Introduction

Thus far I have identified two of what have been described in the economic literature as the “four essential roles or functions governments perform in the economy.” There has been firstly, government spending on goods and services. As previously noted readers need to be aware that this role is not as straightforward as it might at first appear. The main reason for this is that a considerable amount of government spending does not take place in private markets (for example, spending on security). And, because of this consideration, in practice it has been very difficult to properly identify and therefore adequately measure such types of government expenditures.

As was also noted in last week’s column, the second role governments perform is to provide mechanisms and means for transferring income among different groups in the economy/society. These transfers can take what economists term as a vertical form (that is from rich to poor) or a horizontal form (for example, the provision of old age pensions irrespective of the pensioner’s income or wealth).

Furthermore, as was briefly referred to in the conclusion of last week’s column, there is a fundamental difference between the first and second roles of government, which readers need to be aware of. Government spending on goods and services in the economy both directly and indirectly affects the production of goods and services throughout the entire economy (both government and non-government sectors). However, providing mechanisms and means for transferring income, among different groups whether horizontal or vertical does not directly impact on the output of goods and services in the entire economy. It may do so indirectly. This would be the case if, for example, the pensioner who receives a government transfer spends some or all of it. At the same time, however, the person or business that provides the income (through taxes) to finance this transfer would find itself in a situation where there is less income available for spending.

Transfers

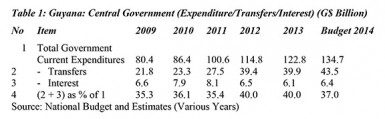

From that table it can be observed that, when taken together, interest payments and transfers presently account for comfortably more than one-third of all government’s current expenditures in Guyana. On average, between 2008 and 2013 these payments accounted for 37.4 per cent of total current expenditures, ranging from 35.3 per cent in 2009 to 40.0 per cent in 2013. Furthermore, as the table reveals the 2014 Budget projects the ratio for this year at 37.0 per cent. Finally, in absolute terms, these combined payments have risen from $28.4 billion at the end of 2009 to $46.0 billion five years later at the end of 2013.

Third role

This brings us to the third role performed by all of today’s governments. In order to support their spending, all governments necessarily exercise policies for the compulsory acquisition of income from non-government sectors. This is principally done by way of taxation (income and wealth taxation and taxes on goods and services). However, governments may also borrow, issuing financial instruments as collateral for these loans. This borrowing would include the printing of money.

Fourth role

The fourth role economists normally recognize for government in the economy is as the regulator of the economic system. The regulatory functions governments perform are extremely varied. They include superintending the laws, regulations and procedures governing the operations of commercial businesses; non-profit enterprises; financial markets (and their related institutions and instruments); land use regulations; as well as environmental and labour standards.

Additionally, there is also the regulation of the macro-economy through monetary policy, fiscal policy and direct controls so as to ensure growth and development with balance. That means containing inflation; minimizing unemployment; stabilizing public indebtedness; promoting trade; and ensuring that international, financial and balance of payments deficits do not interrupt the process of the country’s long-term growth and development.

Conclusion

In the case of Guyana, I would suggest an expansion of these roles in the economy. This should be done in order to accommodate two important economic features. One of these is that Guyana still has in place today a significant state enterprises sector, decades after pursuing policies of privatization back in the late 1980s.

The other feature is that Guyana also has a number of what can be described as apex authorities, which are empowered by law with considerable economic authority. These are boosted by Guyana’s strong post-Independence tradition of statist-oriented development. Indeed it can be argued that this legacy is exemplified today in the economy’s significant state-enterprises sector, which continues to exist decades after the explosive wave of nationalization of largely foreign businesses in the 1970s.