Frequent concessions

In the world of international trade, there is something called national treatment. Ordinarily, the issue of national treatment would be of little concern since it has been a long accepted practice of global trade. It can be found in the General Agreement on Tariffs and Trade. It became a part of the General Agreement on Trade in Services in 1995. It is also part of the Agreement on Trade in Intellectual Property Rights and the Agreement on Trade-related Investment Measures (TRIMS). The push towards the liberalization of trade in services has been prompted by, among other things, technical innovations which have enhanced the tradability of services. For Guyana, the issue of trade in services has begun to take on significance because of its relevance to the many infrastructural projects built with the use of foreign capital and labour. The interest in the matter stems from the frequent concessions that Guyana gives to certain countries to undertake projects locally.

National treatment

National treatment is about foreign goods and services gaining equal access to a domestic market. Under the WTO rules, the national treatment principle says that imports should be treated no differently from similar domestic goods. For example, beer that is imported into Guyana should be treated no differently from beer produced in Guyana. However, it should be kept in mind that goods which are close substitutes for the protected domestic item could also trigger a violation of the principle. In addition to trade in goods, the national treatment principle could be found in trade in services, intellectual property rights and investment related activities.

Purpose

This rule has two purposes. One is to prevent countries from discriminating against imports. The other is to prevent countries from using non-tariff barriers to offset concessions made on tariff barriers. The emergence of new transmission technologies such as electronic banking, tele-education and tele-health has enhanced the tradability of services. The thrust of the national treatment principle is to maintain the balance of rights and obligations and allow the multilateral trading system to work effectively. So with the exception of the imposition of a tariff, no other burden should be placed on the imports, ie, no non-tariff barrier and no hidden charge that places the import at a disadvantage.

Exceptions

Despite the importance of the national treatment principle to the effective functioning of the trading system, there are at least three exceptions to its application. These are the use of domestic subsidies, the protection of infant industries and government procurement. The three exceptions have the same effect on the importing country. At the heart of the trading system is the proper functioning of the market and the belief that it could allocate goods and services across countries rationally. Domestic subsidies have the effect of lowering the cost of production to the local producer and hence the final price of the goods. Domestic subsidies therefore place the locally produced goods or services at an advantage over the foreign import. In other words, a country is allowed to discriminate against others by directing assistance to local producers. In so doing, the subsidy disrupts the allocation by influencing the price at which the import becomes available in the local market. The exception on subsidies is based on the recognition that it is an effective policy tool for promoting development. Even though subsidies can have a distorting effect on trade, they are justified on the grounds of being able to correct for market failure.

The other exemption is based on a need to protect infant industries. Countries that are in the early stage of development are permitted to violate the national treatment principle so as to help young industries to grow. This exception is permitted on the grounds that infant industries are vulnerable to attack from lower cost products from mature industries in other countries. So a country could use a range of measures to protect its infant industries.

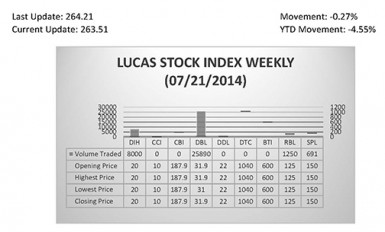

The Lucas Stock Index (LSI) remained unchanged increased 0.89 percent during the second period of trading in July 2014. The stocks of three companies were traded with a total of 844,386 shares changing hands. There were no Climbers and no Tumblers. The value of the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL) and Sterling Products Limited (SPL) remained unchanged on the sale of 31,718; 810,028 and 2,640 shares respectively.

The third exception pertains to purchases by government or what could be termed government procurement. It is this exception that is of interest to this column simply because of the excessive concessions that the government gives to countries which have been involved in infrastructural development in this country. Like the other two exceptions, this one is available also to all governments. It allows the importing governments to insist on certain benefits in procurement. This exception has important value in that it permits a country to promote small business development, local industries or the development of advanced technology. The national treatment rule does not say that a country should restrict bidding to one country.

Despite the exception, some effort has been made to liberalize the government procurement market. The matter was first brought into the Tokyo Round of trade negotiations in the General Agreement on Tariffs and Trade in 1976. Eventually, an agreement was reached in 1994 which allow participating countries to compete with each other for procurement contracts in each other’s territory. The Government Procurement Agreement is an accord which applies to the members who signed the agreement. Guyana is not one of those countries. Neither are China and India members of the Government Procurement Agreement. Guyana therefore has the right to discriminate where government procurement is concerned. Importantly too, it is the commitments that it made under GATS that dictates how it should behave where government procurement is concerned.

Imported services

Guyana has been importing construction services from China and India in abundance. The government identified on more than one occasion the National Stadium, the International Conference Centre, the sugar factory at Skeldon, and the Marriott Hotel as some of the projects which used or are using imported construction services. The regulation of services falls under GATS which recognizes four types of services. These are cross-border supply, consumption abroad, commercial presence and the presence of natural persons. To get a sense of what Guyana feels about making concessions for construction services under GATS, it is necessary to examine the country’s Schedule of Commitments. Therein Guyana gave specific expression in relation to about four sectors and 18 specific services. The sectors are business services, communication, financial services, tourism and travel, and transport services. Guyana listed engineering and architectural services, but not construction as an activity to which foreign suppliers could gain access. Countries are required to use the term none if they wish to provide foreign firms unfettered access to their market and unbound if they wish to limit access.

Expressions of commitment

In its expression of commitments, Guyana gave open access to several specific services in the four sectors mentioned above. In several cases, Guyana also requested to be left free to introduce or maintain laws or regulations that limit market access or national treatment or even discriminate in favour of domestic firms. Guyana made no commitment on integrated engineering projects which includes construction activities. On the other hand, both China and India made commitments. But their commitments contained a desire to be left free to determine if foreign personnel would be allowed to work on construction projects. These commitments come with reciprocity. While Guyana expressed no such commitment, it is implementing it anyway. It appears therefore that Guyana is using its flexibility under the trading rules to grant special concessions to contractors from China and India when it is in no position to demand similar treatment from them.

Defence of position

There have been several opportunities to correct this deficiency in Guyana’s trading regime for services. Every three years following the adoption of the GATS, a country could indicate changes that it would like to make. Twenty years have passed and no such changes have been made by Guyana. One argument that the government makes in defence of its position is the need for fairness. Well, the government has no such obligation since it made no such commitment with regard to construction.

Yielding its rights

It would appear therefore that Guyana is consciously yielding its right, for example to ensure that personnel from Guyana are included in construction projects. Because the projects involved government procurement services, there was no compulsion to buy foreign construction services. It is understood that the move towards foreign services was influenced by the need for financing for the projects. But that is not enough to make Guyana give up all the rights it is allowed to exercise under GATS.