The cash-strapped Guyana Sugar Corporation (GuySuCo) has managed to secure $400M from the National Commercial Bank of Jamaica after modification of its loan terms and the struggling company was the subject of Cabinet discussions yesterday but a decision on a bail-out was put off.

Finance Minister Winston Jordan confirmed to Stabroek News yesterday that Cabinet was unable to come to a decision but would not go into details. GuySuCo was supposed to complete a comprehensive strategic plan prior to a bail-out consideration being taken to cabinet.

Chief Executive Officer Rajendra Singh told Stabroek News that discussion with the Jamaican bank has resulted in a modification of the current loan terms where instead of the bank withholding a portion of the amount earned by GuySuCo from sugar sales to repay the US$15M loan that was taken out last year, the bank will transmit the entire sum earned from sugar sales to GuySuCo which amounts to $400 million.

Singh said that talks are ongoing with the Agriculture Ministry and he hoped that today there would be a recommendation by the Finance Ministry after yesterday’s cabinet meeting. He added that until he receives word from Agriculture Minister Noel Holder as to how much assistance the government will be providing, he did not wish to comment further.

Last Thursday, it was revealed that GuySuCo would be requesting a $16B bailout for the industry. Prior to that revelation, Singh had said that GuySuCo’s financial woes were so dire that without an immediate influx of money, operations would cease as of Sunday. Because of the arrangement with the Jamaican bank, this imminent shutdown was averted.

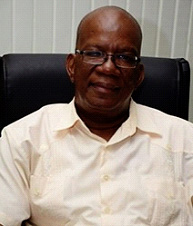

Head of the main sugar union GAWU, Komal Chand said that while operations have not ceased, the union is hoping for more transparency with the disseminating of information by the corporation. He said that it is unfortunate that GuySuCo has not kept the union and workers “in the loop.”

Chand asserted that the union needs to be kept abreast of any decision so it could relay information to workers especially, since barring bad weather, the second sugar crop is to commence next month.

The head of GAWU said that since the financial situation is still precarious and the union was not informed where the additional monies are coming from, workers are still advised to ensure that the corporation is not deducting any money that is to be transferred to the Credit Union.

GuySuCo owes $154,410,525 that has yet to be paid to the credit union reflective of five months of worker savings. GAWU has over 5000 sugar workers who subscribe to the Credit Union. Chand said that since the news broke that GuySuCo has been delinquent in paying the Credit Union and an industry wide shutdown was still a possibility, workers have been withdrawing their savings. He said that so far the Union has obliged and will continue to do so to showcase to workers that their needs are being taken care of. The situation will get worse should GuySuCo not pay what it owes immediately, Chand declared.

As for the corporation itself, Holder had previously stated that the CEO was to provide an industrywide plan. Holder noted that any discussions including with the Finance Ministry were completely reliant on Singh’s ability to showcase how bailout money will be spent.

Analyst Christopher Ram has questioned how the government would be allowed to access the Contingency Fund for such a purpose and as a result, he said that a bank loan taken out by the government may be one possibility.

Without a budget and without a functioning Parliament, there is very little that can be done at this point in time to release large amounts according to analysts.

The opposition PPP/C has not made any statement on the GuySuCo crisis even though it had been in government for the last 23 years and former President Donald Ramotar had been on the corporation board from 1992 until he assumed the presidency in 2011. Critics have said that the PPP/C government ignored the dire problems in the industry for the last five years, in particular, without coming up with viable solutions.