(Conclusion)

Properly and effectively

In the second part of this article, this writer observed that revenue collection was not at its optimal position. To achieve optimal revenues, the existing tax structure has to work properly and effectively. As noted before, the tax structure of Guyana has five parts with some parts having simple substructures while others have complex substructures. An effort will be made to keep the discussion simple, even as one tries to explain the contribution of the various substructures in raising revenue for the government or point out their deficiencies in doing so. In order to understand the risk to optimal revenue collection from each part of the tax structure, it is necessary to talk first about the tax level and the contribution that each component of the tax structure makes to revenues.

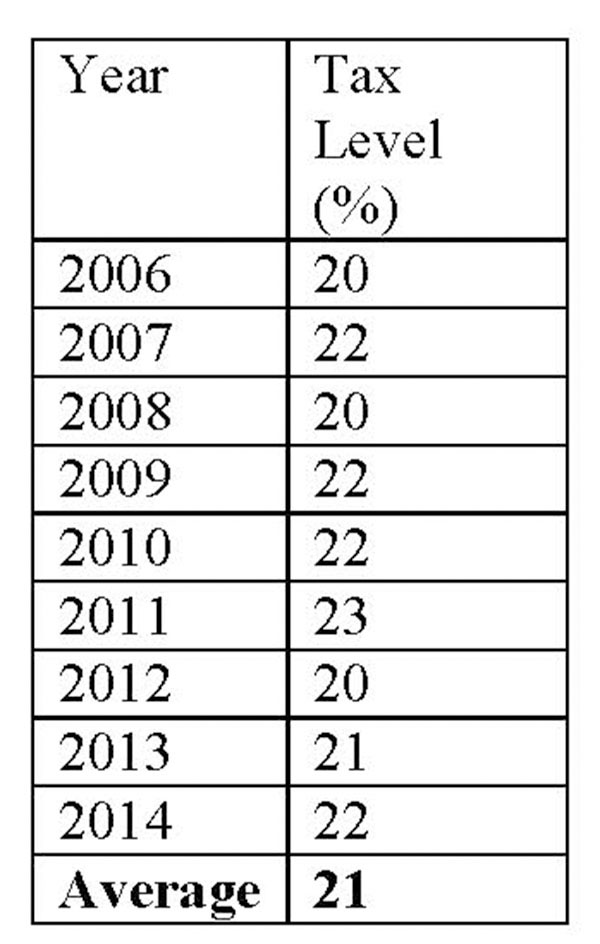

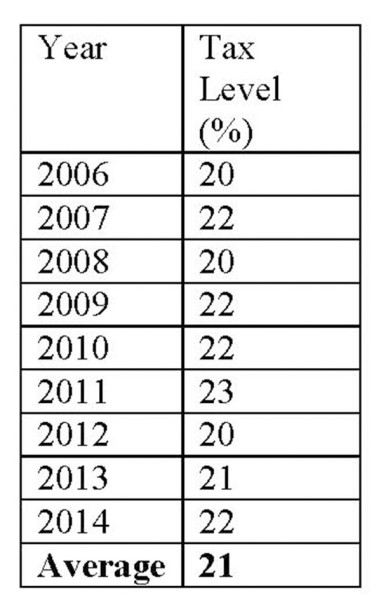

Tax level

A breakdown of the tax level enables one to see further how various parts of the tax structure have been contributing to the revenues of the government. The 21 per cent referred to above is made up primarily of production and consumption taxes which account for 10 per cent of the tax level or 48 per cent of the revenue collected by the government. The other major contributor to the tax level is the income tax. This component of the tax structure accounts for 8 per cent of the tax level or 38 per cent of government revenues. The trade and travel taxes make up the rest with a three per cent contribution to the tax level and a 14 per cent contribution to the revenues.

From the foregoing information, a third benefit of knowing the tax level is that Guyanese get a clue as to which taxes are important to government revenues and which ones are not important. This writer has pointed out before that the tax structure has five parts, but only three of them seem to make significant contributions to government revenues. The other two, the property tax and the miscellaneous group of taxes, appear to contribute virtually nothing to government revenues. It is unimaginable that the property tax, which is directed at the largest asset base (income, moveable and immoveable property and rights) in the country, contributes virtually nothing to government revenues. It is also surprising that with the level of business activity taking place in Guyana the miscellaneous taxes also seem meaningless to the economy by way of revenue collection.

