Introduction

In order to contextualize the analysis of the opportunities and pitfalls of Guyana’s mineral resources extraction dependence, this week’s column introduces further economic information on the overall performance of the sector. This information will continue to be provided for the next two

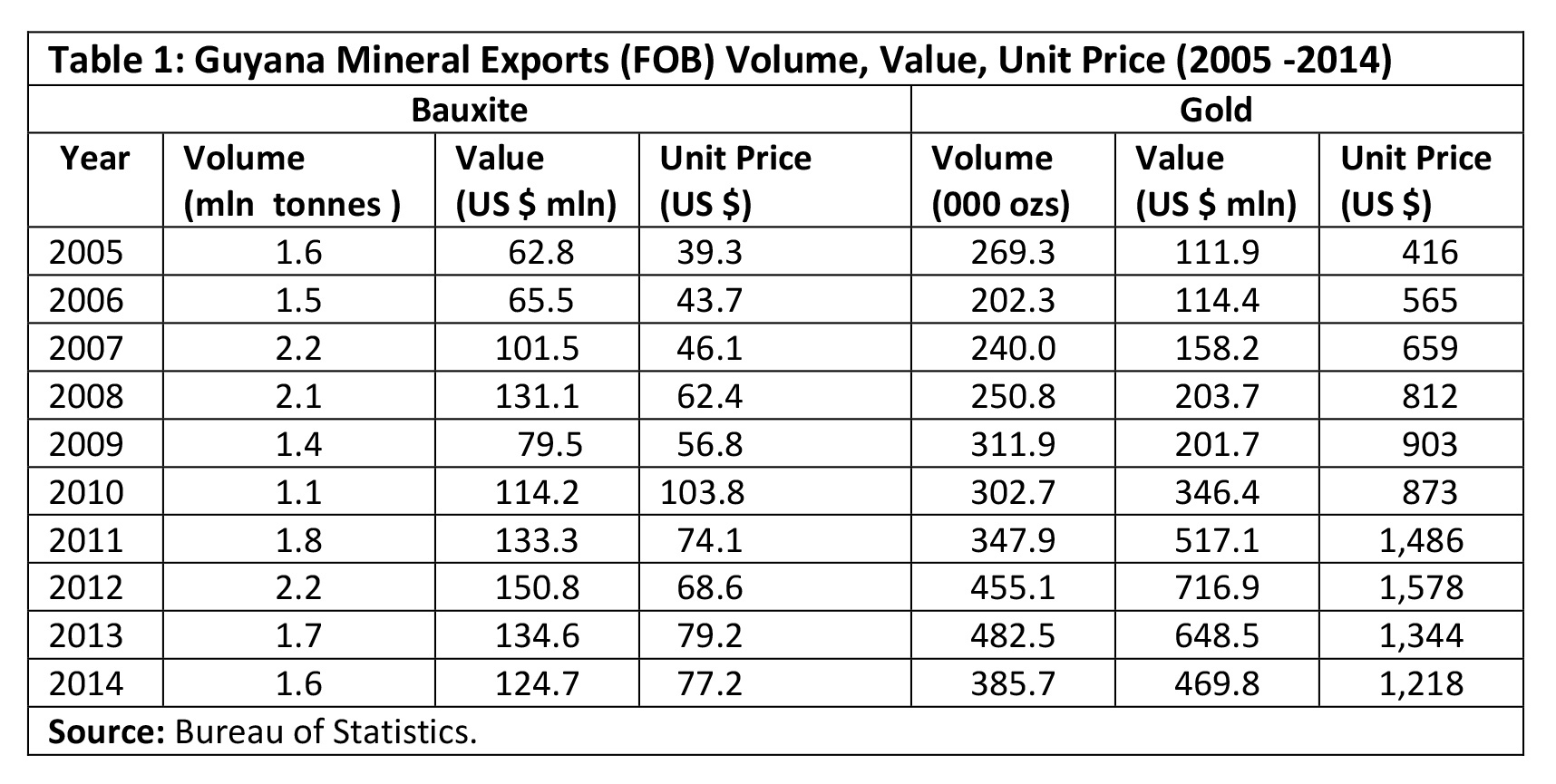

The two leading mineral products exported during the past decade (2005-2014) have been gold and bauxite, with others (clay, loam, sand, stone, diamonds) considerably smaller. Over the past decade, gold exports have averaged about US$350 million, which is more than thrice the average earnings of bauxite (about US$110 million). This difference in earnings has varied over the decade, from less than twice (between 2005 and 2008) to over four times (between 2012 and 2014). When examined carefully, it is also observed that although this variation has obviously been due to both quantity and price fluctuations, export volume fluctuation is less than that for price.

