Summary information

In the Annual Report of the Bank of Guyana, readers can find a series of tables, one of which is entitled ‘Balance of Payments’. It is a table with summary information about foreign economic and financial activities that took place during the course of a given year. As simple as it looks, the data in the table tells many stories about Guyana and other countries around the world. This article seeks to tell the stories that are hidden in the numbers in the Balance of Payments (BOP). The stories include concepts about international trade, things that might incorrectly suggest misconduct by importers and exporters and the activities that influence the numbers. The attempt to reveal the stories is a risky venture because of the many complex issues that must be discussed in order to get the story out. This article therefore lives by the adage, it is better to try and fail than fail to try. The stories will be presented in a two-part series.

To appreciate the stories, one has to know what the Balance of Payments is all about and how it works. Having that information is important because many persons often think that the Balance of Payments is similar to a balance sheet that is prepared as part of the financial statements of a business. Part of this conceptual problem stems from the fact that both reports use debits and credits in arriving at the final numbers found in them. Others somehow believe that the common word balance means that the two statements serve the same purpose. Nothing could be further from the truth and people need to understand that the two statements are completely different things that serve completely different purposes.

Because of the amount and importance of the data that it is supposed to capture, the International Monetary Fund (IMF) has created a special manual to help countries record the data that goes into the Balance of Payments. The manual is voluminous and contains both definitional and conceptual issues as they pertain to what should be recorded in the Balance of Payments, how it should be reported and where it should be recorded. All three pieces of advice collectively help the Balance of Payments to serve the purpose for which it was intended, and that is to help a country to identify, monitor and correct external imbalances where necessary. And to help get the notion that the Balance of Payments is similar to the balance sheet out of one’s head, it must be remembered that balance sheets contain information about assets and liabilities and owners’ equity only. The Balance of Payments on the other hand contains a mixture of information about income, assets and liabilities.

Deriving the numbers

In its manual, the IMF defines the Balance of Payments as “a statistical statement that summarizes the economic transactions of an economy with the rest of the world”. This means that lots of things that happened between Guyana and the rest of the world were condensed into single numbers to represent the transactions of the country. For example, the figure that represents exports is an aggregation of the values of all the money received from the sale of all goods and services to overseas buyers. But the thought that had to go into deriving the numbers might have been very complex. The summary of exports, like all the other items in the Balance of Payments, contains valuable information about the Guyana economy to which this article now turns.

Merchanting

Among the stories found in the Balance of Payments is the complex thought that goes into arriving at the numbers that determine the export value. The single number for a given year simplifies the complex thought that go into deciding what are exports and what are imports. For example, the export value might be derived from an activity called merchanting. Merchanting is the purchase of goods from one foreign country by an importer who then sells the same goods to a different foreign country without the goods ever reaching Guyana.

On the face of it, the activity might look illegal and might even convey the impression that the person initiating the transaction was seeking to evade taxes. That is not necessarily the case, even though that might be a reason for using merchanting. It is a good business strategy that helps to keep costs low and profits high. At the same time, merchanting could be very tricky if transactions are not properly disclosed. Then, there are the issues of re-exports and goods in-transit. Re-exports involve goods that are imported into the country and then exported without undergoing any change in their original condition. Unlike merchanting where the goods do not have to pass through the country, to qualify as a re-export the goods must have entered the country and then left the country. On the other hand, goods in-transit is not included in the Balance of Payments and the reason is simple. The ownership of the goods never changed hands while in transit. Therefore, no one in Guyana could claim ownership of the goods.

Two different accounts

Apart from conceptual and definitional issues, another story about the Balance of Payments is that it contains two different accounts that appear unrelated to each other. At the top of the table is the current account and at the bottom of the table is the capital account. One might not be able to tell from merely looking at the title of the second group of accounts in the table that some financial transactions are recorded also in the section referred to as the capital account. In reality, the full name of the account is the Capital and Financial Accounts. It is within the two groups of accounts that other stories about the Guyana economy lie.

Current account

One can start with the current account. This account harbours information about three distinct groups of activities. There is the group called ‘Merchandise Trade’ which tells us of the things that we produce at home and sell overseas and how much money we get for doing so. It is what is recorded as exports in the current account. But some of our export revenue comes from activities that take place right in Guyana. When foreign ships dock at the ports in Georgetown and they buy goods and other services while they are in the ports that too is recorded as exports. What many of us did not realize was the things that crew members purchased for their personal use were never counted as part of exports. That is the advice found in the IMF manual. At the same time, we can see how much of the money that we earned from exporting our goods was used to buy things from other countries. The data shown below indicate that almost every year our exports are insufficient to pay for the things that we import.

Another thing that the current account does is to record the income that Guyanese earn from working abroad and that which they would have gotten from the investments that they made overseas. It also records the reverse set of transactions, that is, money that foreigners would have been paid for working here. It also includes investment income that they would have gotten from investing in Guyana. This is the reason that the figure is reported as a net figure in the Balance of Payments.

Two sets of income accounts

There are two sets of income accounts neither of which is obvious to the casual reader of the BOP table. One is referred to as the primary income account and the other is called the secondary income account. In the presentation of the Balance of Payments of Guyana, the primary income account is described as ‘Net Services’. The secondary income account is described as ‘Unrequited Transfers’. Not unlike the merchandise account, the primary income account tells us about the money that Guyanese work for abroad and the money that foreigners work for in Guyana.

