Conclusion

Widespread

The problem of customer service is widespread in Guyana and is common throughout the retail industry in Guyana. One cannot be certain if it is lack of interest on the part of the workers, lack of training in customer service or some other factor, but entering a retail establishment and expecting to receive good service remains largely wishful thinking. Massy is conscious of this failing and is determined to prevent its brand in Guyana from being tarnished by poor customer service performance. Massy believes that an intense application of its health, safety, security and environment performance standards would help it to overcome the safety and customer service concerns that it has about the Guyana market.

Stronger

In the view of this writer, unless something extraordinary happens, the Massy Group is expected to be a part of the Guyana economic landscape for a long time. Over the years, the Massy operations in Guyana have shown strong performance and would get stronger once the production structure widens with the addition of petroleum production, incomes expand along with the range of goods available to households and businesses. Massy continues to maintain a majority position of all the companies within the Massy Group that operate in Guyana. It owns 93 per cent in each of the following companies: Massy Gas Products, Massy Distribution, Massy Security and Massy Technologies. With the success that it has enjoyed over the years, one should expect Massy to keep a diversified portfolio of businesses to manage business and other types of risk that could occur in Guyana.

Profile

What did the financial and operating profile of Massy look like at the end of 2015? A review of its Balance Sheet revealed that Massy was able to increase its asset base by 6.1 per cent. The company now has assets of TT$10.4 billion. When expressed in Guyana dollars at the current exchange rate, the value of the company has actually declined. Instead of being valued at G$322 billion which is what it was worth at the end of 2014, the company is now worth an estimated G$291 billion. Despite the decline in the value of the assets, the company controls assets equivalent to nearly half the income earned in the Guyana economy for 2015.

Massy also grew its revenues by 11.2 per cent in 2015. That growth however was not from all the territories in which Massy operates. The growth in revenue came from operations in Barbados and the Eastern Caribbean territories, Colombia and Trinidad & Tobago. Despite the positive growth of the company, Massy suffered setbacks in other territories. In Jamaica, for example, revenues fell 13 per cent. Massy did not do well in Guyana either during the review period. Massy’s revenues in Guyana declined seven per cent during the 2015 performance year. Despite the variable revenue performance, the company was still able to turn a healthy profit. Profits grew 3.3 per cent before taxes and the accounting for its re-branding costs, and just about one per cent after re-branding costs.

