Introduction

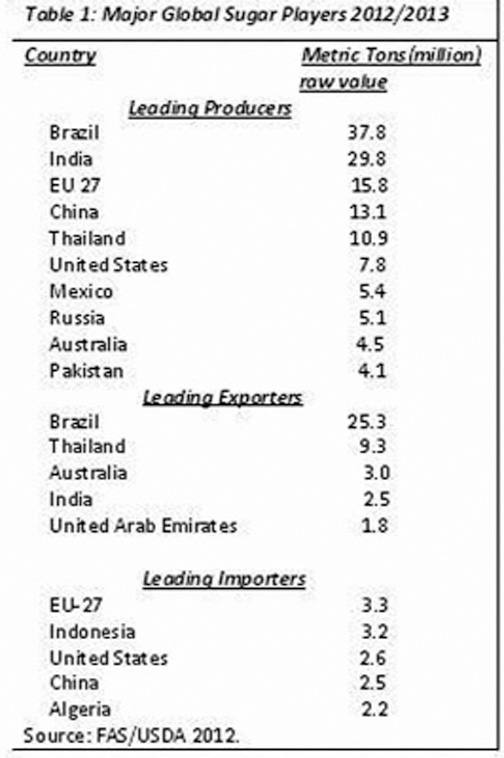

Today I continue appraising the sugar industry (and GuySuCo) in view of the considerable European Union (EU) support and the further $4 billion transfer to GuySuCo from the National Budget 2012. I shall discuss the amount, intent, and rationale behind the EU support. Before attending to this, however, as promised last week, let me present for readers’ benefit an updated list of the major players (producers, exporters and importers) of sugar globally (see Table 1 below).

As hinted last week, there has been no major re-shuffling among the global players. There are, however, three recent changes of note: 1) the rise of Russia as a leading producer; it is now no longer a leading importer 2) the emergence of India and the United Arab Emirates (UAE) as leading exporters and 3) the emergence of Algeria as a leading importer.

EU assistance

As the EU Ambassador described it at the handing-over ceremony, this funding is directed at “the continued modernization of the sugar sector.” Parenthetically, he mentioned his expectations for wider agricultural sector improvements and referred to the Guyana Sugar Action Plan, submitted to the EU in 2006. At that ceremony the Minister of Finance also referred to an “action plan,” which guides the ministry.

However, it was not clear to me whether this was the same plan or the later “turnaround plan” GuySuCo has frequently referenced in the wake of its ongoing distress.

The goals of all the “plans” seem intended to follow routine aims such as 1) to continue the modernization of the industry; 2) to construct a viable and profitable GuySuCo; and 3) to enhance the competitiveness of Guyana’s sugar through increased productivity and more value added. To crown this banality, the Ambassador is reported as telling his Guyanese audience that sugar is “the industry of the future”!

Perhaps intending to comfort sceptical Guyanese, the EU has promised strict monitoring and auditing of its support flows against agreed performance indicators. After the past six years of GuySuCo’s relentless deterioration, and its repeated excuses for failure, one can foresee the same end result for the Second Multi-Annual Sugar Programme. The question therefore, to be resolved is whether the EU is doing anything more then seeking to ensure GuySuCo dies by a thousand cuts?

EU denunciation

The EU’s denunciation of the SP in 2009 has played a major role in reduced sugar export earnings and GuySuCo’s failing financial health. That denunciation however, was widely anticipated by all Caricom governments, which nevertheless acquiesced to it. From previous columns readers would be aware that the SP which was established in 1975 was a multilateral treaty for mutual beneficial trading of sugar between the EC and ACP countries. It was never designed as a one-way preferential system to the benefit of the ACP.

Indeed at the time the SP come into force the world price for sugar was two-and-a-half times that provided by the SP!

The consequent ACP subsidisation of EC consumption continued for years, with at various times the world price reaching four times (and higher) than the negotiated SP price! It was only in the much later years when this price relation was reversed that the EC started to describe the SP as a preferential system (that is, when the EU was required to pay through the treaty higher prices than the world price); this reversed what had been occurring previously.

Conclusion

I do not intend to discuss this issue at length again. Of note, however, the crucial outcome was that the EU denunciation of the SP in 2009 started a process of large cuts in the SP price. As observed last week, this price is now below the world price (formed, as I termed it, in the “residual global market” for sugar).

To the eternal shame of the EC, the abject capitulation of all the ACP countries (in not taking legal action against the EC) the SP is now effectively history. The Accompanying Measures were designed by the EC as “compensation” to the ACP sugar exporting countries, which no longer enjoy their due benefits from the workings of the SP Treaty.

Next week I shall continue the assessment from this observation.