Before beginning today’s article, two issues raised recently in the print media are worthy of comment: the extension of Baishanlin’s State Forest Exploratory Permit (SFEP); and the Presidential Inauguration expenditure. In December 2006, following a public advertisement, Baishanlin applied for the grant of an SFEP covering 104,768 hectares of State Forest. Since the company was newly formed under the Guyana Companies Act, it could not have met all the qualifying requirements, especially as regards audited financial statements for the last five years. It was not until November 2011 that the SFEP was granted, following the lease of 200 acres in Region 10 to establish state-of-art integrated wood processing value-added processing facility. The company had given a commitment to complete the facility by 2013, following which the Government would to make available a further 100 acres for further value-added activities. The facility is, however, yet to be built.

Section 9 (8) of the Forests Act 2009 states that an exploratory permit expires on the earlier of the expiry date contained in the permit, or on the third anniversary of the permit, while Section 9 (9) specifically prohibits the renewal of a such a permit. There is no provision in the Act for the extension of an existing SFEP beyond its expiry date. During the life of the permit, the holder is required to: (a) undertake a Management Level Forest Inventory; (b) prepare a Forest Management Plan; and (c) carry out an Environmental and Social Impact Assessment (ESIA). While the permit is in force, the holder may apply for a concession in respect of all or part of the exploratory area.

Baishanlin’s exploratory permit expired in November 2014. However, based on representations made by the company, the Board of the Guyana Forestry Commission approved of an extension for another year. Since the law specifically prohibits a renewal of an SFEP, it is uncertain whether an extension is legally permissible. Be that as it may, Baishanlin’s extended permit expired a little less than two weeks ago, but there is no board in place to decide on the way forward for the company. We now learn from the Minister responsible for natural resources that the company has applied for a further extension of two years and that the Government is favourably disposed to approving Baishanlin’s request. If this second extension is approved, the company would have enjoyed the benefit of the grant of an exploratory permit covering a period of six years whereas the law allows for a maximum period of three years for such a permit.

A little over a week ago, the Stabroek News requested a comment from me in relation to the expenditure incurred on the Presidential Inauguration. This expenditure was reportedly funded from private contributions both of which to date are yet to be disclosed, despite a question posed in the National Assembly to this effect. I explained that it is a requirement for all gifts and other benefits-in-kind to government agencies to be valued and brought to account in the accounts of the Ministry or Department as well as in the public accounts, both as revenue and as expenditure. I also stated that the sources of the contributions and the related expenditure should be disclosed as a voluntary act to enhance transparency and accountability and that the Government should not wait on the political Opposition or any other interest group to request such a disclosure. Asked whether the donations made were a form of lobbying, I indicated this to be a possibility, especially if there is a reluctance to disclose the names of the donors.

On the same day that the Stabroek News carried my comments, a reporter from the Guyana Times called and requested a similar comment on the matter. I repeated the explanation that I had given to the Stabroek News and added that since 1992 when we restarted the process of having annual financial reporting and audit of the public accounts, every year the Auditor General has been reporting on the failure of Ministries and Departments to adhere to the requirement of having gifts and other benefits-in-kind valued and brought to account in the country’s accounts. To substantiate my explanation, I referred the reporter to paragraph 29 of the report of the Auditor General stated on the 2014 public accounts which reads as follows:

All gifts to Ministries/Departments/Regions are to be valued and brought to account by individual entities. Periodic returns are required to be submitted to the Ministry of Finance and the values of these gifts are to be reflected in the Country’s accounts as Miscellaneous Receipts. Despite a circular to this effect from the Finance Secretary to all Heads of Budget Agencies that detailed the procedures to account for all gifts, only some Budget Agencies adhere to the circular such as Ministry of Health and Georgetown Public Hospital Georgetown. As a result, the amount of $2.950 billion representing Miscellaneous Receipts as at 31 December 2014 (sic) was understated by an undetermined amount.

Now for the Auditor General’s 2014 report. So far, we carried two articles. In the first article, we commented on the actual submission date of the report at a time when Parliament was in recess; the apparent haste in achieving the deadline almost to the exclusion of ensuring that a quality and comprehensive audit is carried out; the undue length of the report; the repetition of same findings and recommendations year in year out; and the need to upgrade our accounting and financial reporting system to bring it in line with international best practice. The second article dealt with the Auditor General’s opinions on the 13 statements constituting the public accounts of the country. We had cause to fault these opinions because the comments of the Auditor General on most of these statements did not support his opinions on them.

Consolidated Fund in severe overdraft

There are two Consolidated Fund bank accounts, both of which were found to be overdrawn by amounts totalling $76.718 billion as at 31 December 2014. The old account, which ceased to be operation in 2004, reflected an overdraft of $46.776 billion. For the past ten years, the Ministry of Finance had indicated that it would take steps to reconcile this account with a view to integrating both accounts. However, given the passage of time, it would be virtually impossible to reconcile the old account. In view of the fact that the overdrawn balance largely remained static over the years, it would be appropriate to proceed with the merger of the two accounts without attempting to reconcile the old account.

In a previous article, I had traced the build-up of the overdraft from 1992 onwards, and I had concluded that this was due mainly to expenditure outstripping revenues over the last 23 years. We were therefore living beyond our means. It is of paramount importance that we instill fiscal discipline and work towards a balanced budget.

