I had earlier cautioned readers to be sceptical of the widely held view that the European Community’s (EC) denunciation of the Sugar Protocol (SP) in 2009 was “the final nail in the coffin of Guyana and the rest of Caricom’s sugar industry.” I have put forward the alternative interpretation that this event was the proximate occurrence leading to the effective collapse of the region’s traditional sugar industry, and in no way either the sole or principal cause for that collapse.

On the same note I have further suggested that, while Caricom sugar producers other than Guyana have labelled their responses to the EC denunciation as “strategic”, in similar vein I would describe Guyana’s response as “opportunistic.” However, to date neither of these responses has given any indication of likely success.

During the SP period (1975-2009), Caricom (including Guyana) exported almost all its sugar to four markets. Apart from incidental exports to the world free market, these were 1) the ACP-EC Sugar Protocol market, which was denounced and transitioned to 2017 as a duty free quota free (DFQF) arrangement; 2) the EC Special Preference Sugar, which lasted to 2001; 3) Caricom; and 4) the United States. The first two have already been described in previous columns, and in the following paragraphs I briefly comment on the others.

Caricom sugar market

US sugar market

Three sugar policy tools underlie the US sugar import programme, as authorized by the 2008 Farm Bill. These tools are 1) import restrictions; 2) domestic support prices designed to encourage domestic sweetener suppliers; and 3) export subsidies for restricted amounts of domestically produced sweeteners. Based on these the United States Department of Agriculture (USDA) issues sugar quotas under a Tariff Rate Quota (TRQ) system, on a country by country basis, for which Guyana and other Caricom producers qualify. At the end of the 2000s this market had accounted for about 5 per cent of Guyana’s exports, but recently the prices offered in this market, together with Guyana’s obligations to the EC market, do not allow for significant exportation of sugar to the US, given recent production shortfalls.

Sugar exports since 2008

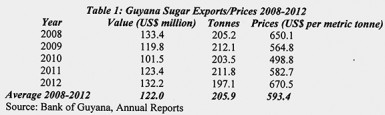

Table 1 below indicates the value (US$ million), volume (tonnes), and prices (US$ per tonne) for Guyana’ sugar exports since the year preceding the EC’s denunciation of the SP (2008) to the most recent available (2012).

The striking observation is that the nominal value of sugar exports has been maintained between 2008 and 2012 at around US$132-133 million. This is the case despite the reduction in the quantity of exports (about four per cent) and fluctuation from a high of 212,000 tonnes in 2009 to a low of 197,000 tonnes in 2012. The reason for this relatively steady value between the two years is that prices have remained high (US$650 in 2008 and US$670 per tonne in 2012), even though there is noticeable fluctuation during the period (from a low of US$499 in 2010 to a high of US$670 in 2012). The average price received over the period has been about US$593 and the export quantity has averaged about 206,000 tonnes.

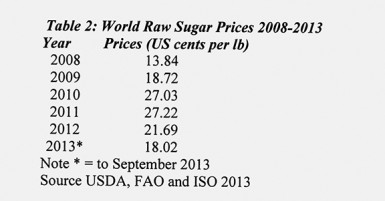

The table shows the stroke of good fortune which befell the former ACP exporters to the EC under the SP, in that world market prices had peaked (over 20 cents per lb) during 2010-2012, and have since remained fairly strong into 2013. (See Table 2 below)

Table 2: World Raw Sugar Prices 2008-2013

Conclusion

Pursuant to its denunciation of the SP, the EC has made available financial assistance to support ACP sugar exporters under the SP (including Guyana and Caricom). This assistance is designed to ensure their successful adjustment to the new EC sugar regime. Readers, however, need to realize that this adjustment assistance must cope not only with the EC’s denunciation of the SP, but also provision of 1) improved market access for sugar from developing countries as a group; 2) the least developing countries (LDCs) as a group also (under the Everything But Arms (EBA) arrangement as previously noted; and 3) other ACP member states that were not yet supplying sugar for the EC market, but which could do so now.

Although country-specific adjustment plans strategies have been adopted by the EC and individual ACP sugar exporters, there are certain general aims behind all these plans/strategies. Three of these are central to our later discussions:

Improving the competiveness of sugar cane production

Diversifying economic (and other) activities in present sugar-dependent areas

Taking into account the wider macroeconomic, employment, social, land use and environmental impacts of the adjustment process.

Next week I shall critically examine EC assistance to Guyana and also consider the impact/benefit of the SP during its heyday.