On 20 November 2013, the Government announced a five per cent increase in wages and salaries for public servants, retroactive to January 2013. The announcement was met with protests from the Guyana Public Service Union (GPSU) and a number of demonstrations took place, the latest being on 9 December in front of the Office of the President. GPSU was demanding a 25 per cent increase but it later revised the figure downward to 15 per cent.

Timing of the proposed increase

Although the 2013 national budget, reflecting “Revision of Wages and Salaries”, was passed in April 2013, the Government has once again chosen to approve of an increase close to the festive season. This practice has been the pattern of the present Administration for a number of years. Under the previous Administration, the increases took effect as soon as the budget was approved. This was a logical approach and reflected good governance practice.

In a column I wrote last year on the granting of a five per cent increase, I referred to the Labour Minister’s statement that the increase was to ensure public servants are financially capable of enjoying the Christmas season. The Head of the Presidential Secretariat (HPS), in announcing the increase for 2013, joined the chorus and expressed similar sentiments. Suffice it to state that salary increases are offered mainly to cushion the effects of inflation which according to the Finance Minister is estimated at 4.3 per cent. There is therefore hardly any real increase. This apart, why make the payment in December?

The only plausible explanation for the current practice is that public servants would be more or less inclined not to quibble over the percentage increase but would rather be happy to receive an accumulated sum to coincide with the festive season. This practice also has the effect of undermining the Union’s ability to bargain for a higher increase. The ploy, however, seems not to be working this year, and it is left to be seen how the situation will play out.

Union’s reaction and the government’s response

The Union is obviously dissatisfied with the quantum of the increase which it argues continues to be arbitrary and a breach of the collective bargaining agreement agreed upon with the Government. The imposition of arbitrary increases is not a new occurrence which can be traced back to the mid-1990s (except for the 1999 Armstrong Tribunal Award which the Union claimed was partially implemented). Related to the issue of salary increases, are travel and meal allowances which have also not increased since then, despite a five-fold increase in the price of fuel in the case of the former. How are those public servants, who are required to be mobile in the execution of their duties, able to carry out such duties effectively? I had raised this issue in connection with the National Insurance Scheme where inspectors are required to use their vehicles to visit business places and to check their records for compliance.

The Government is contending that talks with the Union had reached a stalemate and that it has no alternative than to approve the five per cent increase. How valid is this contention, given that for the last 17 years salary increases have been an imposition and not subject to negotiation and agreement with the Union? The Government also argued that the issue is one of affordability and that its ability to offer a higher increase was affected by the budget cuts, particularly as regards the Amaila Falls Hydro (AFH) Project. The implementation of AFH arguably would have seen subsidies to the Guyana Power and Light significantly reduced, if not, eliminated, thereby releasing funds for the payment of higher increases. However, AFH would have taken 40 months to build and therefore would not have had any impact until 2017.

The Opposition political parties, for their part, quite justifiably argued that: (a) the approved budget did not reflect any cuts in the projected revenue but rather in expenditure; and (b) this would have resulted in the availability of more funds to pay salary increases.

Actual increase offered versus what the National Assembly approved

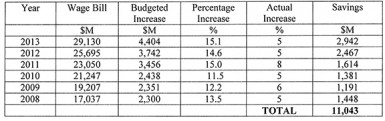

The National Assembly approved a 15 per cent increase in wages and salaries in the 2013 budget. Cabinet, however, decided to grant five per cent instead. The following table shows the actual and percentage increases approved by the National Assembly for the last six years, as against the percentage that the Government would have paid out:

The average increase approved by the National Assembly over the six-year period was 13.7 per cent while the average increase granted by the Government over the same period was 5.7 per cent. This would have resulted in a minimum saving of $11.043 billion.

Expenditure on revision of wages/salaries

An examination of the audited appropriation accounts of the Ministry of Finance for 2011 and 2012 as well as the Estimates for 2010 to 2013, however, shows that the entire amounts budgeted for the revision of wages and salaries were expended. (At the time of writing, the Audit Office’s website was down and therefore reliance had to be placed on the actual expenditure reported in the Estimates.) This would mean that for the years 2008 to 2013, amounts totaling $11.043 billion would have been paid out to meet expenditures other than those relating to increases in wages and salaries.

The Government’s explanation was that employment costs for new recruits and promoted employees were met from the allocation provided for under revision of wages and salaries. The explanation, however, does not have merit since every year the National Assembly approves revised staffing tables for ministries, departments and regions. It is from these tables that the employment costs are arrived at, after taking into account the latest wages and salaries increase.

Take the example of the Office of the President (Programme 12 – Presidential Advisory: Cabinet and Other Services). The authorized staffing for 2012 was 176 (inclusive of contracted employees) while that for 2013 is 196, an increase of 20. In terms of wages and salaries, the revised figure for 2012 was $331.147 million while the budgeted figure for 2013 is $409.615 million, an increase of $78.468 million. The five per cent increase in 2012, which works out to $16.6 million, was met from the Ministry of Finance’s allocation since the revision of wages and salaries is budgeted centrally under the Ministry of Finance. This amount would have to be added to the wages and salaries for existing staff members to arrive at the new figure for 2013. The difference of $61.9 million ($78.468 million minus $16.6 million) would therefore be to cover the wages and salaries of the additional 20 staff members.

The additional cost relating to promoted staff members would have also been reflected in the budgetary amounts. Suffice it also to state that no ministry, department or region can recruit persons beyond the authorized staffing that the National Assembly has approved. Therefore, the explanation that the salaries of new recruits are met from the allocation under revision of wages and salaries is not a valid one.

Auditor General’s report on the matter

The Auditor General’s report for 2012 for the Finance Ministry is devoid of any findings relating to employment costs, including the expenditure under the line item for revision of wages and salaries. One is therefore left to wonder whether the Auditor General was satisfied with the propriety of the amount of $2.467 billion that was paid out in 2012 to meet expenditure unrelated to the revision of wages and salaries. Or, was it a situation where no tests were carried out in relation to this expenditure?

Paragraph 3 of the report states that the Auditor General is required to examine in such manner as he deems necessary the relevant financial statements and accounts and to ascertain, among others, whether all moneys expended and charged to an account have been applied to the purpose or purposes for which they were intended. In other words, funds can only be expended in accordance with the wishes of Parliament, and the Auditor General is by law required to ascertain that this is so. Where there is a violation, the matter has to be reported to the National Assembly. We therefore need to hear from the Auditor General.

On a final note, over the last five years or so, the Disciplined Services enjoyed one month’s salary, tax free, as a Christmas bonus in addition to the normal across-the-board increases. There has been no announcement so far this year. One suspects that the payment will be quietly made, given the level of dissatisfaction with the proposed five per cent increase. I ask the question again this year: Are other public servants not also deserving of a Christmas bonus?

– To be continued –