The Contingencies Fund

The Auditor General’s report did not indicate the balance on the Contingencies Fund. It, however, did state that 66 advances from the Fund totalling $3.240 billion were granted in 2011, 2012 and 2013 but the National Assembly did not approve of the related expenditure so that the Fund could be reimbursed by this amount. These advances were granted under the authority of the previous Minister of Finance. As a result, the expenditure reflected in the public accounts for these years would have been understated by $3.240 billion. At some point in time, the Assembly will have to revisit the matter, and a decision taken to replenish the Contingencies Fund by way of supplementary estimates.

The Public Debt

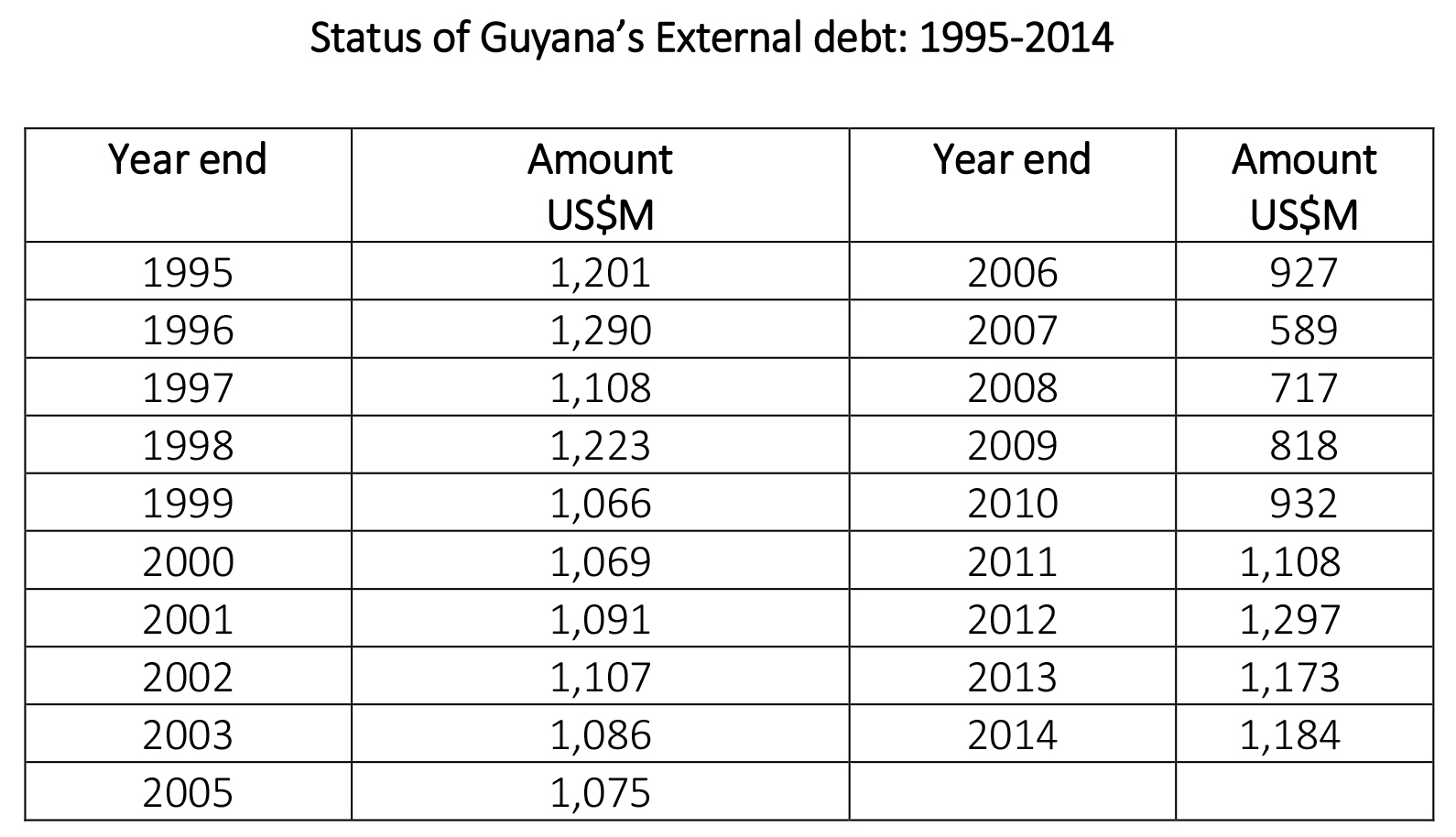

The public debt as of 31 December 2014 was $361.148 billion, compared with $380.074 billion at the end of 2013, a decrease of $18.926 billion. The external debt accounted for $244.532 billion, equivalent to US$1.184 billion, compared with $241.856 billion, equivalent to US$1.173 billion.

At the end of 1992, the external debt stood at US$2.1 billion. Through a vigorous campaign for debt relief, including Guyana becoming a beneficiary of the Highly Indebted Poor Countries (HIPC) Initiative, there was a combination of rescheduling and write-offs of indebtedness to individual countries and international financial institutions. The following table shows the status of the external debt for the years 1995 to 2014. (The Auditor General’s reports for the years 1993 to 1995 are not available in the Audit Office’s website.)