Mood swing

From all indications general elections in Guyana will be held in 2015. But something else will occur in 2015 that will have important significance for the future direction of the country and the world of business. As Guyana prepares for elections, it will have to keep an eye on preparations for the 21st Conference of the Parties (COP) who are signatories to the United Nations Framework Convention on Climate Change. That gathering will assemble in France towards the end of 2015 and make another effort to achieve a global framework that could help to minimize or avoid the catastrophic effects of climate change. The 20th Conference of the Parties will come to a close today in Peru, but it is for next year’s session of the COP that countries apparently are reserving the biggest decisions. The world trophy to be hoisted would be the global agreement to replace the Kyoto Treaty. The mood swing that a successful global treaty will emerge from the 21st session next year stems from the accord reached between China and the USA on action to reduce greenhouse gases, and the determination shown by countries in Peru not to be thwarted in their efforts.

A better world

Linked to the annual attempts to fashion a better world for today and tomorrow are the design and use of better tools to measure the economic impact of human activity. These tools consist of practical changes that will eventually affect the way in which countries account for their national income. Soon, it would no longer be business as usual for the world is headed in the direction of accounting that integrates environmental and economic variables, and countries are being encouraged to move in that direction. Their ability to do so is being facilitated by the release of the 2012 collaborative version of the System of Environmental and Economics Accounts (SEEA) that has been produced by the UN for use on an experimental basis. The emergence of SEEA is a consequence of the limitation of the current system of national accounting to capture the true impact of the economic value of human activity and provide a realistic assessment of a country’s wealth.

Work-in-progress

Opportunity cost

But early study reveals that SEEA is a system that captures the accounts of natural capital in a way that takes account of the opportunity cost of the disturbance of the ecosystem. The current system of national accounts is constructed from data generated by the various economic agents in a country. Economic agents are households, businesses, non-governmental organizations and governments which are accustomed to placing value on the upside of economic activity and hardly ever include all of the downside. For example, we see land, we see plants, we see trees, we see water and we use and value those materials which our technology enables us to utilize and measure. So we clear the land to construct houses, factories and offices without considering the environmental impact of the assets that we do not see, unless it is part of some large-scale investment. We employ the river to move people and produce or search it for minerals without considering the manner in which unseen ecosystems within it are being disturbed. This approach leads to a GDP valuation, the most important measure of economic growth used today, that excludes vital economic assets and many aspects of their economic contribution to society. Further, since GDP is measured at the gross level, the effects of depletion of natural resources are not accounted for in this prominent national figure.

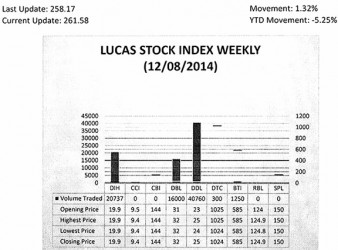

The Lucas Stock Index (LSI) rose 1.32 per cent in trading during the second period of December 2014. The stocks of five companies were traded with 79,047 shares changing hands. There were two Climbers and one Tumbler. The value of the stocks of Demerara Bank Limited (RBL) rose 3.23 per cent on the sale of 16,000 shares while the value of the stocks of Demerara Distillers Limited (DDL) rose 8.7 per cent on the sale of 40,760 shares. The value of the stocks of Demerara Tobacco Company (DTC) fell 0.09 per cent on the sale of 300 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH) and Guyana Bank for Trade and Industry (BTI) remained unchanged on the sale of 20,737 and 1,250 shares respectively.

The desire to minimize or even exclude cost is understandable in a system where profits determine success or failure. While it is impossible to account for human attitude, SEEA enables us to measure ecosystems and flows of services from ecosystems into economic and other human activity. The new system of national accounting enables us to at least understand what environmental assets exist and help us to provide a more realistic view of national welfare. In addition, SEEA provides guidance on the valuation of renewable and non-renewable natural resources. The flows in ecosystem accounting are of two types. There are flows within (intra) and between (inter) ecosystem assets that reflect ongoing ecosystem processes. Inter-ecosystem flows further recognize the interdependence between different ecosystem assets. An example of that interdependence is wetlands which are usually dependent on river flow. These are assets which are akin to raw materials and work-in-process inventory.

Motive

The motive behind SEEA is to help countries to account for clean air, clean water, forests, minerals and other ecosystems as part of the effort to achieve sustainable development. Demand for an accounting system that could measure natural capital is growing as the world becomes more aware of the devastating consequences of climate change. Almost every sphere of environmental life is pressing for action that brings better accounting of environmental activities in an effort to forestall the worst consequences of climate change. The Strategic Plan for Biodiversity encourages countries to incorporate biodiversity values into national accounting and reporting systems by 2020. In a World Bank document entitled ‘Moving Beyond GDP,’ the system of SEEA provides countries with guidance on compiling asset, physical flow and monetary accounts on environmental variables. Eventually, it will be difficult for countries to avoid using SEEA since it is backed by all the major multilateral financial institutions which will eventually begin to apply its use to loan conditions. One would be surprised therefore if Guyana does not soon get onboard the already moving train.

Benefit

One benefit of using the method is to improve the accuracy of measuring the value of natural capital. For example, one resource that is often undervalued is that of timber. Studies have shown that the timber value of forests accounts for less than one-third of the economic value of forest ecosystems because the environmental services provided by forests are often missing. A better understanding of the value of natural resources helps with national development planning. Using the proposed accounting system helps to determine how economic rent from natural resources could be increased. It helps to provide a basis for determining if the economic rent could be used to expand other assets. Many of these factors are considered as part of the opportunity cost of using resources. The advantage that SEEA brings is that it helps to increase awareness of the likely loss of ecosystems and services on economic and financial decisions.

This means therefore for government to construct national accounts using environmental data, the four types of economic agents would also have to think differently about economic accounting. They would have to think differently about what could be left out of economic decisions that disturb the environment. Since most activities would disturb the environment, an objective evaluation would have to include the smallest economic activity, that which takes place at the individual household or firm level.

Thin air

The SEEA did not emerge out of thin air. The seed for this accounting system of the future was planted 22 years ago at the Rio Summit where countries called for a systems approach to monitor progress towards sustainable development. The thrust of the effort was to find a methodology which could lead to the integration of environmental and economic accounting that assisted countries to understand how human activity affected sustainable development. Scientists have produced evidence that the threat from climate change is real and without modification in our behavior the risk of catastrophic events rises.

No idle talk

For many countries the pursuit of a practical means of addressing environmental concerns was not idle talk. While the global effort on building an accounting framework on SEEA began in the early nineties and has progressed steadily over the years, a handful of countries made an early start in search of measures that captured the environmental impact of economic activities in national accounting. Evidence suggests that one of the earliest movers towards environmental accounting was Indonesia, a major oil producing country in South East Asia, which began building environment-economic accounts in the 1980s. However, this early effort did not include the building of indicators for sustainable development. The Philippines is another country which has been identified as a pioneer in environmental accounting having begun to focus on environment and natural resource accounting in 1991. These countries cannot be accused of twiddling their thumbs while Rome burnt. Guyana should become an early user of the experimental methodology to avoid such criticism.