Part 1

Political condition

There has been much speculation about the Guyana economy over the last year or so. One thing that is clear is that in the lead up to the general elections held last year there was a high degree of political uncertainty. Such political condition often reflects itself in the decisions of people and the actions that governments can take. People invest in businesses and people spend money to take care of their households. When people and businesses hold back their spending, governments usually step in to keep aggregate demand buoyant. This type of government action is described as

Handicapped

While Guyanese would wish to know the current situation in the economy, it is only possible to work with the data that is available publicly. As a result the focus would be largely on historical data since the Bank of Guyana has published up to May 2016. The discussion particularly about spending is handicapped further by the fact that data on this variable only comes out once per year. However, one could look at what is happening in the Guyana stock market to gauge the mood of the private sector about the Guyana economy.

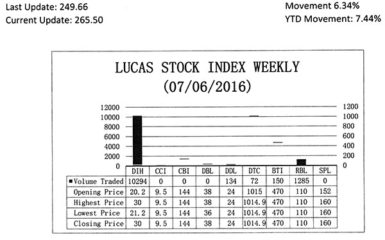

The Lucas Stock Index (LSI) rose 6.34 per cent during the first period of trading in July 2016. The stocks of five companies were traded with 11,935 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 42.86 per cent on the sale of 10,294 shares. The stocks of Demerara Tobacco Company (DTC) fell 0.01 per cent on the sale of 72 shares. In the meanwhile, the stocks of Demerara Distillers Limited (DDL), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 134; 150 and 1,285 shares respectively.

