A remedy

Five years after the collapse of Clico, the long-term portion of the insurance industry in Guyana exhibits a different profile in many of its activities. With the festive season at hand, Guyanese might not be interested in concentrating on difficult matters. But some of the information presented herein might just make Christmas brighter because for several Guyanese insurance represents an important way in which they try to protect their families and property. Indeed, there are dangers close to home and in the wide world that could attack anyone at any time. Such dangers could emerge from any quarter and incapacitate persons or render their property useless. Insurance therefore stands as a remedy against the uncertainties of life. For many, it provides safety and security against loss from a particular event. Some industry experts remind each and every one of the vulnerabilities of life and calamities that could strike at any time. Not knowing when misfortune would hit, insurance also provides peace of mind knowing that family is protected in the event that the principal breadwinner is a victim of any catastrophe. If the surviving family members are unable to fill the shoes of the breadwinner, they could see their standard of living decline and their dependency on others increase. Insurance could prevent that from happening.

Investment component

The year 2009 was chosen as a reference point because that was the moment in time that Clico Guyana began to exhibit publicly signs of problems and eventually collapsed. For a very long time the insurance industry in Guyana was viewed as providing comfort to the people of this country. Many Guyanese accepted the philosophy behind insurance as a vehicle of protection and used it as a means of protecting themselves and family and preparing for retirement. Thus, the fall of a major company like Clico within the same decade as Globe Trust undoubtedly shook the confidence of many Guyanese and raised doubts about the ability of the insurance industry to protect them from financial ruin. It is reasonable to surmise therefore that Guyanese might not be rushing towards insurance with the same speed and enthusiasm as before the disappointment of Clico Guyana.

Level of Investment

One way to assess the level of activity of the industry is to examine the level of investment undertaken by companies in the industry. Though the data is not specific to any company, the index below shows that by 2008, the year prior to the collapse of Clico, the value of the assets of the industry had risen 222 per cent compared to where they were at the start of the decade. The level of investment was modest at first, increasing seven percent in 2001, 27 per cent in 2002 and then rushing to 139 per cent by 2005. The increase in the level of investment eventually peaked in 2008 at 222 per cent of the start period in reference.

Table 1

Source: Prepared from BOG 2014 Qtrly Report

The dramatic decline in 2009 is the tragedy of Clico and the pain and anguish which it brought to many Guyanese. Yet, the trend in the value of the assets of the industry since 2009 is encouraging. Not only have the assets grown to match values seen before the collapse of Clico, the rate of growth in the value of assets from 2009 to 2013 matches that for the period 2005 to 2009, a period of apparent success in the industry. This reality suggests that the industry has begun to recover from the deleterious effects of the Clico collapse.

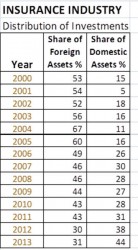

Pattern of Investment

The pattern of investment of the industry is very interesting. Based on data in the 2014 Quarterly Statistical Bulletin of the Bank of Guyana (BOG), the insurance companies in Guyana kept an average of 54 per cent of their income-generating assets overseas while an average of 18 per cent of those assets were at home. The trend of the investment of the industry is shown in Table 2 below. The highest share out there was in 2004 and 2005 when an average of 63 per cent of the assets were in foreign hands. During that period too, the insurance industry had a mere 8 per cent of their resources in the Guyana banking system. Moreover, the deposits of insurance companies in the local banking system were so negligible that they made up less than 2 per cent of the money supply of the country in 2008. So insignificant were the deposits that all of it could be counted as part of the excess liquidity of the banking system. What this means is that

commercial banks could ignore these deposits and fully conduct their operations without them.

Table 2

Source: Prepared from BOG 2014 Qtrly Report

Interestingly enough, this pattern of investment did not change until 2012 when the insurance companies began to increase their investments in domestic assets. It is not clear what is responsible for the shift in emphasis in the investment by the industry. However, one noticeable trend is the increasing share that equity investments are occupying in the portfolio of the insurance companies.

Return on assets

The return on assets for long-term insurance was reported by the Bank of Guyana (BOG) to be 2.9 per cent. This return was higher than the average return of the commercial banks which was given as 2.61 for 2013, indicating that the insurance companies managed their assets better than the commercial banks as a whole. A greater share of the income-generating assets of the industry is being invested in Guyana. The BOG reports also that the return on assets was lower than the prior year which suggests that business might not have been as good as in the previous year or some amount of inefficiency may have crept into the management of those assets. Consequently, despite the comparatively better return than the commercial banks, one cannot be sure that this strategy would continue. One would have to wait and see the performance of 2014, and as Guyanese await the news from the insurance industry may they have a Merry Christmas.

Merry Christmas to all Guyanese and especially those who read the Business Page and Stabroek News!

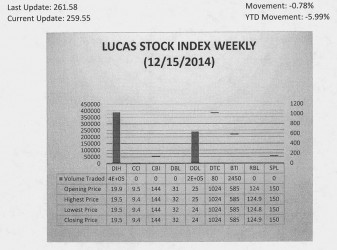

The Lucas Stock Index (LSI) fell 0.78 percent in trading during the third period of December 2014. The stocks of four companies were traded with 632,472 shares changing hands. There were no Climbers and two Tumblers. The value of the stocks of Banks DIH (DIH) fell 2.01 percent on the sale of 389,367 shares while the value of the stocks of Demerara Distillers Limited (DDL) fell 4 percent on the sale of 240,575 shares. In the meanwhile, the value of the stocks of Demerara Tobacco Company (DTC) and Guyana Bank for Trade and Industry (BTI) remained unchanged on the sale of 80 and 2,450 shares respectively.