Having seen what has happened over the years to many economies of oil-producing countries, the thought has crossed the minds of many Guyanese as to what oil will do to this country. Surprisingly many are not concerned about the standard ills of corruption and internal strife that have been seen in many oil-producing countries. In any event, this writer addressed those issues among others in a two-part article last year. The concern is more about inequity and the risk of misalignment of economic policies with economic opportunities. This article seeks to examine the more favourable thoughts about an oil economy. It does begin however with an explanation of why adding oil to the production structure of Guyana matters.

For the better part of 40 years Guyana has been worrying about the direction in which oil prices and production went. It all started in 1973 when the Arab states imposed an embargo on oil sales to the United States of America (USA) and its allies for lending support to Israel in its war with Egypt and Syria. The withholding of the fuel supplies caused oil prices to soar. The effects of that action have stayed with Guyana ever since then as have the effects of the collapse of the fixed exchange rate regime that had underpinned the international monetary system up to that time. As oil prices continued to rise during the 1970s and 1980s, the problem for Guyana was how to gain US dollars to pay for the ever increasing oil bill. Clearly, the focus was to achieve as high a trade surplus as possible. But Guyana was exporting primary commodities whose prices lagged far behind that of oil. It tried clamping down on imports and boosting exports in an effort to save money and improve the foreign reserves. Those combined efforts proved futile and it became obvious that Guyana could not earn its way out of an oil crisis that was not of its making.

The country had no choice but to turn to friendly countries for help. Guyana racked up a debt burden which it could not bear alone. It turned to the international financial institutions for help and got it. But their efforts alone weren’t enough to relieve it of the financial stress brought on by its high dependence on imported oil. Eventually many of its bilateral creditors stepped in and helped bring its debt burden under control by agreeing to forgive portions or all of the money that was owed to them. That benevolence came much later in its economic life. Apart from the debt problem, Guyanese suffered severe power outages and diminished public services. The infrastructure began to crumble and so did standards of behaviour among other things.

Oil matters

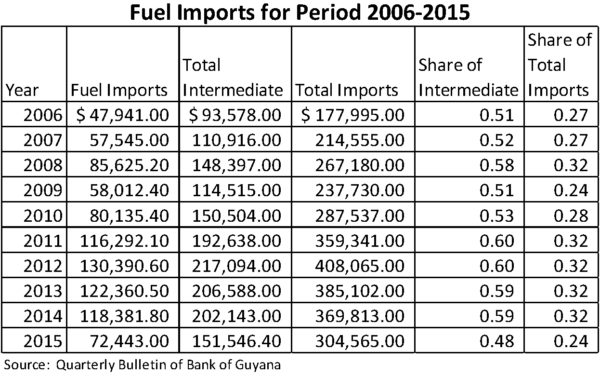

The extent to which imported oil matters to Guyana can be seen from the Table below. Oil for the most part is used as an intermediate good in the Guyana economy. It is usually shown in the national accounts tables as “Fuels and Lubricants” which are counted as intermediate imports. What that means is that these products are used as part of producing some other final product that the country consumes or exports. The data in the Table reveals how critical oil is to the production structure of the country. Over the last 10 years, oil represented more than half of the value of the goods imported into Guyana for use in the production process. Fuel is such a dominant import that the increase in the value of intermediate imports seems to rise in tandem with increase in the value of fuel imports. When one looks at the impact of oil on the overall import bill, it remains significant. It represented close to 30 per cent of the value of all imports.

Reduced influence

The increase in the price of oil tends to be driven by two factors none of which Guyana has control over. One factor was the level of output. Whenever the output level of oil dropped significantly, the price went up. Many times this occurrence was the result of decisions by the Organization of Petroleum Exporting Countries (OPEC) to adjust output levels in order to keep prices buoyant for member countries. This form of price fixing was criticized by many as distorting world trade. Managing prices through collusive action ran counter to free trade doctrine. While the practice is still possible, differences in political positions have made it increasingly difficult for OPEC countries to manipulate prices. Further, many non-OPEC members have increased production, thus reducing the market share of OPEC and the influence which it had over the setting of prices. Current variance in the policies of member countries have seen oil prices collapse from over US$100 per barrel to less than US$40 per barrel at times.