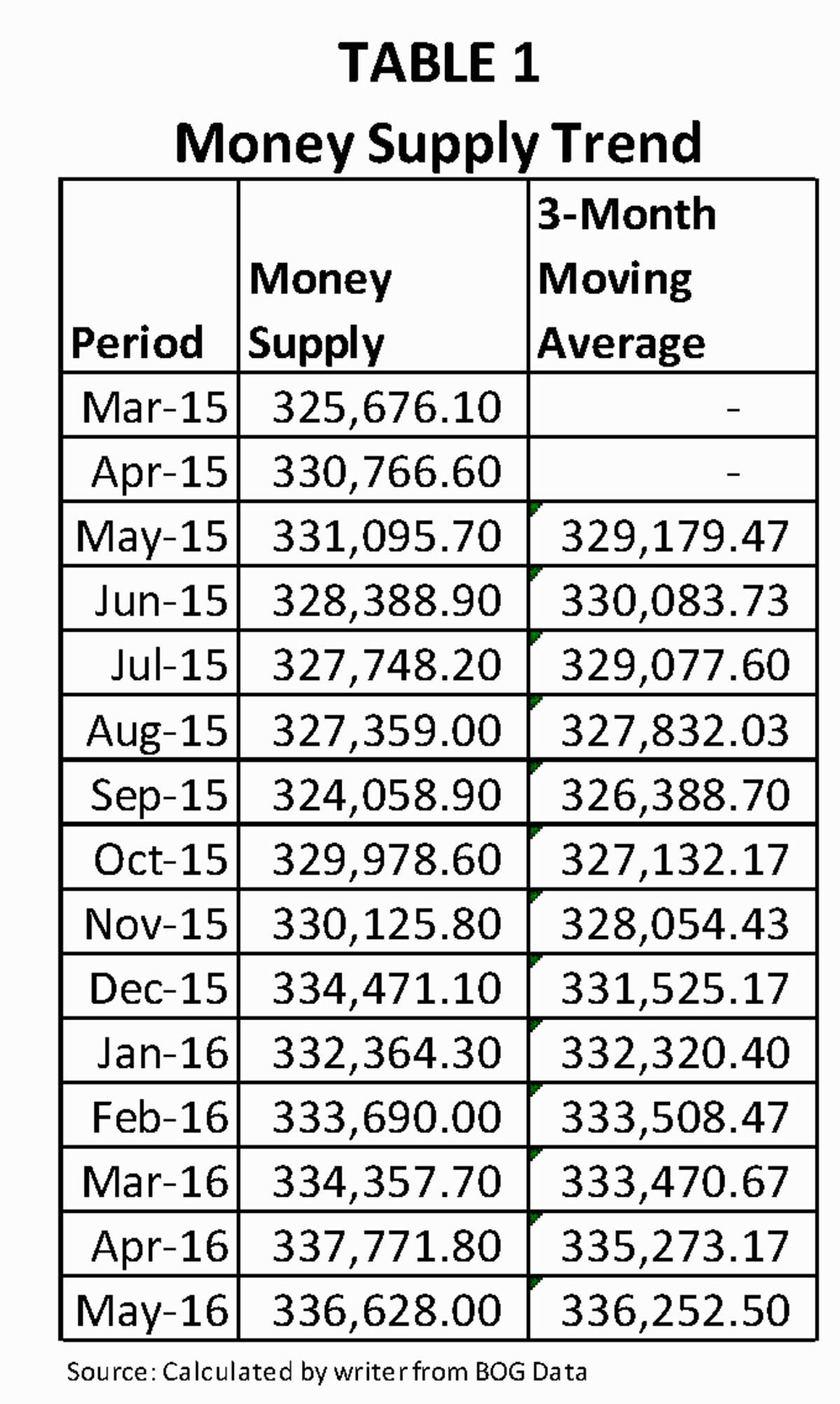

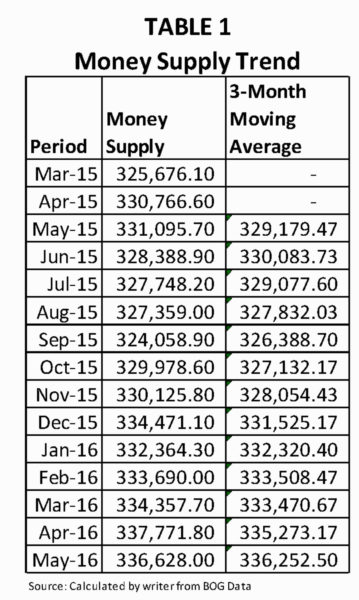

One could start by looking at the money supply. This tells Guyanese about the amount of money in the economy. The money supply consists of the liquid assets that households and businesses hold in order to make payments or use to engage in short-term investments. Table 1 below shows that the money supply increased from March 2015 to March 2016 by three per cent and from May 2015 to May 2016 by two per cent. The moving average of the money supply suggests that the economy is moving in the right direction having sustained an increase from September 2015. One could expect more positive news once the effects of spending during the Jubilee celebrations are included in the numbers.

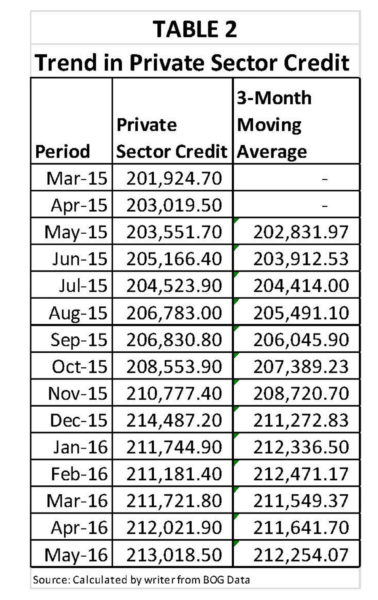

The other variable is the credit to the private sector. Table 2 below shows that credit to the private sector increased by at least G$10 billion or five per cent from March 2015 to March 2016 and by the same amount from May last year to the corresponding period in May this year.

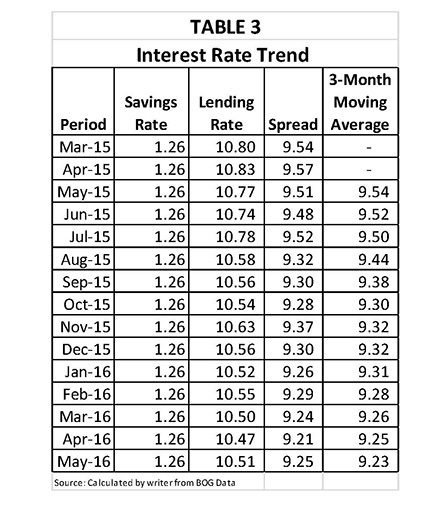

A related variable of usefulness is the interest rates in the market. Table 3 below shows that the interest rate offered for savings accounts has remained unchanged for more than one year. However, the average lending rate has declined three per cent from a high of 10.8 per cent in March 2015 to 10.5 per cent one year later.

(To be continued)