Public Face

Every so often, a story is told or a report appears in the media about public-private partnerships. Indeed, the administration often refers to the construction of the bridge across the Berbice River as resulting from such an arrangement. Apart from Amaila Falls, it is not quite clear which other projects that have been undertaken or that are currently being undertaken fit the public-private partnership model, even though the Marriott Hotel and specialty hospital projects remain stuck in one’s head. Comments on the need for new or upgraded public infrastructure in Guyana often suggest that the development and maintenance of infrastructure should combine public and private money and management for better results.

Very often the politicians are the public face of this development model. Yet, no one could be sure, except those persons privy to what is going on, who might be behind the idea of using public-private partnerships for a particular project. With the administration and some members of the private sector enamored with public-private partnerships, some Guyanese wonder if there are interests beyond altruism or utilitarianism behind the quest for this special model of production and management of what are often cast as public goods or services.

While it is known that public and private actors are involved and that it has been happening for some time in other parts of the world, there is still a need for Guyanese to get the hang of this model of development. No one seems to recall any public debate over the public-private partnership issue and how it should be used in Guyana. The model has benefits and risks and deserved some open debate before being adopted as what now appears as the preferred capital investment model of the government.

Different

One thing that is clear is that the public-private partnership model is different from the traditional method of outsourcing to the private sector to have goods and services produced under procurement contracts. Proponents of the concept, who think that they understand it very well, describe public-private partnerships as long-term contractual relationships between public and private entities to share the risk for the design, construction, and operation of infrastructure or services. The three things that stand out are risk-sharing, joint production and joint decision-making. As clear as that point-of-view is, the way the application of this concept unfolds in Guyana leaves the impression that public participation is often more anxious to proceed with action than private participation. The Marriott Hotel project is a fitting example where taxpayer money is in the forefront of the financing of the project and the taxpayers do not know who else would be picking up the tab.

Lack of funds

The rationale for using the public-private partnership model of development stems from several factors. The reason cited most often is the lack of funds to carry out the many public works that are needed to keep the wheels of industry going and to meet the consumption and leisure demands of households. When governments alone have to undertake the public investment, it turns to taxpayers to raise money or to capital markets or bilateral and multilateral lenders to borrow the funds. Raising revenues to meet many deserving needs that compete with each other is not easy.

Taxation means shifting money from potential private investment or consumption to pubic use and it encounters resistance when taxpayers feel overburdened. The alternative is to turn to the private capital markets where possible or to bilateral and multilateral donors. Donors too have financial and tolerance limits and are not always ready or interested in funding projects that are seen as political in nature. Public-private partnerships give the private sector a chance to invest voluntarily in the project. The potential benefits from such participation from the standpoint of public finance are that it helps to reduce initial capital costs to the government and reduce the need to operate budget deficits.

Another reason proffered for using the public-private partnership is to acquire access to valuable human resource skills that otherwise might not be available to the project. The assumption here is that the private sector would make its best human resources available to the government for participation in the production and management functions of the project. The anticipated outcome is a more efficiently run operation that returns a higher welfare benefit to Guyanese.

Minimal sway

No one could get a clear view of how such projects in Guyana are managed. Disclosure of the management of the bridge over the Berbice River helps. The project utilizes the “build, operate and transfer” management mechanism which suggests that the private part of the partnership is in charge. This will be the case with the Amaila Falls Hydropower project as well. These two examples look more like what some experts refer to as private-sector led development. The projects come under the management of the public sector after an extended period of private cont

rol. Moreover, the sway of the government seems rather minimal since it seems unable to influence pricing decisions of the company managing the Berbice River Bridge, as the recent budget debate in the National Assembly revealed. In countries far more familiar with the public-private partnership model, similar experiences have left many wondering if members of the private sector use the mechanism to gain political power without having to seek elective office. This is a bone of contention among taxpayers who regard the practice of creating public authorities through public-private partnerships as “overhead democracy.”

Integrity

For Guyanese, the concerns might be more about integrity. Competition, risk-sharing, and transparency are considered to be very important to the success of any public-private partnership. Competition helps to reduce costs and to facilitate a more rational allocation of resources. Risk-sharing reduces any potential loss that taxpayers might experience from project delays or cost overruns. Transparency keeps the public informed of the nature, scope, risks and benefits of the project. People feel comfortable with market-type projects when they have full information about what is taking place. To the extent that public-private partnerships are supposed to be market oriented, then the public should be kept informed. As one thinks of the secrecy that was initially behind the Amaila Falls project and now the Marriott Hotel project, it is hard to feel that transparency is among the reasons that the administration favours this model of development.

Posture of secrecy

That posture of secrecy troubles most Guyanese. Guyanese are not confident that arms-length procurement transactions of the government are working and that process is supposed to be transparent. Even with the disquiet among the public about current procurement practices, the government has already moved into a less transparent relationship using the public-private partnership.

The lack of disclosures on the many NICIL investments and the Marriott Hotel is a case in point. It does not help that the projects are developed and agreed without consideration for Guyanese labour, especially those projects that involve the use of complex engineering skills and capital equipment. As a consequence, projects are executed by foreign companies who bring their own labour, leaving capital investments taking place without jobs being created for Guyanese.

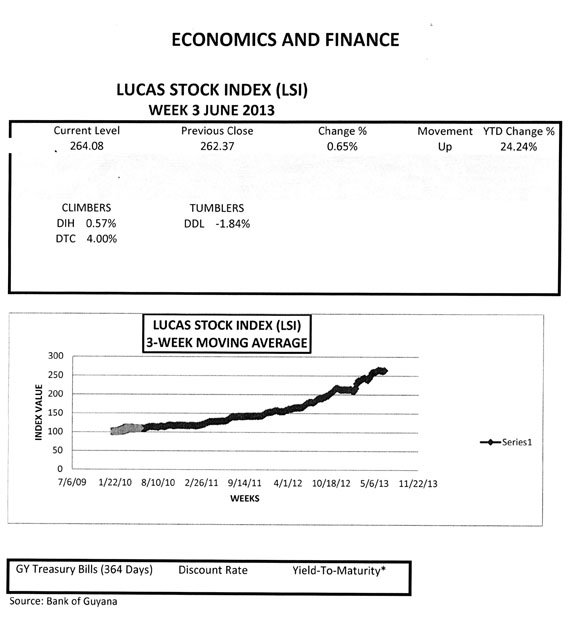

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose slightly by 0.65 per cent during the third week of trading in June 2013. A total of 775,700 stocks of six companies in the index changed hands this week. The LSI recorded two Climbers and one Tumbler, while there was no movement for the stocks of three companies. The Climbers this week were Banks DIH (DIH) which rose 0.57 per cent on the sale of 654,700 shares and Demerara Tobacco Company which rose 4 per cent on the sale of 300 shares. The lone Tumbler was Demerara Distillers Limited (DDL) which fell 1.84 per cent on the sale of 36,700 shares. The value of the stocks of Demerara Bank Limited (DBL), Guyana Bank for Trade and Industry (BTI), and Republic Bank Limited (RBL) remained unchanged on trades of 81,100; 2,500; and 400 shares respectively.