Introduction

Today’s column continues the discussion of Guyana’s mineral resources extractive dependence. The focus is on the gold industry. The data provided last week show that gold is comfortably Guyana’s leading mineral export. Gold exports have earned, on average, US$350 million annually, during the decade 2005-2014. These earnings were more than thrice those of the second leading mineral export ̶ bauxite, (at US$110 million annually).

Artisanal gold mining

Guyana’s first commercial exploration and production of gold can be traced back decades ago, to the early 1880s. The early ownership/production structure was largely based on individuals and small groups operating as artisans (‘pork-knockers’). Alongside this artisanal-structure British, European, and American ‘explorers’, were encouraged/facilitated by the then colonial authorities.

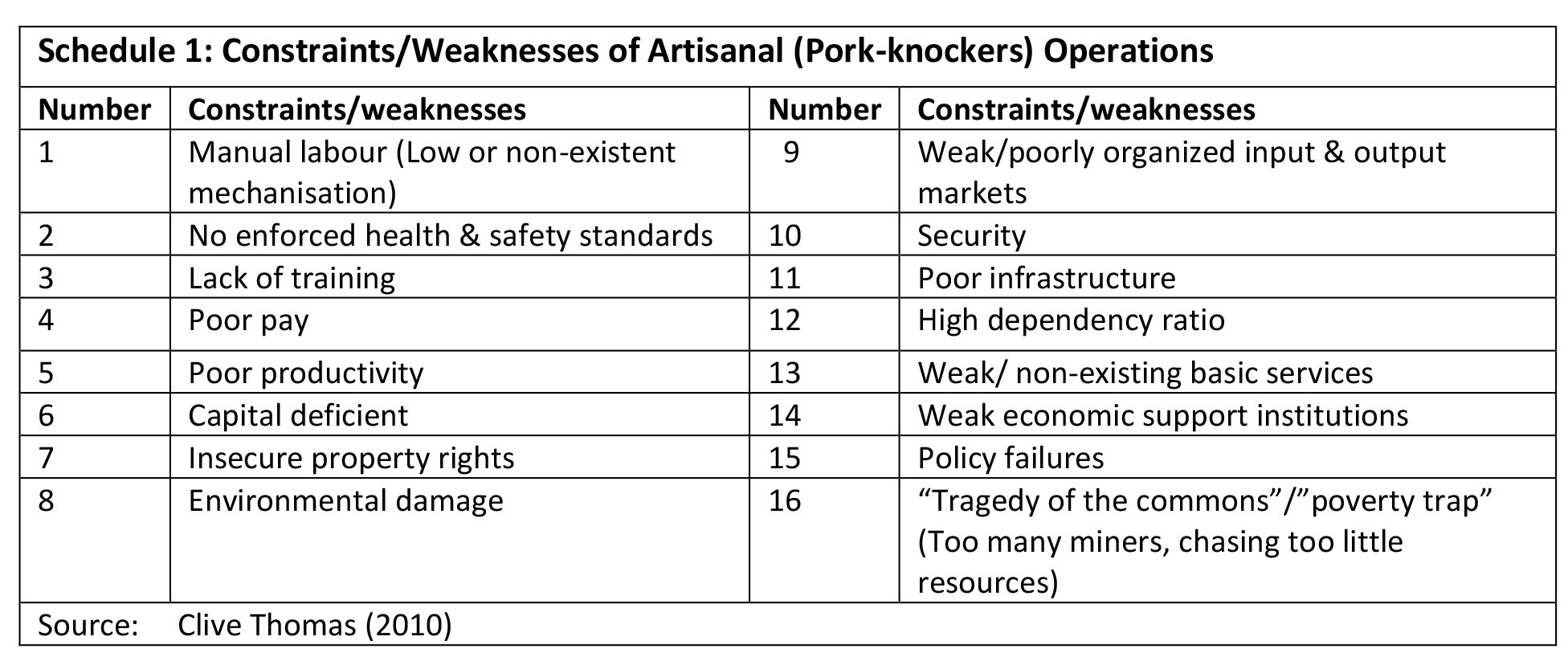

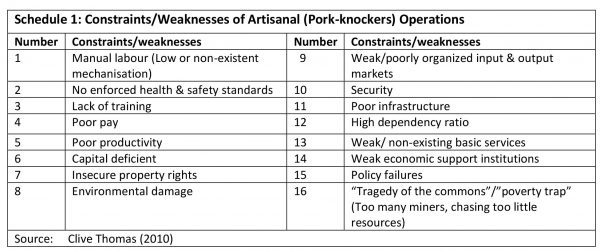

The pork-knockers/artisanal explorers/producers employed basic tools and traditional technologies for recovering gold from near surface or soil deposits. Recovery rates were very inefficient, only 20 per cent. Schedule 1 provides a listing of the formidable constraints and weaknesses facing the artisanal structure of Guyana’s early gold mining. The many policy, legal, and regulatory failures revealed in the Schedule were seriously addressed starting in the 1970s, and culminating in the 1989 Mining Act.

A decisive shift from basic artisanal mining did not occur until the Canadian-based, corporation, Omai Gold Mines, started gold production in 1993, as a large-scale capital-intensive venture.

Following the artisanal/pork-knocker phase of early development, and starting in the late 1980s gold mining is now centred on four types of operations, based on the Mining Act, 1989. These are (1) small-scale (2.7 acres for land claims and one mile of navigable river); (ii) medium-scale properties and mining permits (150-1,200 acres); (iii) large-scale (prospecting licences, 500-12,800 acres); and (iv) permissions for reconnaissance surveys, to seek prospecting licences. Categories (i) and (ii) are restricted to Guyanese, but joint-ventures with foreigners are allowed as private contracts between the parties (See Thomas 2010).

Omai

