Expansion of markets

Like with everything else, the cooperative business model contains advantages and disadvantages. In a study done by Blundell and Bond, there was high praise given to the role that cooperative banks play in stimulating the growth of local economies. They pointed out that local cooperative banks could be effective in promoting local economic growth. The study that they did of such banks in France indicated that cooperative banks played a stabilizing role in the economies that they served and helped to maintain banking services in regions experiencing low growth, which eventually helped to contribute to future growth. While the study could not say that cooperative banks provided more advantages compared to conventional banks, it did however establish the positive impact on economic growth. The study further suggested that countries experiencing low growth might want to further develop this segment of finance.

No panacea

It should be clear from the aforementioned study that no one is saying that cooperatives are the panacea for the economic and social ills that are seen in countries around the world. Instead, cooperatives are recommended as an option that ought to be used where the traditional forms of private investment are not used. Quite often the failure of private investment to produce certain types of goods and services leads to governments intervening to produce the goods and services. But governments do not always produce the goods and services efficiently and their intervention could lead to lower welfare benefits than intended.

Key role

Cooperatives, on the other hand, have played a key role in the expansion of markets and the growth of some multinational corporations. The collective efforts of cooperatives worldwide account for US$2.6 trillion in sales. The revenues generated by cooperatives are significant. In a recent report, it was shown that the 300 largest cooperatives had combined sales of close to US$2 trillion. While a measure of sales to gross domestic product (GDP) is not the best metric to use, doing so gives one a sense of the value of cooperative societies. Their income was equivalent to about 5 per cent of world GDP. They make this sizable contribution because they are not always small enterprises as some people think they are and ought to be. However, it should be pointed out that, while the face of many foreign companies looks like investor-owned firms, their origins and ownership are often cooperative societies.

Perhaps, one of the most significant developments in cooperatives and global activities is the Society for Worldwide Interbank Telecommunications (SWIFT). This most popular and important electronic highway, on which trillions of dollars travel daily, is itself a cooperative society. SWIFT is owned by the banks that use its services to send and receive money from each other. The remainder of this article will consider the cases of CHS Inc of the USA and the Rabobank of the Netherlands.

Global agribusiness

CHS Inc. is a global agribusiness that is owned by farmers, ranchers and cooperatives across the United States. It brings together several cooperative groups which themselves formed other relationships that helped to grow and transform the enterprise. While identified as CHS Inc today, the entity started as a cooperative society in 1929 and over the years merged with other cooperative societies. The oldest cooperative in the group is the North Pacific Grain Growers that was formed in December 1929. Along the way, CHS formed a series of strategic alliances and joint ventures that enabled it to expand its market and product lines. For example, the oldest cooperative in the group merged with another cooperative in 1983 and created the Harvest States Cooperative. In 1998, Harvest States Cooperative merged with CENEX and gave birth to CHS.

Diverse portfolio

The company has a diverse portfolio which focuses on energy, grains and foods. CHS is now regarded as a Fortune 100 company that supplies energy, crop nutrients, grain marketing services, animal feed, food and food ingredients, along with business solutions including insurance, financial and risk management services to its customers. It operates petroleum refineries/pipelines and manufactures, markets and distributes Cenex brand refined fuels, lubricants, propane and renewable energy products. CHS Inc helps its customers, farer-owners and other stakeholders grow their businesses through the services that it provides to its domestic and global customers.

