Principal Owner

Property Holdings Inc is a company that was incorporated on October 5, 1999 for the specific purpose of managing or disposing of property owned by Guyana Stores Limited (GSL). The principal owner of PHI at the time of its creation was GSL, which itself was the property of the Government of Guyana and was under the control of the National Industrial and Commercial Investments Limited (NICIL). GSL then transferred 24 of what was described as “non-core properties” to PHI, the value of which was used to capitalize PHI. After the property had been transferred, the government then sold GSL. The sale of GSL removed it from the ownership of PHI. NICIL then became the majority shareholder with approximately 74 percent of the shares while other investors became the minority shareholders with about 26 percent of the shares. This relationship between the public and private sector makes this a public-private partnership.

No Intention of taking Risk

Currently, PHI holds several commercial properties which are located in Georgetown, Golden Grove on the East Coast of Demerara, New Amsterdam in East Berbice and Lima in the Essequibo. Most of the properties, about 80 percent, are located in Georgetown and some of the properties have buildings on them. The company shows no sign of growth and the stock of property under the control of PHI has dwindled. This decline in the quantity of property under its control has resulted from the sale of such property. No new investments have been made in upgrading existing property or in acquiring new property. From the inception, PHI had no long-term strategy of that type. With no intention of taking risk, PHI focused on its short-term goal of disposing of property to reap gains for its various shareholders. Interest in this company therefore rests in its economic relationships with its shareholders and the status of the public’s interest in this public-private partnership.

PHI has been flying below the radar screen, even though this company with substantial government ownership, 74 percent, is a member of the Guyana Stock Exchange (GSE) and is a subsidiary of NICIL. It is therefore a public-private partnership. No one knows how NICIL, a public entity, selected its private partners. The analysis of this company therefore should start with how it was capitalized. In explaining how it was incorporated, PHI makes it clear that no cash was used to start the company. The value of the property acquired from GSL was used to establish the capital investment of the company. This process of capitalization means that the 24 properties that were transferred to PHI by GSL and given a value of G$100 million represented the capital of the company. Such an accounting move is legitimate and explains how NICIL, representing the Government of Guyana, acquired shareholding status without burdening the national treasury. But NICIL owns only 74 percent of the company while others, including natural persons and possibly some organizations, own about 26 percent of the company.

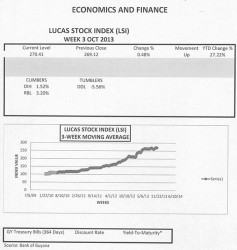

The Lucas Stock Index (LSI) rose slightly by 0.48 percent in trading during the third week of October 2013. Trading involved four companies in the LSI with a total of 34,269 shares in the index changing hands this week. There were two Climbers and one Tumbler since the other traded stock remained unchanged in value. The Climbers were Banks DIH (DIH) which rose 1.52 percent on the sale of 2,336 shares and Republic Bank Limited (RBL) which rose 3.20 percent on the sale of 600 shares. The Tumbler was Demerara Distillers Limited (DDL) which fell 5.56 on the sale of 30,833 shares. Demerara Bank Limited (DBL) with a sale of 500 shares remained unchanged.

This leaves one question unanswered. How did the other entities and natural persons acquire ownership of their shares? The question arises because, under normal circumstances, money received for shares sold would appear in the cash flow statement of the company as part of the cash inflow from financing activities in the year the payment was made. This information does not appear in any of the cash flow statements prepared by PHI, and does not appear to have been addressed elsewhere. However, from all indications, all shareholders enjoyed dividends that were paid by PHI.

Flawed

This model of the public-private partnership is deeply flawed. This model emphasizes the transfer of public resources to the private sector without the private sector bearing any risk. This is no illusion. It is a declared strategy of PHI. The allocation of resources in this manner bypasses the regular budgetary process, thereby underestimating the level of public investment in the economy, and avoiding parliamentary scrutiny. The case of PHI is notable in that regard. For example, in the first three months of ownership, PHI reaped a bonanza of G$105 million for its shareholders on their non-cash investment of G$100 million. This resulted in an income yield of 87 percent, all of which were distributed to shareholders without being disclosed in the budget. PHI followed up this performance with an income yield of 74 percent in 2003. In 2008, PHI had an income yield of 67 percent. That was cut by more than half in 2009 to 28 percent. Since then, PHI has been incurring losses on its investments only because it is in a court battle with GSL.