Omai’s production lasted from 1993 to 2005 and its total output was 3.27 million ounces, yielding an annual average of 250 thousand ounces. Its gold output peaked in 2001 (354 thousand ounces). Also, in that year the combined output of Omai and the small and medium-scale producers was 456 thousand ounces. Of note, during Omai’s production years, the reported output of the small and medium-scale producers more than doubled, rising from 80 thousand ounces in 1992, to 162 thousand ounces in 2005. Data presented last week also show that, since Omai’s closure in 2005, exports of gold have risen from 202 thousand ounces in 2006 to 386 thousand ounces in 2014. To remind readers, the data provided last week indicated Guyana’s all-time peak export was 483 thousand ounces in 2013, and the all-time peak value of exports was US$717 million in 2012.

Other significant developments

Five significant developments should be drawn to readers’ attention. First, Guyana is on the cusp of a return to several externally-based large-scale gold operations; for example, the leader, Canadian-based Guyana Goldfields Inc, has announced projected output for this year at 130-150 thousand ounces of gold, based on its estimated reserves of 3.29 million ounces.

Second, regulatory concerns continue to dog the operations of small and medium-scale producers. One of the worst is smuggling. And, recently, the authorities have indicated this may be as high as 50-60 percent of reported domestic output.

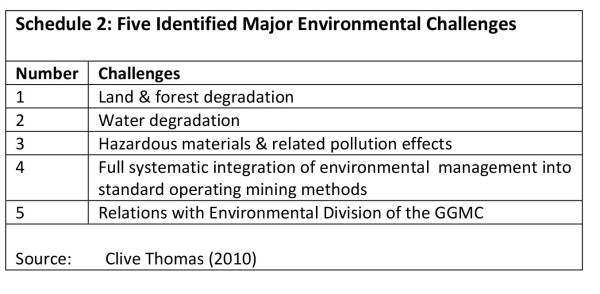

Third, severe environmental concerns have arisen over the past decade. Five major areas of concern are highlighted in Schedule 2:

Fourth, employment information for the sector continues to be unreliable. Various estimates ̶ ranging from 15-20 thousand persons ̶ have been provided. A significant percentage of these persons are registered and unregistered Brazilian operators.

Finally, I refer readers to a study of mine for fuller details on the gold industry. ‘Too Big to Fail: A Scoping Study of the Small and Medium Scale Gold Mining Industry in Guyana’ is available on-line through most search engines.

Next week I discuss bauxite, before commenting on the overall performance of the mining and quarrying extractive sector in Guyana, over the past decade.