Income tax

Further assessments of the impact of the various parts of the tax structure are also revealing. Starting the discussion with the income tax would help to demonstrate how the allocation of resources takes place. It is also the most complex of the tax structures and plays a big part in determining what happens in the rest of the economy. The use of the income tax determines the direct allocation of resources between the public and private sectors. Despite its complex structure, income taxes account for eight per cent of the tax level. This means that Guyanese are able to keep and determine how to spend 92 per cent of the money that they earn. This level of disposable income suggests one of two things, either the average income is closer to the exemption threshold or a substantial amount of income escapes the tax structure. The story about this, when eventually told, might not be all that wholesome.

The conclusion that one reaches is that the self-employed do not pay taxes to the government. They do, but the amount is minimal. The self-employed encompass several professions, trades, and activities. They include doctors, lawyers, accountants, financial analysts, investment advisors, engineers, and educators. They also include shopkeepers, mechanics, building contractors and sub-contractors, minibus owners and operators, boat operators, small-scale miners, pavement vendors and other categories of taxpayer who own and direct their operations. It is a large catchment of taxpayers who do not seem to pay their fair share of taxes. These taxpayers need to be sensitized about their obligations to file tax returns and to register with the GRA if they have not done so. While the tax base is broader than the revenue collected seems to suggest, it is clear that the income tax structure is unable to harness revenues from all the possible income sources.

Trade and travel taxes

The other component of the tax structure that raises eyebrows is that of trade and travel taxes. The focus here in particular is the import duties on goods imported into the country. The value of imports constitute about 64 per cent of GDP for the years 2012 to 2014. Further, the average ad valorem rate on all items imported into the country is 33.25 per cent. This means that on the reported annual average import values of $388 billion, Guyana should have collected an estimated $129 billion in import duties. Some of this expected revenue is lost to treaty obligations, public policy goals and investment strategies. Persons familiar with import transactions estimate that those factors should not exceed 50 per cent of potential revenues. Yet, duties contribute a mere three per cent to the tax level and no more than 14 per cent of tax revenues.

Causes of revenue gap

It is believed that enquiries into the causes of this revenue gap would reveal two things. One is that under-invoicing might be more rampant than is being disclosed. Under-invoicing leads to an underestimation of the value of imports and by inference, the import tax base, and ultimately the revenues collected. In the broader gap analysis, under-invoicing also suggests that the resource gap in Guyana is much larger than projected. This further implies that the level of unreported income and uncollected income tax is much higher than imagined.

The second thing revealed by the revenue gap is that Customs officials seem to exercise much more discretion with importers than one could have imagined. The revenue loss to Guyana through such discretionary behaviour is phenomenal. Too much discretion in the hands of Customs officials could distort competition and the true behaviour of the Guyana economy.

Tax collection seems to suffer the most in areas where the GRA is supposed to be responsible for collecting the taxes. The concern that exists here is that four areas of revenue collection that rely exclusively on GRA, namely self-employment taxes, property taxes, Customs duties and the miscellaneous group of taxes, do not seem to be doing so well. Together, they contribute less than four per cent of revenues collected. This outcome points to a major problem of management of GRA which seems unable to prevent or control revenue leakage. These are areas that require good interpersonal skills and excellent customer service. The GRA will have to begin the new year with a vastly different outlook towards taxpayers.

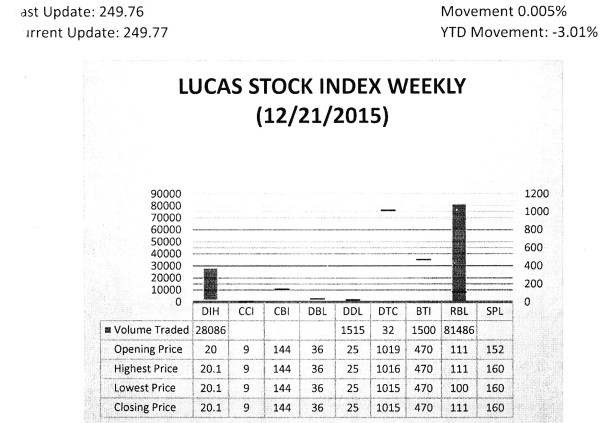

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) remained unchanged during the third trading period of December 2015. The stocks of five companies were traded with 112,619 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 0.5 per cent on the sale of 28,086 shares. The stocks of Demerara Tobacco Company (DTC) fell 0.39 per cent on the sale of 32 shares. In the meanwhile, the stocks of Demerara Distillers Limited (DDL), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 1,515; 1,500 and 81,486 shares respectively.

As always, I wish to extend season’s greetings to all Guyanese, especially those readers of the Business Page and the Stabroek News. May you have a healthy, safe and prosperous New Year.