Last week the Private Sector Commission (PSC) urged the government to increase its spending to stimulate the needed aggregate demand to sustain business activity. Mr Eddie Boyer, Chairman of the PSC, urged government to fast-track awarding of contracts to speed up business activity. The Minister of Business, Mr Dominic Gaskin, was also questioned on what could be done over the next few months to stimulate business activities. We addressed this issue a few months ago in a column:

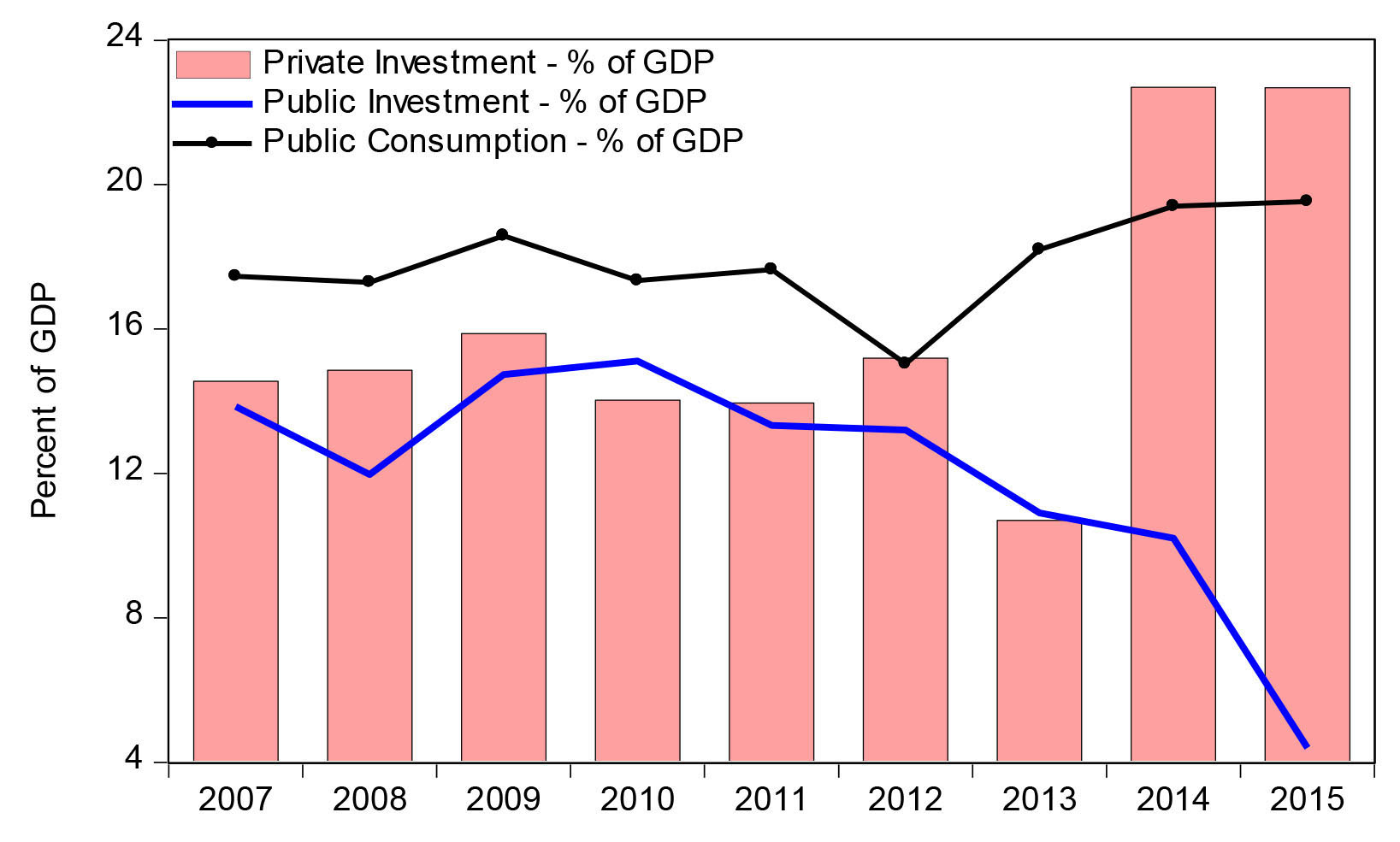

Let us first observe the trends in government spending and private sector investment from 2007 to 2015. Unfortunately we don’t yet have the data for these variables up to half year 2016, but a clear pattern is evident that tends to support the contention that government spending has declined. Although government investment has declined precipitously, government consumption has increased noticeably. Private investment has increased significantly from 2013 to 2014 but remained unchanged in 2015.

