From a dynamic perspective, over the medium to long-term the profitability of the sugar industry as a whole, and GuySuCo in particular, is more than any other variable, the best representative indicator of its sustainability as a commercial venture. From a business accounting standpoint the profit that is made indicates the extent to which total earnings or business income derived from sugar can cover all sugar costs or business expenses, thereby resulting in a surplus of income over these expenses or c

Accounting profit

If, to the contrary, sustained losses are incurred, then the sugar industry as a whole and particularly GuySuCo becomes unsustainable as a commercial venture. Furthermore, because GuySuCo is a state-owned corporation continued losses would make its survival contingent on being provided with state hand-outs, bail-outs, subsidies, and/ or other forms of relief. In effect, this would turn GuySuCo into a welfare operation for the Government’s constituents and not a commercial venture.

Economic profit

At this juncture, it should be observed that the accounting profit referred to above differs from what economists term ‘economic profit.’ The reason for this difference is that economists deem the real cost of every resource utilized in the sugar economy as its opportunity cost. In simple language this cost would be equal to the alternative (or next best amount of) earnings the resource can obtain, if it were to be employed elsewhere than in sugar. To all intents and purposes therefore, this is an implicit cost. Explicit costs are consequently, the actual accounting costs which have been described in the previous paragraph. In order to arrive at economic profit one would have to deduct from total earnings (revenue or income) not only accounting costs (which would express accounting profit) but also opportunity costs. That is:

Accounting Profit = Total Earnings (Income) minus Total Expenses

and

Economic Profit = Total Earnings (Income) minus Total Expenses minus Opportunity Costs.

As a rule, economic profit is normally less than accounting profit. Both measures of profit are nevertheless, immensely useful. No sensible claim can be entertained that one measure is preferable over the other, save and except in situations where the evaluation of public projects is concerned. In this instance economic profit is a more relevant concept. Readers, however, need to be aware of this difference, principally because GuySuCo is a parastatal enterprise and not a private one.

Going forward, for the purposes of future presentations on this topic, accounting profit is the concept that is intended whenever I refer generally to profit, unless specifically indicated otherwise.

GuySuCo’s profitability 1990s, 2000s

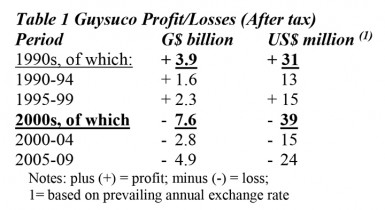

In this section I briefly recap, for readers’ benefit, information on GuySuCo’s profit and losses over the 1990s and 2000s as officially published in its Annual Financial Returns.

Source: Guysuco Annual Reports, various.

The main purpose for giving the information in both Guyana and United States dollars is that the bulk of GuySuCo’s sugar production is exported and paid for in foreign currency. The prevailing exchange rate is therefore a critical determinant of GuySuCo’s income in Guyana dollars terms, and hence its profitability. The average mid-market exchange rate for the 1990s, had depreciated over the decade by more than 50 per cent. For the 2000s, however, the depreciation was substantially less – just under 10 per cent.

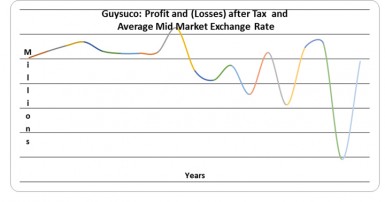

These profit data are reproduced in the Graph.

Conclusion

With the background information provided above, next week I shall address the situation as regards GuySuCo’s current and forecast profit (losses) to 2017. This will be accompanied with a discussion of the corporation’s current and long-term liabilities and their major components. We should note however that since the 2000s GuySuCo has been generally mired in a sea of losses.

At this stage it would be useful to recall two earlier observations, which reveal GuySuCo’s seeming acceptance of a culture of losses: 1) Under the caption ‘Results and Dividends’ its last Annual Report (2009) states: “In accordance with the policy of the corporation for many years (my emphasis) no dividends are declared as payable”; and 2) The Auditor General is also reported, under the caption ‘Emphasis of Matter’ as recording that the corporation’s indebtedness to GRA for unpaid taxes is about G$2.3 billion, and that a settlement on this was being negotiated with the GRA.