Wide-ranging powers

The National Industrial and Commercial Investments Limited (NICIL) was formed in July 1990. The objectives of NICIL are plentiful. They include subscribing or acquiring shares or other security of any company, cooperative or body corporate. NICIL could also purchase or acquire all or any part of the business, property or liabilities of a company, partnership or person to meet the objectives of the company. It could purchase, lease or otherwise acquire estates, lands, wharves, warehouse bonds, docks, along with other

Controversial entity

Over the years, NICIL has become a highly controversial entity. As a consequence, it is now the subject of a forensic audit probe that could very well find the company in breach of its own bylaws. Without an examination of all of its transactions, it is not clear when NICIL started subverting its own interests for that of others. Nowhere in the bylaws of the company does it say that the interests of the state should be subordinate to the interests of any other person, company or investor. Yet, that appears to be the objective that NICIL has pursued over the years. One glaring example of this situation is the deal to build and sell the Marriott hotel. Guyanese were told the hotel was built for approximately US$60 million. This was made up of US$15 million, representing money borrowed from Republic Bank and US$45 million that the government provided as equity. The PPP/C government intended to sell the hotel to private investors for US$8 million. In exchange, it would give up two-thirds of the ownership of the company. The people of Guyana would have ended up subsidising the purchase of the private investor to the tune of US$22 million.

Marriott brand

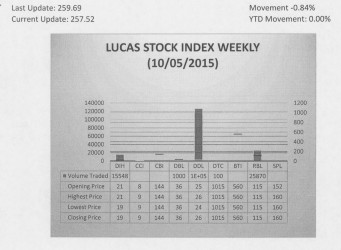

The Lucas Stock Index (LSI) declined 0.84 percent during the first trading period of October 2015. The stocks of five companies were traded with 169,031 shares changing hands. There were two Climbers and one Tumbler. The stocks of Banks DIH (DIH) fell 9.52 percent on the sale of 15,548 shares. The stocks of Demerara Tobacco Company rose 0.05 percent on the sale of 100 shares while the stocks of Demerara Distillers Limited rose 4 percent on the sale of 126,512 shares. In the meanwhile, the stocks of Republic Bank Limited (RBL) and Demerara Bank Limited (DBL) remained unchanged on the sale of 25,870 and 1,000 shares respectively.

The Marriott hotel brand is one of the best-known brands globally. Even though the name Marriott was involved in business long before 1957, it was not until that year that Marriott became connected to the ownership of a hotel. The first Marriott hotel was opened in Arlington, Virginia in 1957. From that start, the company expanded its share of the hotel market and carved out a niche in the segment that catered to the business traveller. The brand is known worldwide and is capable of selling itself to world travellers of reasonable financial means. The Marriott brand therefore should be able to command premium prices and not bargain prices. Instead of adding value to the construction price, the government behaved as if it was holding a bad asset and needed to sell it at a deep discount in order to get it off its hands.

Questions about mandate

The building of the hotel raises questions about the mandate of NICIL. According to its articles of incorporation, NICIL is supposed to get involved in a business if it is convenient to do so. Convenience implied that the assets and income of NICIL would be enhanced and not diminished. The decision to enter the hotel business has a major impact on the production structure of the hotel industry. If the PPP/C government knew that it could not conveniently carry on the hotel business then it is legitimate to ask why the government built the hotel in the first place. The impact that the hotel has on the market is not insignificant. The public policy rationale for constructing the hotel would be market failure stemming from an insufficient amount of hotel rooms and overconsumption of existing rooms at low prices that the private sector was unwilling to sustain. In a case like that the government would have needed to step in to add more hotel rooms at the non-excludable prices. That was not the case with the industry at the time the decision was made to build the hotel, indicating that there was no rational reason for building a new hotel in Guyana notwithstanding the quality of the brand.

The Marriott deal itself holds another example of NICIL subordinating the interests of Guyanese to that of the foreign investor. The PPP/C government made available the land on which the hotel was built at a bargain price. The PPP/C made it appear as if NICIL was in very bad financial shape and was desperate for money and that it would take anything for the assets that it had possession of or control over. From the evidence at hand, the seaside property was given away by the PPP/C administration. The following statement makes this behaviour of the PPP/C surprising. “Public opinion holds that transactions have been concluded too hastily, have failed to achieve optimal prices for state assets divested, did not consider participation of Guyanese in the process and did not secure preservation of national assets.” Those words can be found in the Privatisation Policy Framework paper that was prepared by the PPP/C dealing with the privatisation of state assets. The very thing that it accused the former PNC administration of, is the very thing and worse that the PPP/C administration ended up doing.

Impact on foreign policy

Quite revealing from examining the influence of NICIL is the extent to which NICIL’s actions impact the foreign policy of Guyana. International political economy which is about relations between countries is evaluated in a number of ways, but most people utilise the four structures of production, finance, security and access to knowledge to assess the content and impact of those relations. From an economic standpoint, important to the relations that develop among states is the functioning of the global production and finance structures. These structures are made up of the actions and agreements between states. The global production structure is about who produces what, where, and under what conditions. It is also about how it is sold, to whom and under what terms. The finance structure concerns itself with how debts are created, honoured and paid between and among countries.

NICIL has been very active in promoting production with foreign participation through the construction and primary resource industries in Guyana. The question must be asked who benefits from the way NICIL structures its production and financial relationships. Several of NICIL’s production activities in Guyana have gone to companies from China and to a lesser extent India. These foreign contractors finance the production in many cases. In one instance at least, World Bank money was involved. This happened in the case of the Skeldon sugar factory. Many of these projects contain a trade and labour component. The producers from China and India have tended to rely on their own resources, including human resources to undertake production in Guyana. Two years ago, the government itself identified several projects where this production practice occurred to justify the construction of the Marriott Hotel without Guyanese labour. None of these investments appears to have brought labour benefits to Guyana.

Foreign policy role

Where private investment is concerned, the trade component involves the importation of equipment and the export of raw materials. In some cases, they resemble trade under colonial rule. Under colonial rule for example, sugar was produced by a British company primarily for the British market and bauxite was produced by a Canadian company for the Canadian market. The investment in the bauxite and timber industries shows that the products are being produced by companies from China for the market in that country. NICIL has managed to redirect the production and financing of investments in Guyana to China and away from other countries. The complaints heard from local producers also indicate that the preferential treatment given to the companies from China are hurting local investment in the transport and other service industries as well. As a consequence of NICIL’s actions, Guyana is receiving very little benefit. NICIL’s actions also appeared to rely less and less on loans from international financial institutions and traditional bilateral supporters of Guyana. Without bringing clear benefits to Guyana, one has got to reexamine the foreign policy role of NICIL.