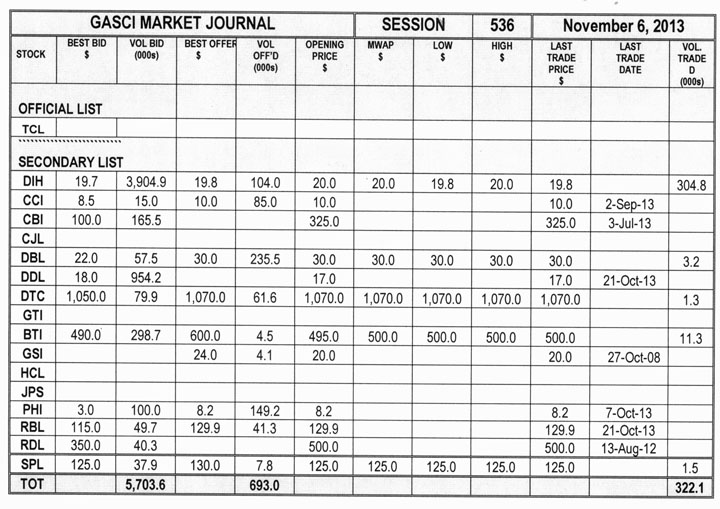

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 536’s trading results showed consideration of $13,360,923 from 322,086 shares traded in 14 transactions as compared to session 535 which showed consideration of $3,388,135 from 8,673 shares traded in 3 transactions. The stocks active this week were DIH, DBL, DTC, BTI and SPL.

Banks DIH Limited’s (DIH) five trades totalling 304,802 shares represented 94.63% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $20.0, which showed no change from its previous close. DIH’s trades contributed 45.58% ($6,090,043)

Demerara Bank Limited’s (DBL) single trade of 3,246 shares at $30.0 represented 1.01% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $30.0, which showed no change from its previous close. DBL’s trade contributed 0.73% ($97,380) of the total consideration.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 1,250 shares represented 0.39% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $1,070.0, which showed no change from its previous close. DTC’s trades contributed 10.01% ($1,337,500) of the total consideration. Both of DTC’s trades were at $1070.0.

Guyana Bank for Trade and Industry Limited’s (BTI) three trades totalling 11,300 shares represented 3.51% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $500.0, which showed an increase of $5.0 from its previous close of $495.0. BTI’s trades contributed 42.29% ($5,650,000) of the total consideration. All of BTI’s trades were at $500.0.

Sterling Products Limited’s (SPL) three trades totalling 1,488 shares represented 0.46% of the total shares traded. SPL’s shares were traded at a Mean Weighted Average Price (MWAP) of $125.0, which showed no change from its previous close. SPL’s trades contributed 1.39% ($186,000) of the total consideration. All of SPL’s trades were at $125.0.

N.B: Please note that two companies have been added to the Secondary List from this Trading Session – City Jewelers and Pawnbrokers Limited and Humphrey & Company Limited.

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

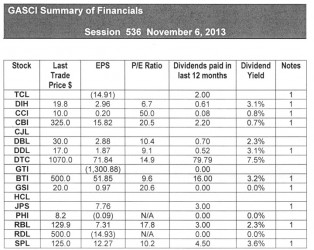

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2011 – Final results for RDL.

2012 – Final results for DTC and PHI.

2013 – Interim results for TCL, DIH, CCI, CBI, DDL, BTI, GSI, JPS, RBL and SPL.

2013 – Final results for DBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.