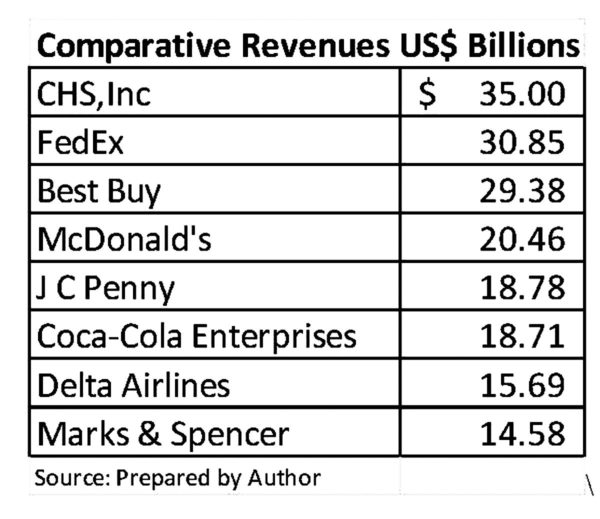

The use of the cooperative to bring about market and organizational change is reflected in the strength that CHS enjoys among investor-owned businesses. CHS is reported to own operations in about 30 countries around the world. In 2015, CHS had sales of US$35 billion which compare favourably to other privately owned companies as can be seen from the Table below.

TABLE 1

Complex organization

Another company of interest is the Rabobank. The Rabobank is headquartered in the Netherlands and is the biggest agricultural bank with operations in over 45 countries worldwide. The Rabobank is proud to report that it emerged from small agricultural cooperative banks that were set up by farmers and horticulturists in the late nineteenth century. Today, the Rabobank is a complex organization made up of 106 local banks in the Netherlands and several subsidiaries and affiliates around the world. The Rabobank has 8.6 million customers worldwide with 7.4 million in the Netherlands. With a population of about 16 million, nearly half of the population is a customer of the bank. The Rabobank has a membership of 2 million which is 28 per cent of its customer base and close to 13 per cent of the country’s population.

Value of cooperative

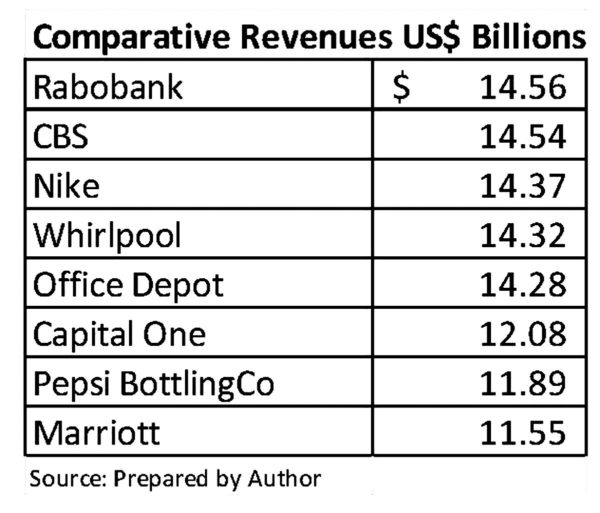

The value of the cooperative to market growth and economic stability is seen also in the market size and reach of the Rabobank. Table 2 below shows that the Rabobank compares favourably with some big names in the investor-owned firms.

TABLE 2

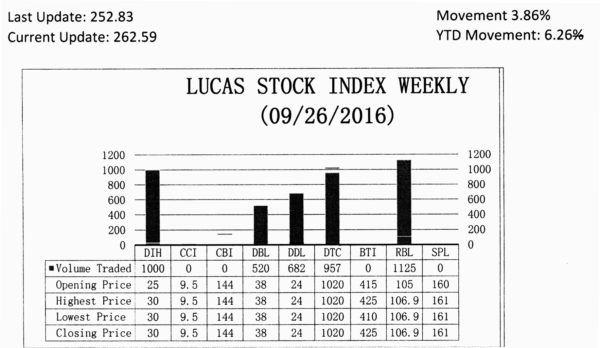

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose 3.86 per cent during the final period of trading in September 2016. The stocks of five companies were traded with only 4,284 shares changing hands. There were two Climbers and no Tumblers. The stocks of Banks DIH (DIH) rose 20 per cent on the sale of 1,000 shares and the stocks of Republic Bank Limited (RBL) rose 1.81 per cent on the sale of 1,125 shares. In the meantime, the stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 520; 682 and 957 shares respectively.