Last week, we discussed a few of the stories hidden in the Balance of Payments. The discussion started with a recognition that the BOP had two sections, one called the current account and the other referred to as the capital and financial accounts. In doing so, it also started examining the first part of the current account, namely the Merchandise Trade and one aspect of the primary income account, the factor services.

Within the Merchandise Trade section, it was observed that various business strategies could be employed to effect cross-border trade.

For example, there was the issue of merchanting which is the export of goods from one country to another without the goods reaching the country that initiated the transaction. On the face of it, the transaction looks nebulous, particularly since it often involves more than two countries before it is completed. However, it is agreed that ownership of goods can change hands without having to land in, or pass through, the country that initiated the transaction as long as all other conditions for changing ownership were satisfied.

Merchanting is actually a reflection of the process of globalization that enables several countries to contribute to the production of one product. It is also a consequence of the practice of outsourcing of certain activities.

Last week’s article also revealed that the primary income account was part of the Current Account that was titled Net Services in the Balance of Payments prepared by Guyana. That was income that came from labour, management and invested capital. In other words, it was income that was associated with the factors of production and that was recorded as factor services in the Balance of Payments.

The other item found under Net Services, “Non-Factor Services”, refers to services that are not connected to the transport or delivery of goods. The services connected to the transport of goods are accounted for under “Merchandise Trade”. The services under “Non-Factor Services” relate more to passenger transportation such as air and water transport of people, consultancies, information and communication technology services and travel for health reasons among others.

Gap-filler

The secondary income account is described as “Unrequited Transfers” which contains one of the most important gap-fillers in the “Current Account” of this country. Unrequited transfers include items such as aid from foreign governments, claims on non-life insurance, taxes paid and remittances sent home by Guyanese living abroad.

The remittances sent home by Guyanese living and working abroad play a very critical gap-filling role in the Balance of Payments. But, it also plays a very critical role in the lives of many Guyanese. Guyana imports more goods and services than it exports. This situation is reflected in a negative current account balance or a current account deficit.

In a sense, that deficit is like buying goods on credit and paying for them later. In order to make the payment, Guyana would have to find the money from somewhere.

Several factors are involved as we will see later in a discussion of the Capital and Financial Accounts. However, the amount that Guyana has to find to cover the current account deficit is reduced significantly by the remittances that it receives.

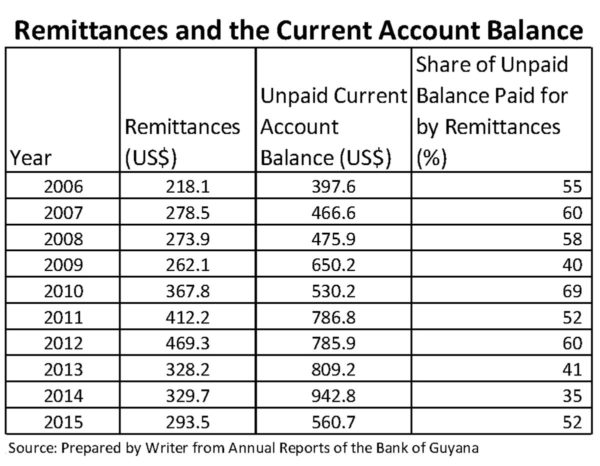

Consequently, remittances carry a special meaning and significance for the country. They represent one-sided transactions that involve giving by the Guyanese Diaspora. The Diaspora receives nothing in return for the money that it sends home. The Table 1 below contains data described in a manner that tries to make it easy to understand the powerful role that the Guyanese Diaspora plays in supporting the Guyana economy.

Critical

The data in the Table reveals that, for the last 10 years, remittances covered on average more than half of the current account deficit. In some instances, the contribution was as much as 60 percent of the outstanding balance. It was not until 2014 that the contribution of the Diaspora to the current account fell below 40 percent.

There is no clear reason that this should happen because they give with a kind heart. But one could also see from the Table that the Current Account balance was exceptionally large in 2014. Coincidentally or otherwise, remittances grow more or less at the same rate (3.4%) as the current account balance (3.8%). By maintaining parity in growth, remittances remain critical to the Balance of Payments.