In determining what goes into the primary income account, it is necessary to recognize that income is usually associated with the production process. The income that is produced through the production process is called the gross domestic product or GDP. To produce that income, businesses usually rely on things like raw materials and factory labour. That labour is usually captured in the value of goods and services that Guyana exports and imports. The income that appears in the primary income account is the income that is allocated from the GDP and is linked to what could be described as direct labour paid to foreign labourers and administrative costs by a business to its foreign employees. This income would include payment to foreign workers, foreign management staff and foreign support staff, payment of interest if loans were involved, dividends, and reinvested earnings. It would also include rental payment for the buildings used as offices, warehouses and factories made by foreign investors. Taxes and subsidies are accounted for also in the primary income account.

All the income described above could be found in the sub-section of the Balance of Payments table called ‘Factor Services’. Since factor services would be linked to foreign investment and Guyana has by far more inward foreign investment than outward foreign investment, the factor services balance is negative. (To be continued)

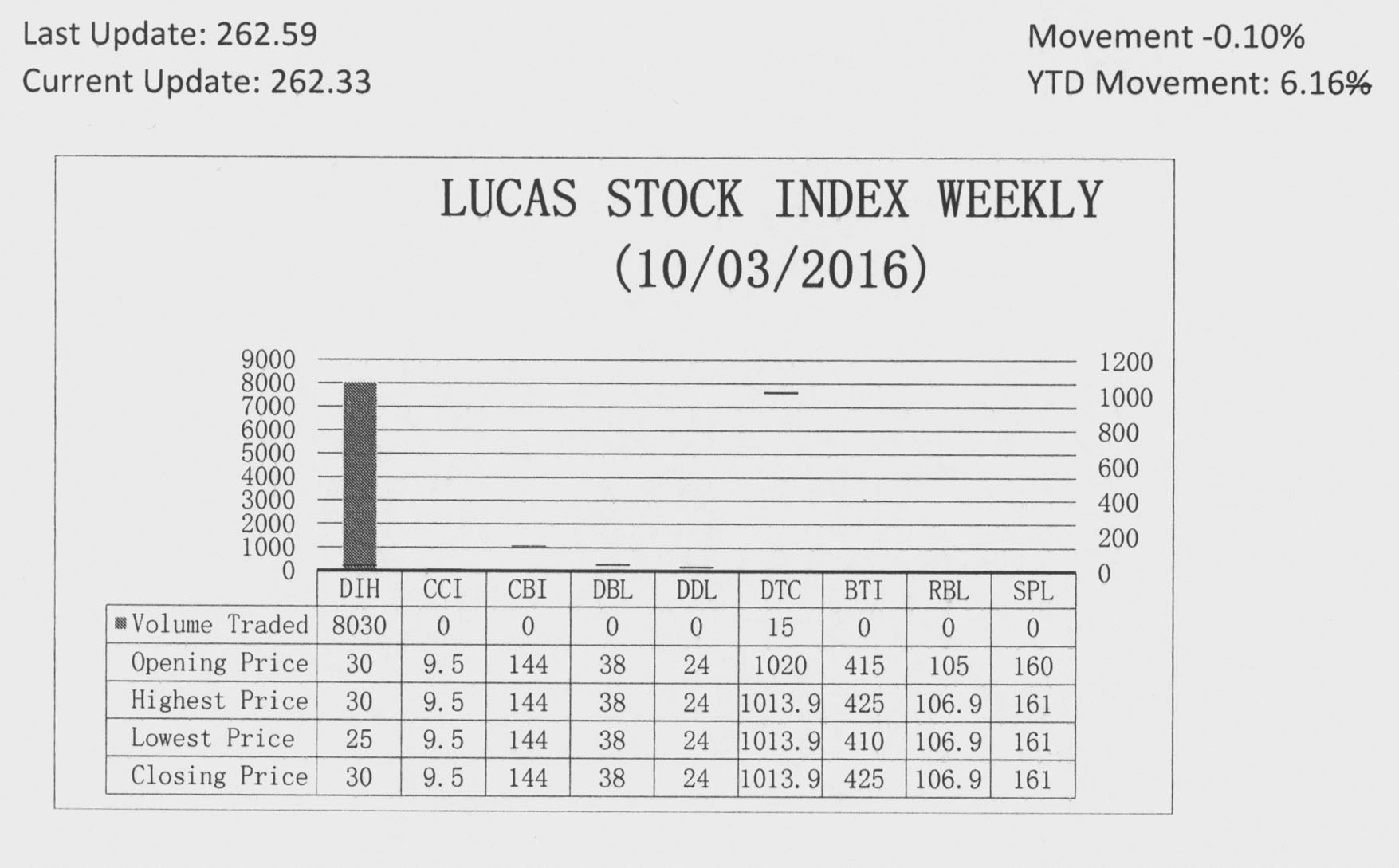

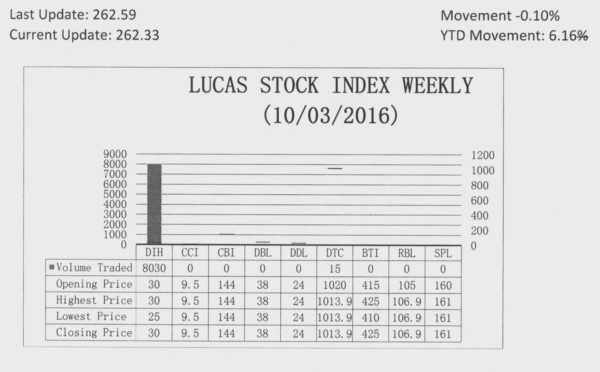

The Lucas Stock Index (LSI) declined 0.1 percent during the first period of trading in October 2016. The stocks of two companies were traded with only 8,045 shares changing hands. There were no Climbers and one Tumbler. The stocks of Demerara Tobacco Company (DTC) fell 0.6 percent on the sale of 15 shares while the stocks of Banks DIH (DIH) remained unchanged on the sale of 8,030 shares.