Reputation

Last week, this column took the opportunity to examine the performance of Republic Bank during 2014. This week attention turns to Demerara Bank Limited which describes itself with pride as the only indigenous bank in Guyana. Its origins have in no way been an impediment to the growth and expansion of the entity which has branches in all three counties of Guyana. Demerara Bank has earned the reputation of a bold risk-taker given its willingness to construct portfolios that do not follow the conservative model of banking in Guyana. The bank has been conscious of the uncertain operating environment in Guyana and in past years has studiously attempted to avoid the choppy waters of the political environment and spread its portfolio beyond the shores of Guyana. The current effort to examine the 2014 performance of DBL will attempt to decipher the business strategy used by the entity to grow its asset base and to expand the value that it gives to its shareholders.

Exceed performance

An examination of the performance of the stock index that this writer publishes will reveal that the market across the board in Guyana was jittery. The index lost over six per cent of its value in 2014 compared to 2013. Yet, of all the banks that are tracked by the LSI, DBL was the only one that managed to increase its market value in 2014 compared to 2013. The value of the stock rose about 1.4 per cent over the period in question. One has to believe that it is more than luck that has enabled this financial institution to exceed performance in an otherwise lethargic market. To gain a sense of what was happening, this writer took a look at the year-end asset quality data reported by the Bank of Guyana (BOG). This report provides an interesting profile of DBL vis-à-vis the other commercial banks that are part of the LSI where asset quality was concerned.

Asset quality

The recorded performance of DBL produced the following additional results. It had assets of $55.8 billion and held deposits of customers to the tune of $46 billion at the end of 2014. Assets therefore grew by 12 per cent while customer deposits grew by about 10 per cent. As a consequence, DBL was able to end 2014 with a book value of $7.9 billion. The change in net assets represented a 23 per cent growth over the 2013 period. These measures of size make DBL the third largest bank in the Lucas Stock Index (LSI). The market confirmed this finding and valued the company at 1.9 times its book value or at $14.7 billion by the end of 2014.

Lagged in performance

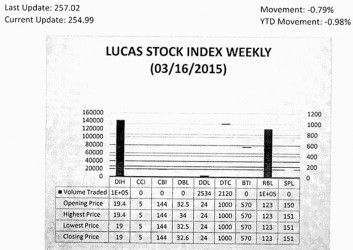

The Lucas Stock Index (LSI) fell 0.79 per cent in trading during the third period of March 2015. The stocks of four companies were traded with 268,426 shares changing hands. There were no Climbers and two Tumblers. The Tumblers were Demerara Distillers Limited (DDL) whose stock rose fell 4.0 per cent on the sale of 2,534 shares and Banks DIH (DIH) which fell 2.06 per cent on the sale of 142,179 shares. In the meanwhile the stocks of Republic Bank Limited (RBL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 121,593 and 2,120 shares respectively.

While the performance of the bank was good overall, there were some indications that it lagged in performance in some areas last year. For example, the deposits of the bank rose a mere 10 per cent in 2014 as against 16 per cent in 2013. The strategy of using door-to-door solicitation produced good results for DBL in 2013, but does not seem to have had a similar impact in 2014. The drop-off in the rate of expansion of new accounts might in itself be an indication of the trouble that the Guyana economy experienced and the hesitation of households, and both local and foreign investors to get further involved in the Guyana economy at this stage.

Doing business differently

DBL has demonstrated a willingness to do business differently from the competition. For example, it has demonstrated an ability to attract a sizable amount of deposits with longer-term maturities than is normally the case. The year 2014 was no different. In 2013, 25 per cent of the deposits held by DBL had maturities of over one or more years. The bank was able not only to maintain the business strategy, but it was also able to increase the amount of deposits with long-term maturities. In 2014, DBL had 30 per cent of its deposits maturing beyond one year. The ability to hold deposits for long periods of time is a dream of commercial banks. Most investors try to keep their money as liquid as possible even though that is not always possible. However, when a bank can hold money for extended periods of time, it takes tremendous pressure off its liquidity risk. It also gives the bank a chance to lend the money for longer periods of time and earn higher interest income from doing so.

Luxury of borrowing long

Last year, it was observed that DBL had more of its customers’ deposits in investments than in loans and advances. As noted earlier, the wish of bankers is to have the luxury of borrowing long so that they could lend for long periods of time. In any event, one would expect that in the banking business banks would be making more loans and advances than searching for speculative investments. After all the entire purpose of the commercial banks is to provide financial intermediation. They bring persons with excess amounts of money into contact with persons who have a deficit of funds and need access to additional resources. Despite having as much as 25 per cent of the deposits of customers for long durations, the bank lent less of its deposits as loans and advances. That disposition changed in 2014. DBL had more of its income-generating assets in loans and advances than in investments. It is not clear what prompted the shift in strategy but it obviously did not hurt the performance of the bank.

Liquidity profile

Notwithstanding the shift in strategy, one could discern that the liquidity profile of DBL is consistent with that of other commercial banks in Guyana. In 2014, the liquidity gap was consistent with its long-term lending as against 2013 when less of the long-term advances was financed with customer deposits. An additional change in strategy is how DBL is financing its long-term investment. In 2013, 61 per cent of the long-term investment by DBL came from long-term debt financing. The share of long-term debt financing rose still higher to 63 per cent in 2014.

One should not expect DBL to give up on the strategy that it has been using over the years. According to the BOG, Demerara Bank puts about 82 per cent of its assets to work. A reconstruction of the Balance Sheet to identify the earning assets of the company and how they are financed suggests that far fewer assets are employed to generate the level of income reported by DBL. The reconstructed Balance Sheet indicates that somewhere between 61 to 63 per cent of assets are used to generate income. Part of the reason is that some assets represent claims that the bank does not have in its possession or otherwise cannot use because of restrictions imposed by the regulatory authority.

Effect of business strategy

The reconfiguration of the data enables one to understand better the effect of the business strategy employed by DBL during 2014. A major concern of any organization is how well it is using its assets. As remote as it might seem, the use of the assets is all about the relationship between management and its customers. Management has control over the assets – the resources that are used to run the business. The use of those resources is meant to produce a positive experience for customers, and to the extent that that happens, the customer would provide more financing to the company through borrowing. The willingness of the customer to do so shows up in the asset turnover ratio. Though a number, the ratio is a good indicator of whether or not management is using its assets to provide customers with a good experience. One understands that changes exogenous to the customer relationship (for example interest rate movement), could affect the ratio. By and large, increased borrowing would come from good customer satisfaction which would lead to an intensification of the use of assets, at least in the short-run. The asset turnover increased to about 6.1 per cent indicating the efficiency with which the bank was able to use its assets.

Muster the courage

This general discussion of the performance of DBL in 2014 again indicates the extent to which the bank has asserted itself as an important part of the financial services sector of the economy. Its willingness to operate on the margins of the conservative paradigm has exposed it to business opportunities that bring it higher returns than those achieved by other banks operating in the domestic space. A key element of its business strategy is to use long-term borrowing to finance its long-term investment, something that none of the other banks in Guyana has mustered the courage or demonstrated the ability to do.