Examining the last century or so of the industrial life cycle of Guyana’s sugar industry, it is observed that the period up to the late 1960s and early 1970s marked the phase of its maturity. More or less, thereafter, the period of its decline commenced, leading to what I have termed as its point of no return today. In stark contrast, over the last century or so, the global sugar industry has enjoyed a period of vigorous growth. Presently it has morphed into a global sweetener industry, whose principal components are 1) sugar (cane and beet); 2) other caloric sweeteners (principally high fructose corn syrup, HFCS or, isoglucose as it is known in Europe); and 3) non-caloric sweeteners (for example aspartame, splenda and truvia).

Thus the data for the period show that, while in 1920, the global output of sugar was about 12 million tonnes, by 1940 that output had more than doubled to 27 million tonnes. Between 1940 and 1960 output had once again more than doubled to 55 million tonnes. Furthermore, between 1960 and 2010 global sugar output had trebled to reach about 165 million tonnes. And, in the period since the recent global crisis (2008-09 to 2013-14) it has increased by as much as 30 million tonnes (or about one-fifth) to reach a current output of 175 million tonnes.

This contrasting experience over the past century highlights both the pressing urgency for timely interventions in Guyana’s industry today, as well as the long-term time-frame into the future, on which any meaningful intervention should be based.

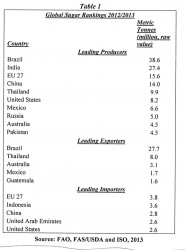

Presently, about 120 countries worldwide produce sugar on a commercial basis. Further, about 18 countries (like Guyana) devote more than ten per cent of their crop-land to cane sugar cultivation, while six countries devote more than one-third of their crop-land to sugar cane cultivation. Table 1 below identifies the ten leading global sugar producers. A few observations on this table are warranted at this point.

Second, Brazil is easily the world’s leading producer and exporter of sugar. India is the world’s second largest producer of sugar, but unlike Brazil its output is primarily utilized for domestic consumption, as it is not a significant sugar exporter. It does however move from being a net importer to a net exporter of sugar from time to time making it a pivotal player in the world sugar market.

Third, the European Union (EU) is the largest producer of beet sugar, and holds third position among sugar producers. As we shall note later the EU 27 is also the world largest importer of sugar. China is also unique in that it is the world’s fourth largest producer and its third largest importer. Countries that play this dual role exert considerable influence on the global trade in sugar.

Finally, over the years, the order of the country rankings has shifted only marginally. The ten leading producers today are substantially the same as in 2005, except that Colombia is no longer number 10 and Russia is in at number 8.

Projections

Projections of global sugar output by the Food and Agricultural Organization (FAO) and the Organization for Economic Cooperation and Development (OECD) show sugar output increasing annually by about 2 per cent over the next decade. By 2022 global sugar output is projected to reach 212 million tonnes, with this increase principally driven by rising production in Brazil and India (See OECD-FAO Agricultural Outlook 2013-2022).

At this stage readers should also note that the growth in global sugar output is expected to be paralleled across the entire spectrum of the sweeteners market. In particular, the output of HFCS/isoglucose, (which is used primarily in the beverages and processed foods industries) is expected to increase by about one-sixth over the next decade, largely due to rising consumption in the USA and Europe.

Sugar trade

Global sugar trade (imports and exports averaged) is about 30 per cent to one-third of global sugar output. As indicated, Brazil is the leading exporter at about 28 million tonnes raw value. This is more than two and a half times the world’s second largest exporter of sugar (Thailand). Note that the EU 27 is the world’s leading sugar importer (3.8 million tonnes) and the United States its fourth (2.6 million tonnes). As we shall observe later these two countries import their sugar under government regulatory regimes which not only control their sugar imports, but also regulate their domestic sweetener production.

Next week I shall wrap up this appraisal of the global sugar industry by examining global sugar consumption and the price of sugar on the world market.