Table 1 displays information on the volume, value and unit price of bauxite and gold for the recent decade (2005-2014).

Mineral resource dependence

The IMF has identified the category of mineral resource extraction dependent economy because when such economies sell more than 25 per cent of their merchandise exports (fob) on world markets, the intrinsic volatility of these mineral sales, (largely due to price movements), generates further volatility in 1) foreign exchange earnings (and hence capacity to import); 2) government revenues (and hence its capacity to spend on public goods and services); 3) provision of jobs (and hence the level of poverty, availability of livelihoods) as well as 4) generation of income in these societies.

As Guyana’s mineral resources exports comfortably exceed 25 per cent of merchandise exports (fob), the prices obtained therefore constitute the most important driver of their production, given the physical supply constraints in these industries. As a general rule, however, worldwide, primary mineral exports have been notorious for their volatility; prices vary from minute-to-minute; hour-to-hour; day-to-day; month-to-month quarter-to-quarter; year-to-year and longer. Price volatility, in terms of distinct commodity cycles have also been observed by analysts, over the short-term (2-3 years); medium-term (3-7 years) and long-term (8 years and over).

Volatility

Volatility in prices, and hence the total value of export sales, directly affect all of Guyana’s key macroeconomic variables, including private and public consumption and investment; export income and jobs, government revenues and expenditures; domestic capacity to import all sorts of goods and services; as well as the general processes of wealth-creation in the economy.

Two recent innovations (improved availability of historical economic data and advanced time series statistical analysis) have been attributed for the recent identification of what is known in the literature, as the ‘commodity super-cycle’. I have reported on this phenomenon in previous columns and will not repeat here, except to note that super-cycles, like other regular commodity cycles, have ‘boom’ and ‘bust’ phases. The difference is that these latter, can last for two decades or more during each phase!

The boom phase of the present super-cycle is considered as largely a function of 1) years of explosive growth of emerging market economies, and 2) fears of long run fundamental commodity supply shortages. The impending decline phase, however, is expected to be a direct consequence of the Great Recession of 2008 and its aftermath, (elements of which still linger) along with deep-rooted fears investors and the public at large hold about financial institutions that are considered as being too big to fail.

Graphs

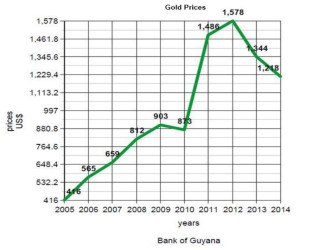

The two graphs below reveal the variability of gold and bauxite prices for Guyana during the most recent decade. Gold prices have shown a strong upward trend, but of equal importance they have fluctuated considerably from a minimum of US$416 per oz. in 2005 to a maximum of US$1,578; a huge range of US$1,162. The average (mean) value of these prices for the decade was US$985 and the median value US$888. The other useful descriptive statistics on gold prices reveal its standard deviation at 400.2; the coefficient of variation at 0.4061; and, as a percentage the relative standard deviation is 40.61 per cent. Finally, to confirm the high volatility the mean absolute deviation is at 336.9.

Similarly, bauxite prices show considerable volatility, but without as striking a continuous upward trend. The minimum price ranged from US$39.3 per ton in 2005 to US$103.8 in 2010. The range was US$64.5 and the average (mean) over the decade US$65.12. This was close to the median at US$65.5. The standard deviation was US$19.71 and the coefficient of variation 0.3027. As a percentage, the relative standard deviation was 30.27 per cent.

Next week I shall continue with further observations on the gold industry.