Re-branding

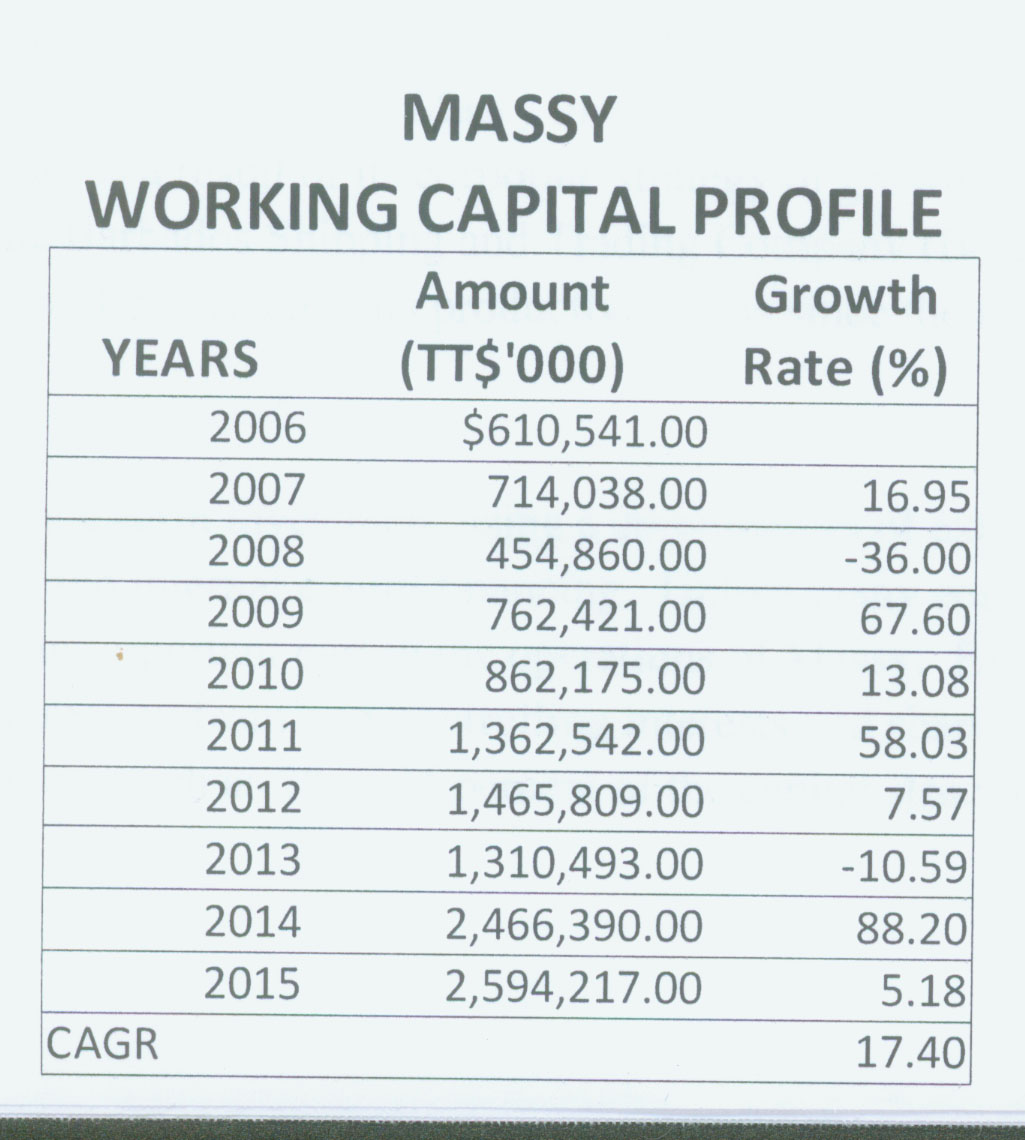

The re-branding exercise is an investment in the long-term future of Massy. The company has not only reconfigured its image, but it has also repositioned itself to take advantage of emerging growth opportunities in the Americas. This is reflected in the long-term investment strategy of the company as could be seen from its financial moves over the last 10 years. With any long-term investment strategy of a business, the focus tends to be on three areas, namely working capital, productive assets and other assets.

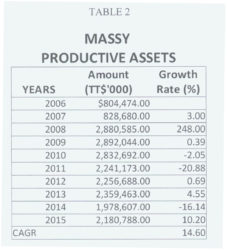

The investment by Massy into its productive assets showed a greater degree of variability as could be seen from the Table 2.

Financing

Massy has financed the long-term investment using a combination of external debt financing, external equity financing and internal equity financing. Unlike many companies in Guyana, external financing plays an important part in the operations of Massy. External financing consists of external debt, money from non-controlling interests and share capital. External financing has constituted as much as 28 to 44 per cent of the capital structure of the company. As at the end of 2015, external financing accounted for about 40 per cent of the capital structure of Massy and has grown at the rate of 18 per cent per annum. Massy has increased its share capital by 330 per cent from 2005 to 2015 while increasing its debt by 437 per cent over the same period. While the internal equity of the company accounts for 60 per cent of the capital, it only grew by 13 per cent over the 10-year period from 2006 to 2015.

Influential

It is evident from the foregoing that Massy is willing to utilize external financing as part of its growth strategy. As a consequence, the company stands as a major player in the gas products and automotive industries in the Caribbean. It remains an influential player in Guyana and could be expected to increase its participation in the oil and gas industry in this country.

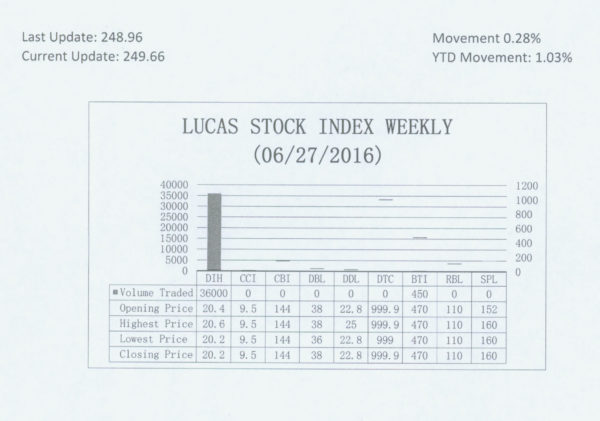

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose 0.28 percent during the final period of trading in June 2016. The stocks of two companies were traded with 36,450 shares changing hands. There was one Climber and no Tumblers. The stocks of Banks DIH (DIH) rose 1.94 percent on the sale of 36,000 shares. In the meanwhile, the stocks of Guyana Bank for Trade and Industry (BTI) remained unchanged on the sale of 450 shares.