terms of trade (or the ratio of the relative price levels of 1&2) which help determine the real effective exchange rate of the Guyana dollar; 4) private foreign investors; 5) re-migrant investment; 6) bilateral government concessional (aid) flows; 7) multilateral institutional aid financing; 8) overseas remittances; 9) migration opportunities; and 10) tourist visitors.

There are also other non-traditional transmission mechanisms, which are closely associated with the shadow/parallel/underground aspects of the economy. These include capital flight; money laundering; trafficking in precious metals, other high valued goods (for example fuel), and persons. Together and separately, these illicit activities make substantial contributions toward generating livelihoods for Guyanese.

At this point in time the global economic and financial crisis (the Great Recession), which has been ongoing five years now is showing no definite signs of recovery. The major developed countries are facing a likely double-dip into another recession. Of special note the European Union is facing a momentous sovereign debt crisis and meltdown, including the possible breakup of the Eurozone. On top of this China and India, two towering emerging market economies, are facing a likely slowdown from double digit and high single digit annual GDP growth rates. Such a scenario clearly poses serious challenges to Guyana’s macroeconomic stability.

Aid variability

Another area of challenge lies in the growing uncertainty of aid flows to Guyana. Recent official reviews of the economy are replete with warnings about the growing unreliability in both the amount and timing of external grant/aid disbursements, as a by-product of the Great Recession. This complicates budget planning, as it poses the risk of shortfalls in external funding. Indeed the IMF has gone as far as recommending that PetroCaribe funds held by Guyana should be used as a “buffer” to cover shortfalls!

Next week I shall continue cataloguing the challenges/threats to Guyana’s near to medium-term macroeconomic stability.