Small Flame

As Guyanese gradually settle into the New Year and the trading season for 2013 gets on the way, it is a good time to review the performance of the Guyana Stock Exchange (GSE) during 2012. Given its level of development, it will be some time before the GSE becomes a hub of activity since its expansion continues to move at a snail’s pace. In addition, the weekly transactions of stock trades remain equally subdued in a political environment of uncertainty and an economic atmosphere of cautious optimism. This state of affairs is a far cry from one year ago, when the talk of a new dispensation raised hopes and expectations of the likely emergence of a new political culture and anticipation of fulfillment from great economic opportunities. Among others, oil prospects were promising and the ray of gold receipts glitter to distances beyond its source. Yet, somewhere between the extremes of despair and hope, Guyanese found the time and energy to keep their dreams alive. It is a similar unassailable spirit that attends to the GSE that has it shining, though dimly, in the overhang of Guyana’s political and economic situation. That small flame on the lamp of the index produced weekly by this writer will be used to make the assessment of the performance of the GSE in 2012.

A Crown Jewel

The discussion herein begins with a look at the GSE as a whole and then examines individual company and sectoral performance in the LSI during the course of 2012. Unlike the assessment of 2011 when it was possible to report the addition of one new company to the Exchange, there is no such good news to report on this occasion. But the lethargy in the evolution of the GSE is not something that should be of great concern to Guyanese, at least not just yet. The life experience of the now famous and prominent New York Stock Exchange (NYSE) offers some hope for the GSE. While not attempting to place the GSE and the NYSE on par, it should be noted that the NYSE began its life over 200 years ago with just five stocks. When the GSE began in 2003, it started with more than twice as many stocks than the NYSE had in its own infancy.

A crown jewel in the assessment of the performance of the US capital market is the Dow Jones Industrial Average (DJIA), an average used as a stock index in capital markets. The DJIA was started in 1896 with about 12 companies in its portfolio, and it took 10 years for its index to reach 100, and 180 years to break the 1000 mark with 30 stocks in its portfolio. It is reasonable to expect that with time, the level and intensity of activity at the GSE will increase, and so will its importance to capital markets in Guyana.

Market Capitalization

Aware of the value of the GSE to the potential growth of companies in Guyana, the Lucas Stock Index (LSI) continues to rely on data from the GSE to follow the performance of the companies whose stocks are part of the index. The LSI is made up of nine of the 14 companies identified in the Secondary Listing of the GSE. That number represents 64 percent of the companies mentioned in that grouping on the exchange. In reality, the LSI accounts for nearly 70 percent of the active stocks since Globe Trust has been liquidated and J. P. Santos is inactive, perhaps on account of new ownership. The nine companies in the LSI are in the banking and manufacturing sectors of the Guyana economy. Their market capitalization reached G$121 billion by the end of last year, accounting for 98 percent of the market capitalization of the GSE.

This level of capitalization represents over 20 percent of projected GDP at current basic or market prices for 2012. The forward movement of the stocks is also an indication that there is some confidence in the general economic situation of the country. As a result, spending by the business community could be expected to grow in 2013. However, several issues give cause for concern and continue to weigh heavily on the mind of the private sector as evidenced by their statements on the unresolved situation involving Linden, the impasse on several issues in the National Assembly, the indifference towards corruption and the apparent aborted attempt at tax reform. The sectors involving and supporting exploration of Guyana’s natural resources were likely to continue receiving the most investment on account of the current gold rush and the implications for implementing the low-carbon development strategy.

More than Worth It

At the level of individuals and businesses, the increase in value of 39.7 percent in 2012 over 2011 could be seen as a proxy for the increase in savings through the capital market. The slow pace and low levels of activity of the GSE could in effect be an indication of the willingness of Guyanese to use stocks as an important form of savings. That is not a bad idea when compared with the performance of alternative investment instruments such as interest rates on savings accounts and certificates of deposits. Though relatively safer and remaining under the ownership and control of the saver, saving through the purchase and retention of the stocks in the LSI brings in far more money than saving with the commercial banks could yield. Even returns on the safer and risk-free Treasury Bills are no match for what can be obtained from investing in the stock market of Guyana. The cumulative returns from the nine stocks in the LSI were 16 times greater than the risk-free returns of Treasury Bills in 2012. The higher risk of investing in stocks in the LSI is more than worth it.

3-Dimensional View

The GSE and the LSI serve other purposes. With the aid of the stock index, Guyanese also obtain what could be described as a 3-dimensional view of company valuation that is not readily visible from annual reports or other company publications. For example, despite reporting billion dollar profits in 2012, the value of Republic Bank fell by three percentage points from 33 to 30 during 2012. In addition, only two companies saw their value increase from a year ago. Those were Demerara Tobacco Company (DTC) and Guyana Bank for Trade and Industry (GBTI).

The second dimension of the market influence is the redistribution of resources within industries. The banking industry gave up seven percentage points, but only gained three percentage points. This suggests that some banks might have lost ground to GBTI which was the only bank to which the market directed more resources. This possible shift in resources within the banking industry is not surprising given that they compete directly with each other. DTC, the company that attracted additional resources to the non-banking sector does not compete in the same industry as other non-banking entities. It is not surprising therefore that most of its gains came from outside of the non-banking sector.

The third dimension that could be gleaned from the LSI data is how resources have been allocated by the market between the industries in the index. At the end of 2011, the banking sector had attracted 63 percent of the resources while the non-banking sector had attracted 37 percent. By 2012, the non-banking sector had managed to increase the share of resources coming its way. Resources amounting to four percentage points were redistributed from the banking sector to the non-banking sector, causing the former to end up with 59 percent and the latter with 41 percent of the resources.

Conclusion

The year is over one week old and very solemn resolutions probably have already begun to pop. More resolutions will be broken with the passage of time, but the GSE will soldier on at its own pace. The survival of the GSE brings opportunities for Guyanese to save and obtain comparatively lucrative returns in an economy that is expected to expand. Just as importantly, it will provide evidence with which to judge the performance of companies operating in Guyana.

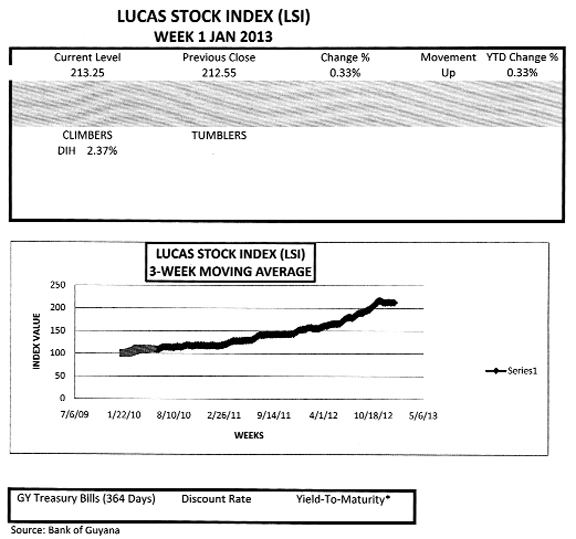

The Lucas Stock Index (LSI) recorded a gain of 0.33 percent in the first week of trading in the year 2013. While four stocks traded, only the stocks of Banks DIH (DIH) recorded a gain which amounted to 2.37 percent. The stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Guyana Bank for Trade and Industry (BTI) remained unchanged.