Introduction

Alongside the debates about the roles/functions of government in the Guyana economy, there has been another equally enduring economic debate as to whether presently the government is too big, too little, or just about right-sized. This week’s column will pursue this topic.

Much of the difficulty in securing consensus on the optimal size of government in the economy resides in disagreement over the appropriate way to measure that size. Many economists consider this as total government expenditures as a share of GDP. Others use different variables, such as government revenues as a share of GDP, or the number of government employees as a share of total employment.

Budget size

From a broader perspective it is useful to note that, in the course of a country’s economic life, many aggregates grow larger with the passage of time. One such aggregate is the size of a country’s projected annual Budget. Despite this, one finds that in each succeeding year of annual Budget presentation, the Ministry of Finance makes the silly boast that “this year’s budget is the largest ever”!

Government spending as projected in its annual budgets does not come from thin air, despite the widespread perception that the means to finance such expenditures would fall like manna from heaven. This wrongly held view implies government spending is without cost to the economy! In actuality government spending is provided either through 1) taxes/levies on residents and businesses, 2) government borrowing (including the printing of money), 3) overseas grants, or 4) sales of government assets.

Over time, the first item has been the principal source of government spending. The Guyana Government’s sale of assets peaked in the years when it was privatizing the assets, which had been earlier nationalized in the 1970s. Government’s borrowing has to be eventually repaid by Guyanese taxpayers, as default on its debt is not a practical option nowadays.

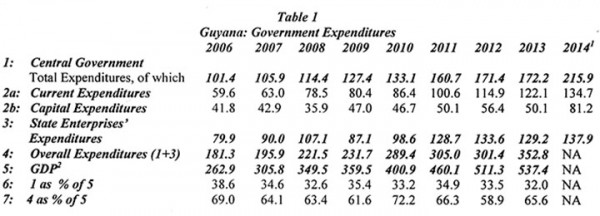

Notes: NA – not applicable

1 – Budget 2014 estimates

2 – GDP at basic prices (industrial origin)

Source: National Budgets, various years

What do the data show?

In the table, central government total expenditures are divided into current and capital, with the former substantially larger than the latter. State enterprises’ expenditures also cover current and capital. Overall expenditures are simply the sum of total central government expenditures (capital and current) together with the similar measure of state enterprises’ expenditures. The GDP measure used is GDP at basic 2006 prices.

As a percent of GDP, total central government expenditures have been high, ranging from 38.6 per cent in 2006 to 32.0 per cent in 2013. The average for the years 2006-2013 was 34 per cent. By similar token, the level of overall public sector expenditures has ranged from 72.2 per cent in 2010 to a low of 58.9 per cent in 2012. The average for the period 2006-2013 was 65 per cent. Most of the year-to-year variability for this category has come from fluctuations in state enterprises’ expenditures, as total current expenditures have experienced regular yearly increases during the entire period (2006-2013).

The data in the table also show that the National Budget for 2014 has projected a substantial expansion in total central government expenditures; much of this increase is in its capital expenditures, which are projected to rise by about 60 per cent (from $50 billion in 2013 to $80 billion in 2014).

Conclusion

As revealed in the table, the size of the Guyana Government in the economy is quite large. This is a matter of concern. However, in fairness it should be observed some economists (including me) argue that small economies, irrespective of their ideological predilections would tend to have, on a relative basis, large government sectors as shares of their GDPs. Three major factors account for this.

First the public goods and services that governments usually provide offer significant economies of scale. That is, as the scale of their provision increases, average unit costs fall.

Small economies therefore face significant diseconomies of scale, where the reverse operates; that is, average unit costs for their provision rise.

The second is that a substantial proportion of publicly provided goods and services face significant indivisibilities. Thus for example, an interior airport, which is costly to construct, could perhaps serve scores of passengers per day at an operating cost not far removed from that incurred if the airport serves less than a dozen passengers because of limited demand.

Thirdly, most small economies experience locational/geographical disadvantages along with severe environmental risks. Guyana is below sea-level, runs climate risks of flood and drought, and perhaps most importantly is bifurcated into hinterland and coastal areas. All these factors add to governmental costs of providing goods and services.

Despite those provisos, the performance record suggests the Guyana Government has been too large, too cumbersome, too inefficient and technologically undeveloped to have been entrusted with spending as much as two-thirds of Guyana’s GDP over the past decade.