Reinforcing

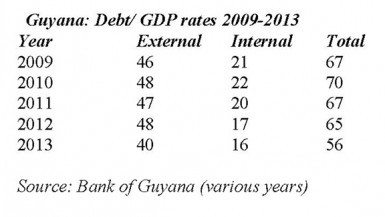

The official information in Table 1 reinforces the observation made last week that Guyana’s present debt burden starkly contrasts to what it was at its peak in 1982 (over 600 per cent for the total debt/GDP ratio and over 500 per cent for the external debt/GDP ratio). In the early 1980s, this proposal might have been plausible. Today’s information however, reveals that for the past five years Guyana’s external debt burden has averaged 46 per cent of its GDP and its total debt burden has averaged 65 per cent of GDP.

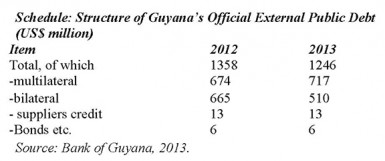

Last week’s column indicated this turnaround was mainly due to the global debt-relief campaign following the eruption of the Third World Debt Crisis in 1982. For the benefit of readers, Schedule 1 displays Guyana’s present external debt structure.

Before closing the discussion on debt relief, I repeat, in order to impress on readers the tremendous significance of the global political and civic agitation (much like the agitation for reparations payment) aimed at placing debt relief to the forefront of global economic management, from which Guyana was to become a major beneficiary. A monumental global campaign (symbolized in the Jubilee 2000 Coalition led by civic groups, workers organizations, professional associations, academic and financial experts, the media, and faith-based organizations) acting in solidarity persuaded governments of the leading economies and global financial institutions that 1) the Third World Debt Crisis could not be resolved by the Third World Countries acting on their own; 2) global solidarity was essential; and 3) furthermore, if the crisis prolonged unduly the world economy would stumble into a Great Depression, which would adversely affect all economies ― rich and poor alike!

Recent Caricom summit

At the end of its recent summit in July of this year, Caricom reported it had requested a meeting with European nations that engaged in the Atlantic slave trade to “talk about reparations.” This gives urgency, therefore, to this topic. Further Guyanese should recall that, back in March 2007, President Jagdeo had deliberately added Guyana’s voice to the earlier Jamaican parliamentary initiative calling for slavery reparations payments to the region.

The second flaw

While from Guyana’s perspective one of the two critical flaws in the proposal for debt relief as reparations payments is its lack of empirical validity, the other flaw lies in the fact that such a form of payment would invariably have to be paid to the Government of Guyana. As a matter of both principle and international best practice, such an outcome would be undesirable. The reasons for this are indicated below.

Cash support, choice, control, dignity

Those who propose debt relief as reparations payments also tend to support the financing of long-term national reconstruction of the economic, social, physical/environment, and institutional infrastructure of the countries where present day slave descendants reside. Such representations have a powerful appeal to laypersons.

My basic concern, however, is that such representations lack proportionately. By this I mean, they urge (both explicitly and implicitly) that the bulk of such payments should go to governments and not directly to slave descendants! Going back to Guyana’s experiences with the Great Flood of 2005, I had proposed then that flood relief funds obtained from abroad should be distributed principally through cash support to families, individuals and local communities (for self-disbursement within the community). Of course, this last would require the installation of appropriate oversight and safeguard mechanisms.

International best practices reveal that cash support yields at a minimum the following distinct advantages: 1) it provides an immediate impact on the income and assets of beneficiary households, which also allows for the swift reduction of their indebtedness; 2) it enhances the primary role of household beneficiary choice in the utilization of the disbursement of these funds; 3) it reinforces slave descendants’ control of their resource endowments and opportunities; and 4) as a result of 1-3, the disbursement mechanisms promote the dignity of slave descendants, as beneficiaries.

International best practices further reveal that disbursement to governments of external compensation payments for poor countries, encounter, several dangers: 1) mis-spending and losses of these funds due to mismanagement; 2) loss of funds due to theft and corruption; 3) bureaucratic delays in their disbursement; 4) lack of timeliness in their execution; 5) expensive administrative overheads and operational costs; as well as 6) the potential insertion of discriminatory procedures and practices in the compensation process, based on political, social, cultural and other such considerations.

In conclusion, therefore, Guyana’s official debt burden (as distinct from some Caricom countries) does not warrant its prioritization as the target of reparations payment. And further, passing such payments through any Government of Guyana to slave descendants does not accord with present-day best practices for public relief.

This brings to an end my discussion of this topic. Next week, at the urging of readers, I shall discuss the recent population and housing census preliminary report.