The general debate on the 2016 budget is now over. It was to be confined to the financial and economic state of the country and the general principles of Government policy and administration, as outlined in the Finance Minister’s budget speech and in the Estimates. One disappointing aspect towards the end of the debate was the staging of a walk-out by Opposition Members after the Opposition Leader had spoken. The issue at hand was the decision last August for the Prime Minister to be the penultimate speaker, instead of the Opposition Leader.

Standing Order 71(2) states that “After Members have spoken and the Minister has replied, or at the end of the Sitting on the last day allotted (whichever is earlier), the debate in the Assembly shall be concluded…” There is therefore no clear guidance on the matter. However, according to the Opposition, it has been the long-standing practice for the Opposition Leader to be the penultimate speaker. This column reiterates last year’s comment that our elected representatives should at all times seek to rise above small and peripheral issues and, in the spirit of goodwill and compromise, attend passionately to the affairs of the State free of any form of distraction. One hopes that there will be a change in attitude as the Assembly resolves itself into the Committee of Supply for a detailed consideration of the Estimates.

Private, public and

Government companies

A company can also be a private limited liability company while at the same time having the status of a Government company. Section 344 of the Act defines a Government company as one in which the Government owns at least 51% of the paid-up share capital in the company and includes a subsidiary of a Government company. Since the Government owns 100% of the shares in NICIL, NICIL is a Government company. However, since 2002 it has been allowed to operate as a private fiefdom, utilizing intercepted State revenues and controlled by certain top officials of the previous Administration. One only has to reflect on the extraordinary, high-handed and arrogant statement from the former Executive Director exclaiming to the public that NICIL does not have to disclose from where it gets its money, as a clear attestation of the manner in which NICIL operated.

The above principles also apply to Atlantic Hotel Inc. (AHI) which is a wholly-owned subsidiary of NICIL. AHI is the owner of the Marriott Hotel and therefore the hotel is owned by the Government and not Marriott International. The latter has been contracted to manage the operations of the hotel via five agreements entered into with AHI.

Financial reporting and

audit requirements

Like all companies, a Government company is required to have annual financial reporting and audit and to have its audited accounts laid at annual general meetings (AGMs). An additional requirement relates to the submission of these accounts to the concerned Minister and to the National Assembly within six months and nine months respectively of the close of the financial year, as provided for under Section 346 of the Companies Act. Section 345 also provides for sections 48 and 49 of the Public Corporations Act to be made applicable to Government companies. These two sections require the company to keep accounts of its transactions to the satisfaction of the Minister and for such accounts to be audited by an auditor appointed by the concerned Minister. The latter requirement has since been superseded by the constitutional amendment of 2001 which vests with the Auditor General the responsibility for auditing all entities in which controlling interest vests in the State and reporting to the Legislature. There is provision for the Auditor General to engage the services of Chartered Accountants in public practice to audit on his behalf the accounts of any of these entities and to report the results to him for transmission to the concerned Minister and to the National Assembly. Notwithstanding this, the Minister may at any time appoint an auditor to examine the accounts of a Government company and to report thereon to him. The key distinction is the reporting relationship.

If a company has subsidiaries, the requirement for having a profit and loss account is not applicable if the consolidated profit and loss account dealing with the company and its subsidiaries is framed in such a manner as to show how much of profit or loss relates to the company.

