On 16 January 2014, the Minister of Finance presented to the National Assembly the 2012 annual report of the National Industrial and Commercial Investments Limited (NICIL). The report is five months late in the case of the audit and four months in terms of presentation in the Assembly. It contains three sections – corporate information; Directors’ report; and the audited financial statements along with the report of the Auditor General.

Corporate information

This section lists the Minister of Finance as Chairman along with four other directors, namely Dr. R. Luncheon (Head of the Presidential Secretariat); S. Roopnauth (Director of the Budget, Ministry of Finance); N. Dharamlall (Permanent Secretary, Ministry of Amerindian Affairs); and W. Brassington (Executive Director, NICIL).

Let us compare the situation when NICIL was formed in 1990. The first Directors were: H. Thompson (Secretary to the Treasury); A. Bhagwandin (Permanent Secretary of the Ministry of Trade); and the late Harold Davis (Chairman of GUYSUCO). In 1998, NICIL filed Articles of Continuance, and the new Directors were: E. Heyligar (Consultant at the Ministry of Finance); M. Pertab (Deputy Secretary to the Treasury); and N. Totaram (Deputy Permanent Secretary, Ministry of Trade).

In principle, state-owned/controlled entities should be allowed to operate with some degree of autonomy and flexibility, free of political interference, and this should be reflected in the composition of the boards. After all, this is mainly why these entities are given corporate status, as opposed to being part of a Ministry or a Department. It follows that Ministers should restrict themselves to the formulation of policies and allow professionally and technically competent persons to be involved in the management of these institutions. Such an arrangement will leave room for recourse to the higher authority, that is, the Minister, in event of a problem.

Report of the Directors

This section contains very brief statements on the results of operations; the declaration of dividends; the list of directors, remuneration and service contracts; NICIL being a going concern; and the external auditors. One would have expected that the Directors’ report would go into some level of detail about NICIL’s activities for the period under review, the key challenges and constraints the company faces, and plans for the future, among others. One also only needs to look at the Directors’ report of Banks DIH Ltd. to realize the shortcomings contained in NICIL’s report.

NICIL’s audited accounts

On 22 November 2013, the Auditor General issued his opinion on NICIL’s financial statements for 2012 in which he gave a “clean bill of health” of the company’s financial performance and position, and its cash flows. He also stated that the financial statements complied with the requirements of the Companies Act 1991 as well as the International Financial Reporting Standards (IFRS).

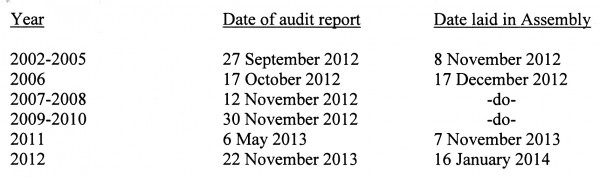

However, Section 346 of the Companies Act requires the audited accounts of a Government company to be finalized not later than six months after the close of the financial year and to be laid before the National Assembly not later than three months later. While NICIL has been in default on both counts, the 2012 annual report represents a significant improvement, compared with

previous years, as can be seen from the following:

On 27 June 2012, the National Assembly passed a motion calling on the Minister of Finance to: (a) account for the lands that NICIL has been entrusted with; (b) explain the basis upon which such lands were disposed of; (c) ensure that NICIL brings its accounts up to date; and (d) hand over the monies and excess funds to the Treasury. Since then, within a period of one year, NICIL has produced audited accounts for eleven years! I have argued on several occasions that accountability becomes enriched if it is seen as a moral act, indeed a personal responsibility, given voluntarily rather than being imposed. Imposed accountability is likely to result in minimum compliance or in some cases no compliance. The NICIL experience lends credence to these assertions.

The Minister has not yet acted on the other three requests, prompting the main Opposition party, APNU, to threaten to take the matter to the Committee of Privileges for possible sanction against the Minister. However, the Attorney General has reportedly stated that the Government is not bound by any resolution of the Assembly. APNU has also not ruled out Court action on the matter.

Examination by the Public Accounts Committee

Section 82(1) of the Standing Orders provides for the Public Accounts Committee (PAC) to “examine the accounts showing the appropriation of the sums granted by the Assembly to meet Public Expenditure and such other accounts laid before the Assembly as the Assembly may refer to the Committee together with the Auditor General’s report thereon”. There are 74 public enterprises and statutory bodies, including NICIL, that are required to have their accounts audited and laid in the National Assembly.

There is, however, no evidence that the Assembly referred the audited accounts of state-owned and controlled entities to the PAC for examination. This is a significant shortcoming in the work of both the Assembly and of the PAC. Given all the concerns relating to the operations of NICIL, this entity has so far escaped scrutiny from the PAC!

NICIL up to 2001

NICIL was formed to oversee the Government’s privatization programme and to ensure that all proceeds are collected and paid over to the Treasury. For doing so, NICIL received a subvention from the Government. The financial statements from the date of incorporation up to 2002 reflected this, and NICIL did not retain any proceeds from the disposal of state assets and dividends received from public enterprises. In fact, there are two budget line items in the estimates of revenue and expenditure under the captions “Sale of Assets” and “Dividends and Transfers”. For the period 1994 to 1999, amounts totalling $2.674 billion and $8.354 billion respectively were collected and paid over to the Treasury

However, since 2002, no amounts have been budgeted for the sale of assets while in respect of dividends, only sums expected to be collected by way of dividends from NICIL are shown. Dividends from other state enterprises, such as GUYOIL, are not reflected in the national budget.

NICIL post 2001

On 31 December 2001, the Privatisation Unit, NICIL and the Government entered into an agreement for the Privatisation Unit to be the exclusive manager of NICIL. The collection and accounting of privatization proceeds, rents, dividends and other income of the combined entity are to be done in the name of NICIL. Expenses of the combined entity are also to be regarded as costs of NICIL.

Here again we find the dominating influence of the Minister in that: (a) the Privatisation Unit was part of the Ministry of Finance; (b) the Chairman of the NICIL’s Board is the Minister; and (c) the Government designated representative on all matters relating to NICIL is the Minister. In effect, the Minister has signed the Management Co-operation agreement with himself!

The Agreement paved the way for an important and significant source of revenue to be diverted away from the Treasury and placed in the hands of a government-owned company to be used at the discretion of its directors. Since there are budgetary implications involved, one would have expected that the proposed changed arrangement would have been taken to the National Assembly for its approval. Regrettably, this was not done. In any event, it is extremely doubtful that the Assembly would have sanctioned such an arrangement that violates Articles 216 and 217 of the Constitution.

To be continued –