Violating International Accounting Standards

Another weakness of this model of the public-private partnership is that it allows the private sector to violate international accounting standards without suffering any penalties. In addition to the disappearance of its income yield, PHI has recorded no appreciation in capital in the period under review. This is a very interesting phenomenon. The auditors have pointed out since 2003 that PHI needed to revalue the assets in its possession and PHI has refused to do so. The majority shareholder, the Government of Guyana, appears quite happy with this posture of the company since it has not asked its subsidiary, PHI, to comply with required accounting standards.

The use of the public-private partnership allows the government to shield the partner private sector entities from penalties. The motive is clear. Keep the value of the properties at cost or below cost with depreciation where relevant and reap a wider margin of profit. Failure to revalue the property represents no real risk to the investors since there is no evidence in the financial statements that they paid any cash for the shares that they received. A revaluation could lead also to an increase in liabilities for rates and taxes. Under this model of the public-private partnership, the private sector is able to violate rules with no fear of penalty.

Ongoing Dispute

PHI might have been able to close shop had it not been for an ongoing dispute with its former owner, GSL. At the moment, 98 percent of the existing value of the properties reportedly remaining under the control of PHI is in dispute. The dispute with GSL regarding the property rights is before the courts and the outcome of that case would likely determine the future of PHI. Interestingly, the annual reports of PHI do not say if PHI or NICIL, which makes it government’s responsibility, is paying the legal fees for this dispute.

Other than GSL, two other entities of note are in a continuing relationship with PHI. One of those companies is GUYSUCO and the other is NICIL. GUYSUCO has been indebted to PHI since 2003. From all indications, GUYSUCO was paying its debts, but the debt at its current level of G$1.9 million has been around since 2007. PHI retains the debt on its books with confidence that it will recover the full amount outstanding. The justification for this position of certainty is unclear. It could only be that since the debtor is the government and the creditor is essentially the government, PHI could not be bothered under the current public-private partnership model if the debt was recovered or not.

Rates and Taxes

A review of the accounts receivable data also shows that NICIL had owed PHI as much as G$40 million as recently as 2011. With NICIL as its majority owner and the acquisition of assets at no cost, PHI was born with a silver spoon in its mouth. Given that its income is tied up in a lawsuit, PHI has largely been surviving on the rates and taxes that it owes municipalities. Under this public-private partnership, PHI sees no urgency to pay this debt. Data in its 2012 annual report show that nearly 30 percent of the short-term investment relating to the operating cycle is financed by the rates and taxes that it owes.

Privileged Position

The privileged position that PHI enjoys is explained by the parent-subsidiary relationship between NICIL and PHI. As most people probably know, an important director of PHI is Mr. Winston Brassington, who is also a director of NICIL. Mr. Brassington’s penchant for making investment decisions that are deemed questionable by many has been in the spotlight of late with questions being raised about several high profile contracts that follow the public-private partnership model. These projects include the Marriott Hotel, the airport expansion at Timehri and the Amaila Falls hydropower project. There are many aspects of the Marriott project that are of concern, including that relating to the lease of land at below market price. The heavy dependence on the government for capital and operating expenses leaves open the question of how private is this company. With a net debt of G$27 million to the city and state, PHI is not adding value to the economy of Guyana. Its operations are in effect being subsidized by the city and state governments. Since it is dealing in already developed property, PHI is not making a positive contribution to the economy of Guyana.

Much to be Desired

The gap in information of how private persons acquired shares of PHI and the confusion in the relationship between PHI and GSL over 98 percent of the assets in which it is currently invested reflect a deficiency in the public-private partnership. Indeed, PHI, with a questionable start, might be a horrible reflection of the public-private partnership which continually places public investment at a disadvantage. Real estate deals tend to be valid mostly on written contracts and for that much confusion to exist with one investor leaves much to be desired by this company.