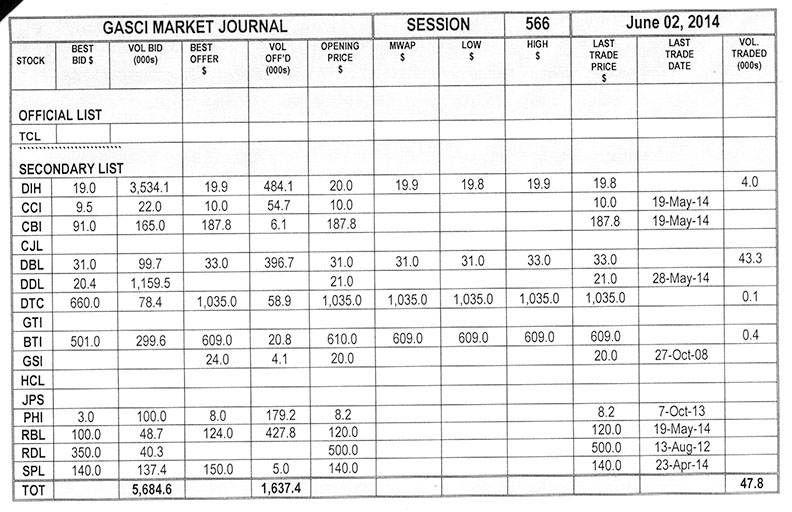

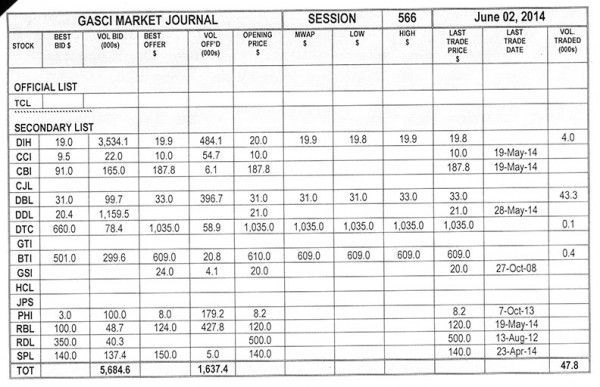

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 566’s trading results showed consideration of $1,744,761 from 47,771 shares traded in 13 transactions as compared to session 565’s trading results which showed consideration of $23,439,905 from 826,008 shares traded in 23 transactions. The stocks active this week were DIH, DBL, DTC and BTI.

Banks DIH Limited’s (DIH) five trades totalling 4,000 shares represented 8.37% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $19.9, which showed a decrease of $0.1 from its previous close of $20.0. DIH’s trades contributed 4.56% ($79,600) of the total consideration. DIH’s four trades totalling 3,998 shares were at $19.9, while its fourth trade of 2 shares was at $19.8.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 70 shares represented 0.15% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $1,035.0, which showed no change from its previous close. DTC’s trades contributed 4.15% ($72,450) of the total consideration. Both of DTC’s trades were at $1,035.0.

Guyana Bank for Trade and Industry Limited’s (BTI) three trades totalling 410 shares represented 0.86% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $609.0, which showed a decrease of $1.0 from its previous close of $610.0. BTI’s trades contributed 14.31% ($249,690) of the total consideration. All of BTI’s were at $609.0.

NOTES:

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

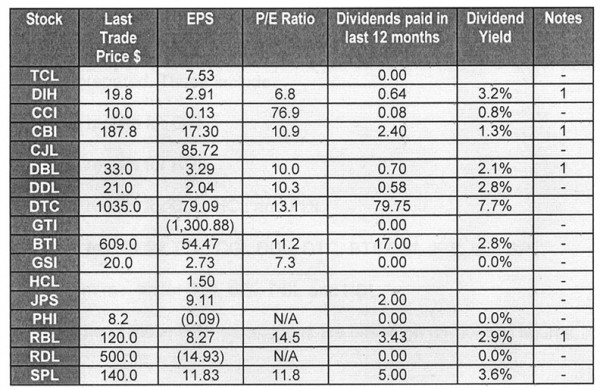

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2011 – Final results for RDL.

2012 – Final results for CJL, HCL and PHI.

2013 – Final results for TCL, CCI, DDL, DTC, BTI, GSI, JPS, and SPL.

2014 – Interim results for DIH, CBI, DBL and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.