Capital and Financial Accounts

Then, there is the capital and financial accounts. This is an interesting group of accounts because they serve to bring the Balance of Payments into balance. It is like remittances and other components of the unrequited transfers. It contains elements of generosity and plays a key role in balancing Balance of Payments. The capital account consists of capital transfers. Important components of the capital transfer are debt forgiveness and investment grants. Debt forgiveness is a mutual agreement between debtor and creditor to cancel a debt. It is intended to convey a benefit to a debtor. It is important for Guyanese to recognize that debt forgiveness is a big reason that Guyana’s external debt has come down significantly. Countries around the world decided to help Guyana by forgiving the debt it owed them. It is important to realize that Guyana did not produce or export itself out of its difficult debt situation. The debt cancelled by creditors had the same effect on the Balance of Payments like the money sent home by family and friends. It helped Guyana to keep more of the money that it earned rather than having to pay it out.

Investment grants

Investment grants are capital transfers made by international organizations or governments to assist recipients to meet certain needs of capital projects. This money is associated with projects that are partially or even fully funded by foreign governments or international organizations. They too have a positive impact on the foreign indebtedness of the country. Money that would have to be spent meeting imported goods does not have to be spent in that way.

Another story hidden in the Balance of Payments are the activities surrounding non-produced non-financial assets. The non-produced, non-financial assets refer to things like subsoil assets, water, the electromagnetic spectra (radio and TV spectra), possession of the right to use natural resources, goodwill, transferable contracts, brand names and trademarks. Capital transfers are transfers in which three things tend to occur. One is the ownership of the asset changes from one person to another. Two, it obliges one or both parties to acquire or dispose of an asset. Three, it refers to a situation in which a creditor forgives a liability. This action is also referred to as debt forgiveness.

The financial account records transactions that involve financial assets and liabilities that arise between residents and nonresidents. Typically, the financial account is classified according to the functional categories and financial instrument. In Guyana’s case, the emphasis is on functional classification. A key component of the financial account is the investment that comes to the country. This includes foreign direct investment and portfolio investment. Foreign direct investment is the one that lasts a long time and is identified as “Private Sector” in the Balance of Payments of this country. Attracting and keeping this type of investment are important goals since they help to pay for the deficit in the Current Account. But, it is also important for keeping the economy moving forward. The relevance of the foreign investment to the Current Account is established through the purpose of the investment. An investment that is export oriented would help to cut or even eliminate the Current Account deficit. Foreign investment that focuses on the domestic market brings benefits other than for the Current Account. The favourable impact of the foreign investment increases when it engages in value-added production. That the country has to use its foreign reserves continually means that the foreign investment is not having the desired impact. That is a story hidden in the Balance of Payments.

Nature and size of investment

The portfolio investment on the other hand is the short-term investment and has no attachment to the long-term future of the country. This type of investment tends to be transient and, unlike foreign direct investment, could result in larger outflows than inflows. While important, the frequency of movement of this type of capital leaves one uncertain of the condition of the “Current Account”. The nature of the investment is just as important as the size of the investment.

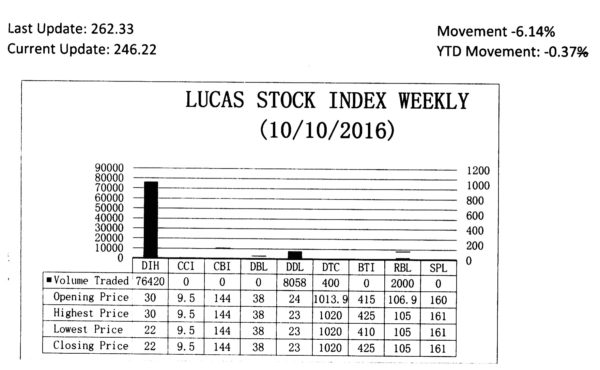

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 6.14 per cent during the second period of trading in October 2016. The stocks of four companies were traded with only 86,878 shares changing hands. There was one Climber and three Tumblers. The stocks of Demerara Tobacco Company (DTC) rose 0.6 per cent on the sale of 400 shares while the stocks of Banks DIH (DIH) declined 26.67 per cent on the sale of 76,420 shares. The stocks of Demerara Distillers Limited (DDL) also fell 4.17 per cent on the sale of 8,058 shares and the stocks of Republic Bank Limited fell 1.78 per cent on the sale of 2,000 shares.