Introduction

For the next few columns I shall assess the position of Guyana’s sugar industry in light of the billions of dollars the EU has committed in assistance under its Second Multi-annual Sugar Programme 2011 to 2013 (24.9 million euros or $6.5 billion) and the proposed Budget 2012 subsidy of $4 billion for the coming year. A year ago I had examined The state of the Guyana sugar industry and its reform in the course of 21 consecutive Sunday columns (May 29-October 16, 2011).

Those articles addressed the following major topics in some detail: 1) the explosive expansion of the global sugar industry under an international trading regime dominated by inter-governmental trading arrangements.

This is crucial, given the export-oriented nature of Guyana’s sugar industry. 2) by way of comparison, the stagnation and decline of sugar production and exports in Guyana; 3) an appraisal of the key performance indicators for the local industry (production, productivity, profitability and financing); 4) the Sugar Modernization Project (particularly the Enmore Packaging Plant, the Skeldon factory, and the wider Berbice field restructuring of the industry); and 5) GuySuCo’s operations, management, financing, and planning. The sixth and final topic considered was an exploration of future options for the sugar industry.

Observations

More recently, the Cariforum-Economic Community (EC), Economic Partnership Agreement, (EPA), along with the United States Sugar Tariff-Quota Agreement and the sugar marketing mechanisms of Caricom have been important. Only marginal amounts of Guyana’s sugar have been traded on the “world market.” Indeed as we shall see Guyana has not benefited at all from the recent vigorous global expansion of sugar production, consumption, and trade.

The task, which I shall therefore seek to accomplish in the coming columns, is to ascertain if one year later, the fortunes of the Guyana sugar industry are improving, bearing in mind the billions of dollars committed to the industry, in large part as compensation for the EU’s unilateral repudiation of the Sugar Protocol in 2009.

Global context

As observed in the earlier series global sugar output had doubled between 1940 and 1960, and then further doubled again between 1960 and 1990. Today world output is projected to rise (over the five-year period 2008-9 to 2012-13 from 144 million metric tons to 174 million metric tons).

Global consumption continues to grow at about 3 per cent per annum and in turn, this has been dependent on the growth of population, incomes, and changing tastes.

About one-fifth of global sugar production is exported. Most of this is, however, traded under special inter-governmental trading arrangements. Of note, year ending global stocks are about one-fifth of world consumption, down from a level of one-third reported in the previous columns I had published last year.

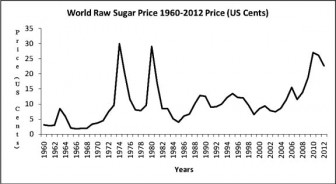

As a result of these features, the world market for raw sugar is still best described as a “residual market,” in that producers mainly sell sugar on the world market when they cannot find an inter-governmental arrangement under which they can make sugar sales at better prices! As would be expected, this residual market has been highly volatile ranging between 2 cents per lb and 30 cents per lb over the long run.

Since 1960 there have been three clear peaks in world raw sugar prices. The first was in 1974-75 when the price was 29.99 and US20.49 cents per lb respectively. The second was in 1980, when again the price reached 29 cents.

The third price peak is recent, 2010 to date. In 2010 the annual price averaged 21.5 cents per lb and in 2011 it rose further to 26.1 cents per lb. So far this year (January-July 2012) the price has averaged 22.7 cents per lb.

Generally, three world prices are reported for raw sugar — the EU price which is the negotiated import price for raw unpackaged sugar from ACP countries under the Lomé Convention at European ports (cif); the US sugar price which is based on nearby futures contract (cif); the reported International Sugar Agreement (ISA) daily price for raws (fob) stowed at greater Caribbean ports.

So far for this year (January-July 2012) these prices average 19.1; 31.8; and 22.7 cents per lb respectively. The effect of the EU repudiation of the Sugar Protocol is thus revealed in that the price paid to the ACP countries is below the world market price. This is the exact reverse of what prevailed before!

Conclusion

There have been no major changes among the leading players (producers, exporters and importers) in the global sugar industry. Because of space limitations I shall begin next week’s contribution with an up-to-date listing of these players as projected for the current crop year (2012-13), before looking a bit more closely at the EU’s assistance, the reasoning behind it, and the Budget subsidy in light of the ongoing disintegration of Guyana’s sugar production and GuySuCo.