At no point over the nine year period of analysis has public investments exceeded short-term public consumption spending. This indicates the misplaced priorities and inverted choices of the Guyanese political class, primarily those from the PPP side. We are not even considering household consumption in this column. Excellent commentaries on the abysmally low household savings rate and excessive household consumption have been provided recently by Dr Ramesh Ganpat and in the past by Prof Bishnodat Persaud. I will not repeat their arguments here; suffice to say, a significantly higher household savings rate is necessary to generate a higher long-term economic growth rate.

Since 2011 public investments have plummeted from 13.3% of GDP to 4.4% of GDP in 2015, in spite of the fact that the Marriott mal-investment was really a government “investment.” This series would imply the radical disinvestments in GuySuCo and other state industries needed to sustain the production capacity of the nation. Certainly the tit-for-tat political fights between PPP and PNC over this period played a role in the deconstruction of the country’s capacity to produce, as has been the case since 1974. Over the same period, public consumption as a percent of GDP increased from 17.6% in 2011 to 19.5% in 2015, reflecting the fact that the PPP would have boosted patronage in the hope of winning the 2015 election.

There was only a marginal increase in public consumption from 19.4% of GDP in 2014 to 19.5% in 2015, in spite of the spending associated with Jubilee celebrations which could have injected about US$18 million into the economy (excluding the multiplier effect) if indeed 9,000 Guyanese went back home to celebrate.

Total government spending – both public consumption and investment – amounted to G$142.5 billion in 2011. Total spending declined to G$136.3 billion in 2015, after reaching a peak of G$164 billion in 2014. For context, total private investment increased from G$64.2 billion in 2011 to G$129.2 billion in 2015. Moreover, private investment increased from G$125.7 billion in 2014 to G$129.2 billion in 2015. As a percent of GDP, however, private investment increased from 14% in 2011 to 22.7% in 2015; but from 2014 to 2015 private investment was flat at exactly 22.7% of GDP. This would indicate that in spite of the misplaced priorities in public expenditures, the private sector is stagnant. It has not contracted under the new government, at least not yet.

But that is all it takes to dampen the “animal spirits” and investor confidence. Elements of the present government and their vocal supporters have actually stereotyped private investors as enmeshed in the underground economy. The President excessively delegated the economic task of reassuring the investors during the first month of the new government. His party and the WPA are filled with anti-business supporters with strong ethnic undertones. Indeed, Mr Baishanlin has broken an agreement of setting up a wood processing plant in Guyana, but he has been investing in other sectors of the economy, primarily luxury real estate which it appears was meant for rich Asian buyers seeking to escape the reach of their governments. Certainly there must be a way to align his profit interests with the national interest of getting the economy moving along.

After reading the APNU+AFC Manifesto, it was clear to me they gave the economics of the country passing thought. At best the Manifesto is long on general fluff and short on the strategic stuff needed for structural production change. This resulted in loss of opportunity in the first month and continual policy dissonance, which no doubt played a role in engendering the perception that the new government is anti-business. SOCU also would have played its role in dampening investor confidence. Furthermore, the Ministry of Business appears to be duplicating Go-Invest – neither of which is meant for creating the overarching strategic goals. There is much uncertainty about what will become of GuySuCo. It appears like overall policy uncertainty has overwhelmed Minister Jordan’s valiant attempt of producing a very good 2016 Budget. As this column has noted on multiple occasions, budgets operate mainly on the cycles and can only incrementally influence the trend. A new government has to always clarify what are its policies that set the future trends.

In closing, it is not so much the level of government spending that matters as much as the structure and makeup of the spending. If not structured properly, public spending can actually harm private investors as we observed during the Cooperative Socialist experiment in Guyana.

It is clear from the data presented above that a lot has to be done to restructure government spending away from the short term to the long term investments. No country’s government can continue to misplace its spending on short run patronage transfers at the expense of boosting production enterprises. The much talked about multiplier effect would not work the same way if government expands unproductive patronage versus capital spending on sensible productive activities; not mal-investments in the form of ill-conceived public enterprises and poorly sequenced infrastructure projects.

Comments: tkhemraj@ncf.edu