Most feared

Every time one reads about the economic crisis in Greece, one cannot help thinking of how the world has changed. For many decades, it was governments of developing countries who were embroiled in conflict with the IMF over its prescriptions for fixing their economies. The prescriptions for gaining access to the money that it was willing to lend to support their balance-of-payments problems were seen as harsh and mean. The institution was despised by many governments of the developing world even though they are part owners of the entity. In many instances, the policies of the IMF were most feared for the apparent restraints they placed on domestic decisions and the impact that they had on national politics and human development. The target of IMF policies was always the spending of governments which in themselves were seen as an attack on the independence of newly formed states.

The position of the IMF was simple yet highly controversial. Governments are never efficient in utilizing productive resources and should leave production to the private sector, except in cases of market failure or the need for public goods. They asked governments to restructure things and leave more resources

to the private sector. So, the people who bore the brunt of the adjustment were the ones who worked for government and lost their jobs as a result of restructuring of the economy. Today, the IMF does not have such a bad image among developing countries. This two-part article examines some of the reasons why there is less friction between the developing countries and the IMF today.

Changes

Several reasons are associated with the change in the relationship between the developing countries and the IMF. The political tug-of-war of the Cold War era has ended; there is a greater appreciation of the impact of its policies on poverty levels in developing countries; there has been the introduction of a menu of measures by the IMF that were more responsive to the conditions of developing countries; there is a better communication strategy and China has emerged as a major creditor and investor. Before exploring the changes, some background to the IMF and its role will be useful.

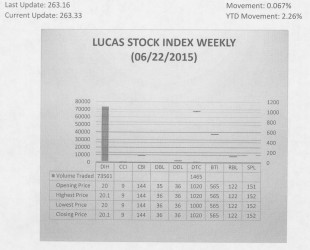

The Lucas Stock Index (LSI) rose slightly by 0.067 percent in trading during the fourth period of June 2015. The stocks of two companies were traded with 75,026 shares changing hands. There was one Climber and no Tumblers. The stocks of Banks DIH (DIH) rose 0.5 percent on the sale of 73,561 shares while the shares of Demerara Tobacco Company (DTC) remained unchanged on the sale of 1,465 shares.

Background and role of IMF

The mention of the International Monetary Fund (IMF) automatically evokes thoughts of money and finance. Those countries which had to endure structural adjustment programmes requested by the IMF in earlier times perhaps have more traumatic memories of the institution. The IMF is an important part of the architecture of the international finance structure, albeit with a narrow focus on the monetary conduct of its 188-member countries. The responsibility of this organization is to pay attention to the global monetary arrangements that are in place to serve the international community. Because of the many developing countries that depend on it, one has grown accustomed to seeing the IMF linked to the disbursement of loans. It is essential to point out that the fundamental role of the IMF is not one of merely providing loans to countries. Many people tend to forget that the underlying purpose of the IMF is to ensure that there is a stable global monetary system that can support international trade and investment.

Watchdog role

This watchdog role did not come about randomly. Its antecedents are in the bygone era of the gold standard and the destructive period of mercantilist competition that was evident from 1914 to 1939. The two periods of contrasting economic experience prompted the framers of the IMF to seek ways of stabilizing the monetary system in which global resource allocation and economic exchange could take place. The era of the gold standard was considered to be the more constructive of the two periods. The period of the gold standard which many place as occurring between 1880 and 1914 is associated with a fixed exchange system that supported wealth and prosperity. During this period, world trade expanded, transportation became more affordable and people across the world enjoyed significant increases in real per capita income. The world was thought to be well off and people felt free to enjoy the wealth that they had acquired. With the knowledge and memory of the pleasant days of the gold standard some European countries felt that the conditions of that economic period were worth recapturing and sought to do so with the establishment of the IMF.

In contrast, there was the period that followed the gold standard. It is regarded as a period of turmoil characteristic of a rat race. International trade is regarded as the global extension of the domestic production structure and was seen as the way to increase wealth. The years following the First World War were conspicuous for the subterfuge employed by many governments to use international trade to meet their wealth and security needs. They were motivated by a desire to acquire wealth and power in an effort to protect themselves from security threats. The calculus behind the move was to gain an advantage over other states by running a trade surplus. The trade surplus was regarded as evidence that a country was doing well and was capable of exercising a measure of independence from other states. The pursuit of the trade surplus led many countries to restrict imports by imposing tariff barriers and other restrictive measures. Countries also manipulated their exchange rate by devaluing it to make their exports cheaper to foreign buyers.

Disaster

This era of unabashed mercantilism ended in both economic and political disaster. War broke out among European states and part of the cause was attributed to the economic uncertainty created by the instability in the global economic system in existence at that time. The effort to stabilize things after World War II led to the creation of the IMF in 1944 at Bretton Woods, a town in the state of New Hampshire. The frequent devaluations that occurred in the inter-war period of 1914 to 1939 were unhelpful and some effort was made to create a fixed exchange rate regime like that which existed under the gold standard. Three of the six reasons for establishing the IMF are directed at supporting international trade. The most direct of the reasons seeks to use the Fund “to promote the expansion and balanced growth in international trade”. The second and the third purposes suggest how the IMF could make this happen. One way was to focus on the monetary aspect of international trade and investment while the other was to focus on the financial aspect of the economic activities.

The monetary aspect of international trade deals with the issue of exchange rate stability. Countries use different currencies and for payment to be made countries have to convert their currencies into that desired by the seller. In cases where the seller uses a hard currency like the US dollar, then the buyer must use the exchange rate between his country and that of the US dollar to make the payment. To the extent that the importer has enough local currency to convert into hard currency, the only concern would be the stability of the exchange rate. A central role of the IMF then was to keep exchange rates stable. It did so by creating a fixed exchange rate system which relied primarily on the US dollar establishing parity with the price of gold. The financial aspect of international trade kicks in when the aggregate demand by importers for liquidity exceeds its availability. At that stage, the IMF helps countries to finance their imports.

End of fixed exchange rate system

The desire for a fixed exchange rate system effectively ended in 1971 and the world was forced to move to a floating exchange rate arrangement. That is where things stand today, 44 years later. Ironically, it was the unruly system of floating exchange rates that the international community ran from with the creation of the IMF that it ended up returning to meet the monetary demands for international trade. This time, however, the IMF was there to control the behaviour of member states, and the member states that were the target of this control were those that had the least power to influence decisions of the Fund.

(To be continued)