Group accounts

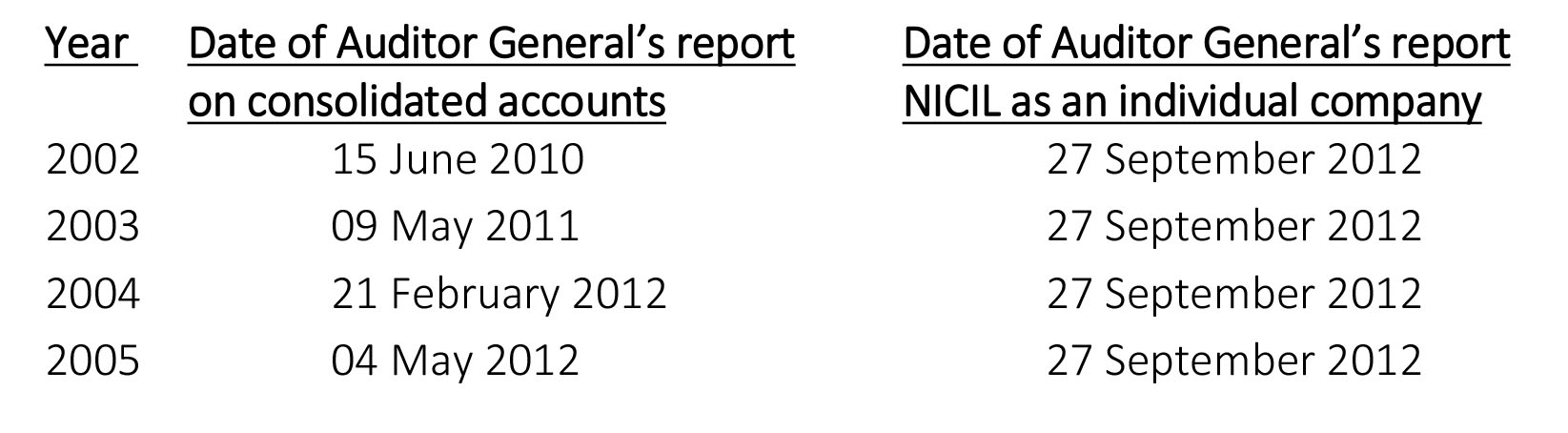

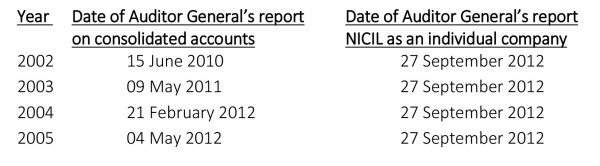

As provided for by Section 160, where at the end of its financial year a company has subsidiaries, accounts or statements dealing with the state of affairs and profit and loss of the company and its subsidiaries shall be laid before the company in general meetings when the company’s own balance sheet and profit and loss account are so laid. It is obvious that group accounts cannot be compiled without the availability of audited accounts of the parent company and each of the subsidiaries to be included in the group accounts. That this has happened in the case of NICIL is a serious violation. On 15 June 2010, the Auditor General issued his opinion on the consolidated accounts of NICIL and its “subsidiaries” for the year 2002. He, however, issued his opinion on the accounts of the parent company i.e. NICIL on 27 September 2012, 15 months later! A similar observation is made in relation to NICIL’s consolidated accounts for the years 2003, 2004 and 2005, as shown below:

Group accounts are not required in a number of situations, including the following:

If the directors are of the opinion that it is impracticable, or would lead to no real value to the members of the company, in view of the insignificant amounts involved or would involve expenses or delay out of proportion to the value to the members of the company, to do so;

The result of doing so would be misleading or harmful to the business of the company or any of its subsidiaries; or

The business of the company and that of the subsidiary are so different that they cannot be treated as a single undertaking.

In all three cases, the consent of the Minister is required. This column has argued several times over that a parent company-subsidiary company relationship does not exist since NICIL is merely acting as an agent of the State in the same way that the Guyana Revenue Authority does. In addition, there was no consideration in exchange for the vesting of public corporations and other entities in NICIL and therefore NICIL cannot claim ownership of these entities. The issue is one of substance over form. It is understood that the preparation of consolidated accounts, which was undertaken at considerable cost and effort, has been discontinued with effect from 2007.

Filing of annual returns

Section 153 of the Act requires a company to make an annual return to the Registrar of Companies in the prescribed form within 42 days of the holding of an AGM. Included in the return are the audited accounts of the company laid before the AGM along with the reports of the auditors and directors. If the company has subsidiaries, audited group accounts have to be filed with the Registrar together with the company’s accounts. However, there is no requirement for two sets of returns to be submitted to the Registrar since each subsidiary would have filed its own return with the Registrar. Unlike individual companies comprising the group, the group as a whole does not have a legal status, hence no requirement for separate filing.

If a company is: (a) a public company; or (b) has gross revenue or assets (as shown in the most recent audited accounts) exceeding such amount as the Minister may by regulations prescribe, it is required to send copies of the related documents to the Registrar not less than 21 days before the AGM.

Appointment of auditors

By Section 170, an individual qualifies for the appointment as auditor of a company (here we are referring to external audit, as opposed to other types of audits), if he is a member of the Institute of Chartered Accountants of Guyana (ICAG) and is the holder of a practice certificate from the Institute. Notwithstanding this, the Minister may, after consultation with the Institute, authorise by instrument in writing, any person to be appointed as an auditor of companies if that person in the opinion of the Minister is suitably qualified for such an appointment: (a) by reason of his/her knowledge and experience; and (b) was in practice in Guyana as an auditor at the commencement of the Act. However, an application for such an authorisation must be made to the Minister within 12 months of the commencement of the Act which came into effect in 1991.

Section 11(2) of the ICAG Act provides for any person who has become a member of the Institute to be issued with a practice certificate on application, notwithstanding that he/she is also a member of any registered body and receives or has received a certificate to practise from that body. By Section 11(3), a practicing certificate shall be issued to any member who, after becoming a member of the Institute, or of any registered body, or of any body with objects similar to those of the Institute, has served continuously for at least two years in the office or offices of one or more practising members of the Institute or of any registered body or of such other body.

Next week, we will explore the issue of practice certificates in greater detail.