Lousy job

Imagine seven years after Sithe Global showed an initial interest in the Amaila Falls hydroelectric project, companies in Guyana are still increasing their profits by as much as 30 per cent in one year. The 19 per cent requested by Sithe Global pales in comparison to the returns reported this year by several companies, including the commercial banks. This matter, while an outcome of the operating enterprises, is also an indication of the poor job that the government did in selling the offer made by Sithe Global as an acceptable risk for the country. However, this article is not about Sithe Global or the lousy job the government did in its attempt to bring cheaper electricity to Guyana. It is about the continued ability of the principal financial entities in Guyana, the commercial banks, to make abnormal profits in a market that looks a long way from reaching its full potential.

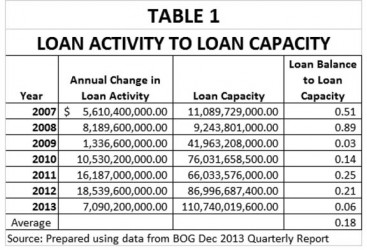

Loan activity

Increases in profit

Despite the relatively low level of activity, the four commercial banks that are part of the Guyana Stock Market and the Lucas Stock Index have reported increases in profits in 2013 over the previous year. Their performances are a mixed bag with three of them reporting substantial increases in profits with a fourth reporting comparatively a moderate increase. Guyana Bank for Trade and Industry (GBTI) reported a 20 per cent increase in profits in 2013 over 2012. Republic Bank reported a 17 per cent increase in profits over the same period. Demerara Bank is reported to have recorded a 30 per cent increase in its profits. According to the information found in the consolidated annual report of Banks DIH, only Citizens Bank would have recorded an increase that was not in double figures. Its increase would have been four per cent.

A surprise

With so much loanable funds available and with so much profit being made, it would be a surprise if foreign commercial banks are not knocking at the door of the Central Bank to open the market to them. There is plenty money to be made in a market that still carries relatively low levels of risk in the loan portfolios. In a globalized world where surplus money is always looking for investment opportunities, eyes must keep turning in the direction of Guyana where every year it seems that the local banks are announcing record profits. No one will sit idly by to see the local banks feed unmolested at the trough of excess profits forever unless something is happening that is deterring potential investors. One must wonder therefore as to how many inquiries the BoG gets every year from other entities that want to do banking business in Guyana, what the nature of those inquiries are, and what might be causing potential investors to keep their enthusiasm in check.

Local interests would have Guyanese wondering what is enabling the banks to do so well each year. A similar curiosity would come from foreigner observers as well. The economy keeps growing is the mantra of the government. But the banks themselves are responsible for managing assets and depositors’ money. Therefore, most of them must be doing something right that enables them to take advantage of investment opportunities and record continually high rates of profits. Some understanding could be gained by examining a few strategies of the companies operating in the industry. The data used is taken from the prudential ratios that are published by the BOG. This data helps us to gain an understanding of the business models of the banks and some of the strategies used to compete successfully in the domestic market.

Asset composition

Asset composition gives an indication of the business model of the banks. All banks give greater emphasis to businesses than households, two of the three groups that spend money in the economy. The third group of spenders is the government. Some banks have more extreme positions than others. For example, the Bank of Baroda has 86 per cent of its loans skewed in favour of businesses while only five per cent go to households. GBTI has a similar posture with over 77 per cent of its loans directed at the business sector and a minuscule five per cent made available to households. Strong preferences are also shown by Demerara Bank and Citizens Bank towards the business community. They both allocate close to 60 per cent of their loans to businesses. Unlike BOB and GBTI, they place differing emphasis on households. Demerara Bank’s loans to households, at 16 per cent of its portfolio, are more than twice that of Citizens Bank.

Balanced strategy

Of the four banks on the local stock exchange, only Republic Bank utilizes a more balanced strategy than the others. In the case of RBL, 40 per cent of its loans go to businesses and 31 percent go to households. With its loan distribution composed as it is, RBL finds itself operating below the industry average for business loans and above average for household loans. With its level of support for households more than twice the industry average, RBL establishes itself as the leader in household loans. Within the business sector, RBL’s penchant for diversifying its risk is also evident. While the majority (23 per cent) of its business loans go to the services sector, the combined risk of the other sectors (17 per cent) is relatively close to its majority position on services. A similar disposition could be observed with Demerara Bank which has an even closer spread between its loan exposure to the services sector and that of the combined sectors of manufacturing, agriculture and mining.

With the resources under the control of differing management, the business models reveal varying degrees of asset efficiency. Demerara Bank recorded a return on asset of $4.16. When compared to the other entities, it means that DBL is getting the best bang for its buck. It is using its assets efficiently and that customers are primarily financing the operations of the bank. Similar observations could be made about the Bank of Nova Scotia and the Bank of Baroda. Customer financing is a principal driver of their business success. The other three banks have returns on assets that are below the industry

average as reported by the Bank of Guyana. The smallest return was recorded by RBL at $1.85.

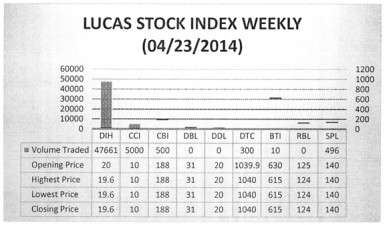

Last Update: 262.20 Movement: -0.67%

Current Update: 260.44 YTD Movement: -5.66%

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 0.67 per cent during the third period of trading in April 2014. The stocks of six companies were traded with a total of 53,967 shares changing hands. There was one Climber and two Tumblers. The value of the stocks of Demerara Tobacco Company (DTC) inched up 0.01 percent on the sale of 300 shares. At the same time the value of the stocks of Banks DIH (DIH) fell 2 per cent on the sale of 47,667 shares while that of Guyana Bank for Trade and Industry (BTI) fell 2.08 per cent on the sale of 10 shares. In the meanwhile, the value of the stocks of Caribbean Container Inc., Citizens Bank Limited (DBL), and Sterling Products Limited (SPL) remained unchanged on the sale of 5,000; 500 and 496 shares respectively.

Shareholder value

At the end of the day, it is shareholder value that matters most. The owners of the company want to know that they are getting a satisfactory return for their investment. This is typically reflected in the return on equity. The largest return on equity was recorded by Demerara Bank which gave its shareholders a 32 per cent return on their investment. Despite having the smallest level of profitability, RBL was able to provide its shareholders with a yield, 24.51 per cent, that surpassed all the remaining banks. It should be clear that other factors played into the healthy returns generated by RBL in particular. The factor most relevant here is financial leverage, or how well it was able to use the money of depositors. A peek into the financial leverage showed that half of the banks, including RBL, operated below industry standards and the other half above industry standards. This occurrence suggests that other factors must be considered too since the loan-to-deposit ratio for RBL is among the lowest in the industry and is below industry standards.

Closer look

The foregoing outcomes require us to take a closer look at the individual banks that are part of the Lucas Stock Index to gain a better insight into the dynamics that enable them to earn abnormal profits. This will involve a focus on four banks, namely Citizens Bank, Demerara Bank, Guyana Bank for Trade and Industry and Republic Bank (Guyana) to which the strategic profit and strategic financing models will be applied.