Introduction

Presently Guyana’s national accounts are compiled relative to the base year 2006. This replaced the previous 1988 base year series. Such rebasing is done periodically, and in 2006, the 1988 base year then in force was already 18 years old. This lapse in time made it plausible to assume that significant structural changes had occurred in the structure of production, consumption, and prices.

Following the rebasing exercise, the BoS indicated that, in addition to the increases in the size of the national accounts values for base year 2006 as compared to base year 1988, which was reported last week, two other changes emerged from the results: 1) the new GDP series yielded higher historical growth rates, and 2) marked changes had emerged in the sectoral composition of the GDP. These matters are treated in today’s column.

Results

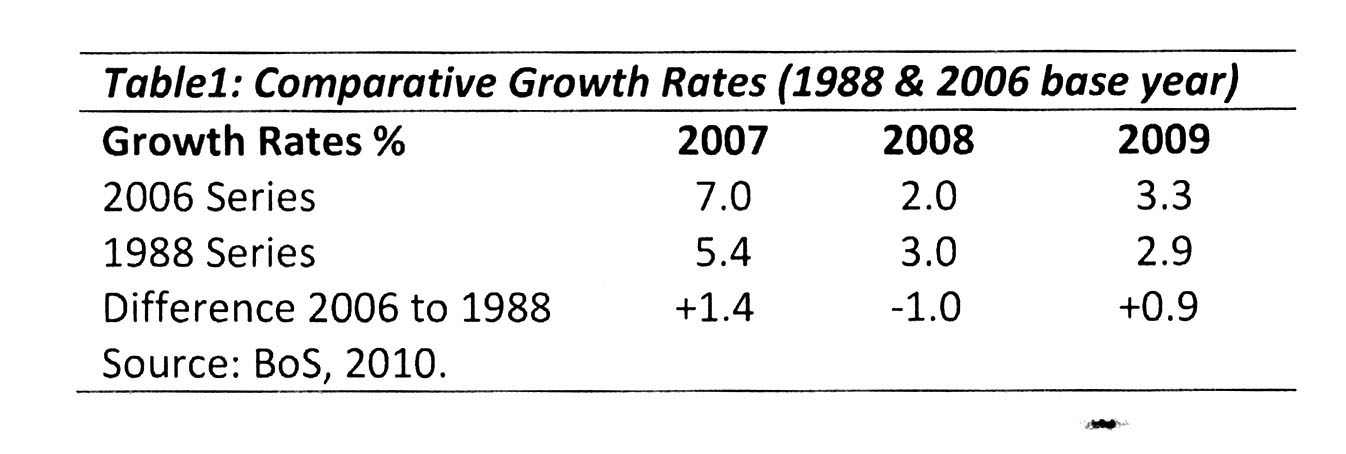

The growth of Guyana’s real GDP for the period where comparable information exists (2007 to 2009), shows it was significantly higher, using the 2006 base year series than for the 1988 series. Table 1 below reveals the difference.

Readers should note the BoS cautions: “due to significant changes in the underlying compilation methods, the incorporation of new data sources, and the adoption of new methodology and classification standards, measures of national accounts data for reference years prior to 2006 was not feasible”. Nevertheless, growth comparisons for the years 2007-2009 are enough to establish the rebased series yields higher historical growth rates.

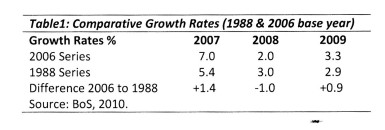

These changes in GDP sizes have had dramatic impacts on key macroeconomic ratios. Thus, Table 2 shows Guyana’s national indebtedness, which up to that time (2006) was easily one of the most widely lamented macroeconomic problems facing the nation, revealed a horrific national debt-to-GDP ratio of 155 percent for 2006, based on the 1988 base year GDP measures. Indeed, Table 2 shows there is a difference of 45 percentage points separating the debt-to-GDP ratio using the GDP 1988 base year series, as against the GDP 2006 base year series for the period with available comparable data, 2006-10.

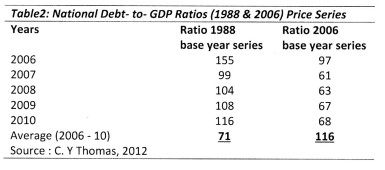

In an academic article, ‘30 Years After the Third World Debt Crisis’ (IDS, 2012), I did indicate: “there has been debate as to whether GDP rebasing in 2006 was contrived, or its results appropriated by the international financial institution (IFIs) and local Authorities in order to make Guyana’s economic performance look better”. Such was the spectacular impact of the rebased GDP on official national indebtedness ratios that this topic instantaneously disappeared from both academic and public discourses. As an aside, readers should note Table 3 shows the improved growth rates identified, persisted over the next few years.

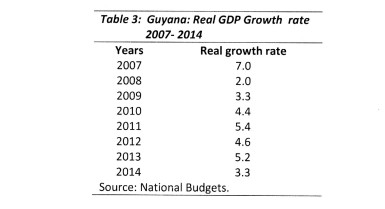

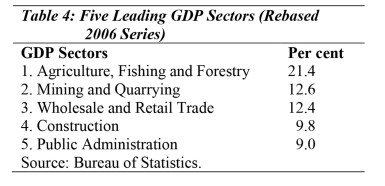

Finally, changes in the sectoral composition of the GDP are shown in Tables 4 and 5. The top five ‘industry’ groupings (based on their percentage contribution to constant price GDP for the 2006 base year series) are shown in Table 4. These reveal agriculture, fishing and forestry (21.4 per cent); mining and quarrying (12.6 per cent); wholesale and retail trade (12.4 per cent); construction (9.8 per cent); and public administration (9.0 per cent).

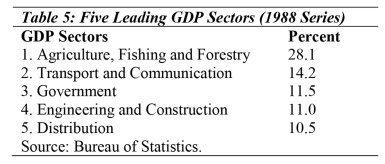

For the 1988 series, it was different, agriculture, fishing and forestry still lead, but at 28.1 per cent; followed by transport and communication (14.2 per cent); government (11.5 per cent); engineering and construction (11 per cent) and distribution (10.5 per cent) (see Table 5).

Conclusion

The dramatic impact of the rebased 2006 GDP series on Guyana’s worst macroeconomic woes (high national indebtedness and anemic growth) has generated considerable local controversy. While most analysts have been willing to concede the need to have the 1988 base year revised, they are seriously concerned that the size of the implied errors of measurement contained in the old 1988 series (approximately two-thirds) is far too large and should therefore, have been the subject of thorough investigation, before their official adoption. Furthermore, no cautions are provided by the authorities or the IFIs (who pushed the rebasing) advising data users of the dramatic changes emanating from the 2006 rebasing exercise. This has been taken by many as evidence of deliberate skulduggery.