Another important factor is the behaviour of the US dollar. Oil, like all other primary commodities is usually priced in US dollars. How this happened is the subject of much speculation. However, some writers claim to have knowledge that it was the result of a deal between the United States of America and the Saudis around 1975 in which the latter agreed to export their oil for US dollars exclusively. Whatever the cause or motive, the behaviour of the US dollar matters to the price of oil. Whenever the value of the US dollar dropped, the price of oil went up to compensate for the loss in revenue that stemmed from the loss in value of the US dollar. Despite the importance of oil in the import size of Guyana, the level of demand for the commodity is insignificant by global standards. This meant that demand for oil by Guyana had no influence on world prices. Therefore, Guyana always had to worry about oil prices.

Different concern

But pretty soon Guyana would have a different concern about the output levels of oil and its price. Government officials suggest that Guyana could start producing oil in three to four years. At that point in time, Guyana would be able to start buying oil from itself. This would result in a significant savings to the country. By that time, Guyana would be able to save at least $30 billion, the value of oil that this writer forecasts that Guyana would need at that time. It becomes money immediately available to the government that could be put to alternative use. That would be money additional to what the government would receive from the export of the oil. It can enable the government to double the pay that the public sector employees received in 2015 or put a couple of bridges across parts of the Essequibo River. The excess revenue available to the government would impose some obligation on it also to review the suite of taxes that it utilizes to raise revenue.

Initial honeymoon

The initial honeymoon with oil revenues will eventually give way to the reality of depending on oil revenues to meet public expenditure. That is when Guyana will have to be concerned about the downward movement of oil prices. The risk here is that the government could become too dependent on oil revenues. That is a risk that would have to be managed properly. The overdependence of the country on oil output and exports should be avoided at all costs. The way to do this is to ensure that there is a commitment to the diversification of the economy and this objective should be encouraged without fail. It should be kept in mind that while oil revenues are often attractive, they do not carry the same level of value-added benefits as manufactured goods.

According to data published by the World Trade Organization (WTO), manufactured goods yield close to four times more revenue than fuels and mining exports. Industrial goods do even better by yielding nearly six times more revenue than fuel and mining combined. The direction of the trade balance remains important.

While liberalist economics might view that as splitting hairs since in their view the direction of the trade balance does not matter, it is real for maintaining balance in an economy. As evident from the WTO data, the more that a country could reduce dependence on primary commodities, the more income it could receive. It would also have the flexibility to create jobs that meet domestic and foreign demand. Consequently, Guyana should seek to avoid letting the oil sector alone dictate its future.

Not welcomed

Very often people ignore the fact that oil producing countries help to maintain global liquidity and contribute to the adjustment of global imbalances. While oil-producing countries have been able to play a positive role in the global economy, failure to control the oversized role of oil in the domestic economy can lead to disastrous economic consequences. This ailment often comes from what is called the Dutch Disease. An important initiative would be preventing the contraction of the Dutch Disease. This is a disease that can manifest itself in several ways. The most likely cause would be the large influx of foreign reserves. Higher foreign reserves can lead to higher imports of foreign manufactured goods. The gravitation of spending towards the foreign sector could spell trouble for domestic producers of similar or substitute products. This would not be a welcomed outcome.

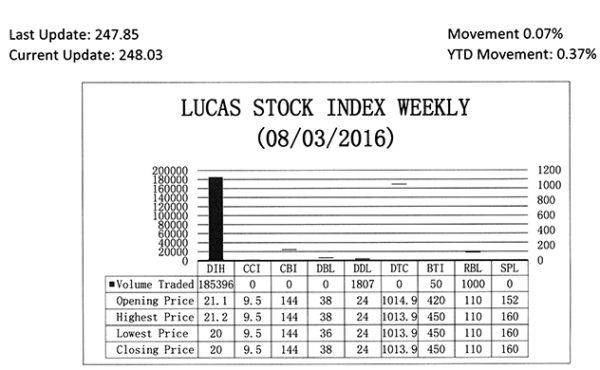

The Lucas Stock Index (LSI) edged up 0.07 per cent during the first period of trading in August 2016. The stocks of four companies were traded with 188,253 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) fell 5.21 per cent on the sale of 185,396 shares. The stocks of Guyana Bank for Trade and Industry (BTI) rose 7.14 per cent on the sale of 50 shares. In the meanwhile, the stocks of Demerara Distillers Limited (DDL) and Republic Bank Limited (RBL) remained unchanged on the sale of 1,807 and 1,000 shares respectively.