Official announcement

The official announcement last week that Guyana had oil in significant quantities is something that Guyanese were waiting a long time to hear. There were several attempts over the years, at least since the 1980s, to find oil in Guyana. The many efforts prior to now, both onshore and offshore, always yielded disappointing results. With a picture of President Granger on the ExxonMobil-controlled exploration rig, Guyanese feel comforted that the announcement was not another hollow hope, but one of substance. The investors now have to determine the quantity of reserves held by the identified oil field. As Guyanese contemplate the future with oil as an asset and not an expense in the national accounts, they must realize that it would take years before any revenues would come to the national Treasury from the first production. But even as they wait, they must begin to think of how to avoid the pitfalls that the discovery of oil has brought to many nations. This article seeks to explore the implications of the oil on the production structure of Guyana and highlight some of the risks and opportunities that the country faces in light of this important economic development. Of necessity, the article will be of two parts.

Not a simple matter

Discussing oil is not a simple matter, for a discussion must attend to the many risks of a political, social, and security nature that often transcend borders and end up as regional and international disputes. Several of the disputes around the world involve oil producing nations. Iran, Iraq, Libya, Nigeria, Russia, Sudan, Venezuela, Yemen and Saudi Arabia are all oil producers with one problem or another that has the global security, production and finance structures on high alert. Another fear is that Guyana’s commitment to good environmental outcomes might diminish as it seeks to take advantage of the economic benefits that come with oil production. This issue would be the subject of another article. But one must wonder how the discovery of oil changes the value of the low carbon development strategy as currently configured and the future of the PetroCaribe agreement with Venezuela. Both issues need to be addressed as early as possible given the implications that they have for bilateral relations with the two countries.

Wind of political change

The euphoria

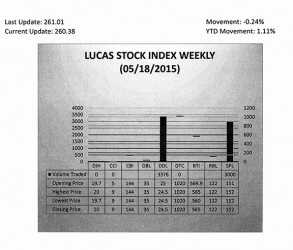

The Lucas Stock Index (LSI) declined 0.24 per cent in trading during the third period of May 2015. The stocks of two companies were traded with 6,376 shares changing hands. There was on Climber and one Tumbler. The stocks of Sterling Products Limited (SPL) rose 0.66 per cent on the sale of 3,000 shares. The stocks of Demerara Distillers Limited (DDL) declined 2 percent on the sale of 3,376 shares.

Even with such assurances, the euphoria from the announcement has to be tempered by the economic realities of a highly competitive global economy. It is true that by the time Guyana is ready to put oil on the market the price could be even lower than it is now, considering that new oil fields are coming on stream all the time. The element of uncertainty remains a factor in the development of the resources. The unique feature of oil is that it is needed in all forms of competitive production. As a commodity, the price is determined primarily by supply and demand. For as long as global production of goods and services expand, the demand for oil will continue to rise. Given the slowness with which supply responds, there is every likelihood that the price of oil could be higher by the time Guyana joins the other global suppliers. In addition, commodity prices are denominated in US dollars. Consequently, whenever the US dollar falls, the price of oil rises to compensate for the loss in the value of the dollar and vice versa. One has got to keep these factors in mind when assessing the future conditions of oil.

In time, the oil discovery will have a more tangible impact on the country’s production structure with major consequences for revenue, employment, and its global competitive position. Guyana’s competitiveness will determine its placement in the global production, finance, knowledge and security structures of the world. It would be easy to understand these anticipated shifts in Guyana’s global position by evaluating its current production structure and the condition of its economic relationships in the Caribbean Single Market and Economy (CSME) and the global supply chain. The latter concerns about international political economy would be examined after the oil reserves have been estimated and made public.

Imposing burden

At the moment, oil represents the most imposing burden on the production structure of Guyana. A look at the trade statistics tells the story of what Guyana is going through as a result of having to include imported oil in its existing production structure. The Bank of Guyana (BOG) reported in its Statistical Bulletin that Guyana expended $118 billion on fuel and lubricants in 2013. This single item represented close to one-third of Guyana’s import bill for that year as revealed in the same BOG report. The situation is even worse when examined from the perspective of export revenues. In order for Guyana to meet its fuel consumption needs, it had to use 42 per cent of the money that it got from the sale of the goods that it shipped overseas in 2013. The net effect was that Guyana had to give up 20 per cent of the things that it produced in order to pay for the oil that it used in the production of goods and services in 2013. Apart from lowering its output, access to oil remained a challenge because of price. Fuel prices is one of the most restraining factors in the manufacturing sector, as could be seen from the following quote from the 2006 Annual Report of Banks DIH: “Steep increases in the price of fuel … affected the overall performance of the Group.” Whenever fuel prices rise, they hurt production. Whenever they fall, they help production.

One could understand how the discovery and eventual production of oil will change radically the production structure of the country. Not only would Guyana be able to retain the $118 billion currently spent, or whatever future sum is spent, on oil for alternative uses. It would also be able to add to the anticipated savings with the export revenues that it expects to receive from the sale of oil. Assuming rational decision-making by the country’s leaders, the change of the position of oil from expense to revenue in the production structure would also expand international reserves and increase the wealth of the country. Such benefits could have come Guyana’s way much earlier than would now be the case had the defeated PPP/C government of Donald Ramotar been more pragmatic in its dealings with the opposition on the proposed Amaila Falls hydropower project. That project was due to come on stream within the next two years and would have saved Guyana from having to spend a major portion of its export revenues on fuel for the next five to eight years. Instead, former President Ramotar let the project go for no rational reason and he has now paid the price for what this writer continues to believe was his most grievous mistake.

(To be continued) (PART 2)