Introduction

Having completed discussion of the appropriateness of GDP as a measure of Guyana’s economic size, progress, and national/individual well-being/welfare, I turn now to a broader assessment of Guyana’s development at this particular conjuncture. In the coming weeks, my focus will be on sectoral considerations, beginning with mining and quarrying, then moving swiftly to consider the forests products and services sector.

This sectoral discussion is intended as a lead-in to a dedicated appraisal of what, in my view, is the clear priority at this particular conjuncture: an economic and political evaluation of the prospects for Guyana in a time of oil/gas production and export. As the National Budget (August 2015) authoritatively asserted:

“In the area of upstream oil and gas, Government will finalize a policy which seeks to address such issues as licensing and contracting, fiscal framework, capacity building, transparency and accountability, environmental management and measurement indicators. The anticipation of a commercial petroleum discovery has become closer than in recent memory”. National Budget, August 2015, page 21

Guyanese expectations

If significant oil/gas production and export come on-stream, most Guyanese would expect the economy to transition to a qualitatively higher level of production possibility. Economists would say that the country could push its aggregate supply curve/production frontier significantly outwards.

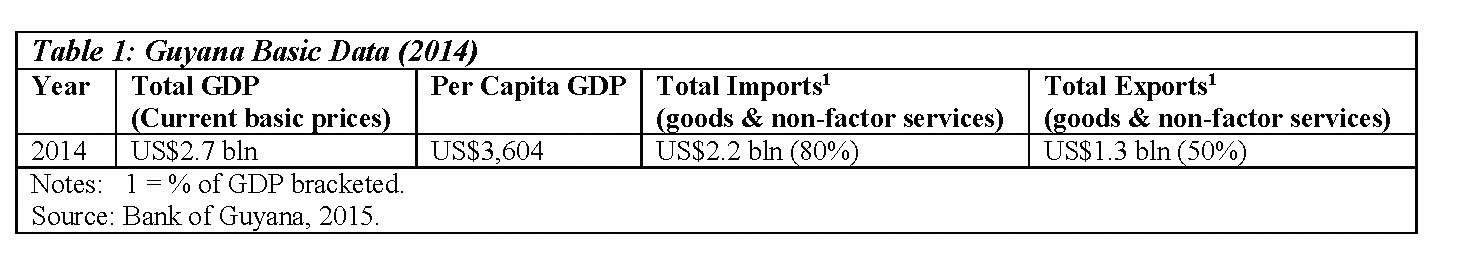

Further, it is so trade-dependent that in 2014 the total value of its exports plus imports of goods and non-factor services was US$3.5 billion or about 130 per cent of its GDP at current basic prices. Indeed imports (which exceed exports), total US$2.2 billion or just over 80 per cent of GDP, with exports equal to the remainder approximately 50 per cent. (See Table 1)

Potential output (GDP)

The above references to Guyana’s production potential, aggregate supply, and production possibility are important for some of the analyses to come in later columns. They are therefore briefly explored for the remainder of this column. Basically, such references are embedded in the economic notion of potential output. Simply put, the potential output of an economy is “what an economy can produce when all its resources are properly applied and fully utilized.”

For Guyana, these resources include 1) its natural resources; 2) the work force; 3) technology; 4) infrastructure (physical, institutional, social and political); 5) planning/programming/management implementation capability. Potential output is, therefore, the situation in which all these (1-5) are fully/efficiently utilized/employed. From this description, any significant discovery of commercial oil/gas resources enhances substantially Guyana’s potential output. At the very minimum, it would yield job increases, government revenue, investment, foreign exchange earnings, consumption and savings.

Potential output is not an abstract notion. It is central to the formation of government policy. Thus if the Guyana economy is operating below its potential output, then public policies are required to expand output.

If the reverse happens, (there is no excess capacity) and therefore potential output is fully realized, then inflationary pressures could emerge, and therefore policies should be directed at dampening increased demand pressures. Such policies can be fiscal (that is taxation-led), monetary (that is money supply and interest exchange rate-led) or direct controls used (instruction to banks; direct limits on economic activity, and so on).

Conclusion

Certain features of this concept are key. First, potential output is not directly observable; it has to be inferred from existing economic data, through statistical analysis and econometric methods. Second, there is no economic consensus on how best to do this estimation. For Guyana I have simply used the long-term (inflation adjusted) trend indicator of the rate of increase of real GDP. Where the data are available I would adjust also for stages of the commodity cycles, in which its main commodity exports are located.

Third, following on the above, potential output clearly refers to Guyana’s productive capacity. It is not a “technical, economist-determined level of output”. As such, it seeks to capture the notion of Guyana’s sustainable productive capacity over the short term (2 years), the medium term (up to 10 years), and long term (a decade plus).