I had reported a few weeks ago in this series data comparing the unit cost of sugar production for Caricom producers in 2005. While the data presented then were useful for their intended comparative purpose, I am not certain that the information provided covered all or only selected components of unit costs across the region. For this reason I cannot therefore use that data for present comparative purposes in this column, since for certain all components of costs are captured in the tables which are presented below.

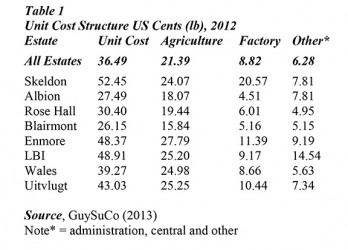

Table 1 shows the unit cost of GuySuCo’s sugar production for 2012 was 36.49 US cents per lb (the most recent year for which the data are available). This amount is nearly double the prevailing raw sugar price in world markets. It is also substantially above the 20 US cents per lb, which I have previously used as a marker for peak prices, when analyzing the price data since 1961.

The table also reveals the main components of overall unit cost for 2012. Clearly agricultural costs dominate (59 per cent of the total) followed by factory costs (24 per cent) and “other costs” (17 per cent). “Other” indicates mainly central and administration costs. These costs are also shown by estate in the same table. These reveal that Skeldon, Enmore, LBI, Uitvlugt and Wales had unit costs above the average for all estates. The estates that had lower than average costs are the Berbice ones other than Skeldon (that is Albion, Rose Hall and Blairmont).

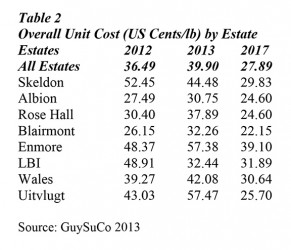

Table 2 indicates the following: 1) unit costs for 2012; 2) GuySuCo’s estimates for 2013; and 3) GuySuCo’s forecast for 2017 (the end date of its Strategic Plan). The high 2012 unit cost in Skeldon obviously reflects that estate’s well-known ongoing difficulties. The 2017 forecast, however, indicates a marked reduction in that estate’s unit cost (by 23.62 cents or 45 per cent). Its unit cost nevertheless, remains above the average level. All the other Berbice estates have forecast unit costs for 2017 that are below the average, with Blairmont being the lowest (22.15 cents). Meanwhile, all the Demerara estates, except for Uitvlugt (25.70 US cents) have forecast unit costs above the average.

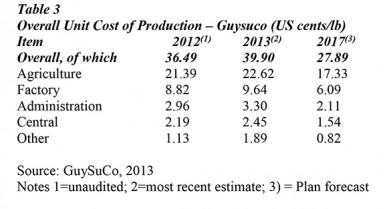

Unit costs and their components are shown in Table 3 for the years: 2012, 2013 and 2017. This reveals the industry-wide unit cost is projected to fall from 36.49 cents in 2012 to 27.89 cents by 2017 – a decline of 8.60 US cents per lb or 31 per cent. For all three years covered in the table, however, agricultural costs represent the leading component (an average of 49 per cent); followed by factory costs (average 24 per cent). Administration, central and other costs represent 6.28 US cents in 2012 and are forecast to fall to 4.47 US cents by 2017. The forecast overall declines for the three components between 2012 and 2017 are 4.06 cents, 2.73 US cents and 1.81 cents respectively.

It would be useful to conclude this column by briefly drawing attention to some of the broader political economy issues related to costs as a performance indicator. This task will continue next week in our examination of profitability.

Employment costs

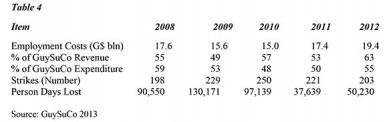

In 1990 the employment cost at GuySuCo was $1.9 billion. However, there is little doubt that, subsequently, high and rising employment costs during the 1990s and 2000s, along with weak labour supply, low turnout, and industrial stoppages have combined to put serious pressures on the overall unit production costs of GuySuCo. Thus, at the start of the PPP/C administration in 1992, employment costs were $4.9 billion. However, by 2000 it had reached $12.4 billion, and stood at $19.4 billion in 2012; the increase has been by a multiple of four! This and other related data are shown in Table 4 below.

As shares of GuySuCo revenue and operating expenditure, employment costs have averaged 55 and 57 per cent respectively over the most recent five-year period for which we have data (2008-2013). Table 4 shows that employment costs have fluctuated somewhat, rising by $2 billion between 2011 and 2013, after having fallen by the same amount between 2008 and 2009.

In relation to industrial relations issues, it is useful to note that 78 per cent of GuySuCo’s employment costs are paid to GAWU employees, eight per cent to Naacie’s, and 13 per cent to others.

Next week I shall wrap up this discussion on costs.