Current Non-Interest Expenditure

The National Budget comprises of a number of elements. These are: statutory payments which are charges on the Consolidated Fund, including appropriations for constitutional bodies and officers; public debt payments of interest and principal; Ministries, Departments and Regions and Statutory bodies.

In this section, Focus looks at the current expenditure by the type of agency: Ministries, Departments, Regions and subsidies and contributions to local and international entities. These amounts are presented to the National Assembly as proposals and are debated, voted on and authorised in an appropriation act.

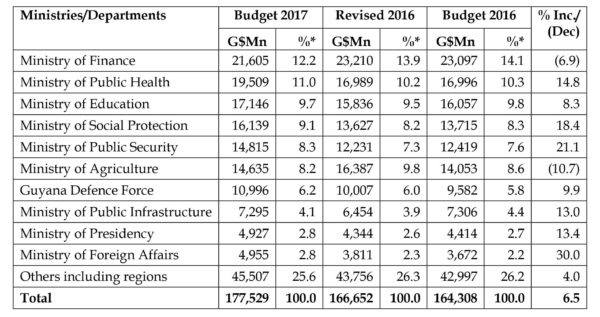

Central Government’s non-interest current expenditure (employment costs, statutory expenditure and other charges) for the year is budgeted at $177.5 billion which is 6.53% more than the revised 2016. The Ministries/ Departments with the most significant allocations and the largest changes between 2016 and 2017 are:

Source: Budget Estimates, Volume 1, Table 8.

While the Ministry of Finance consistently ranks at or near the top, the expenditure is not all incurred on behalf of the Ministry. It includes payments for GRA, its tax collecting agency, about ten other entities and the Linmine electricity subsidy which costs the State approximately $3 billion per year.

Capital Expenditure

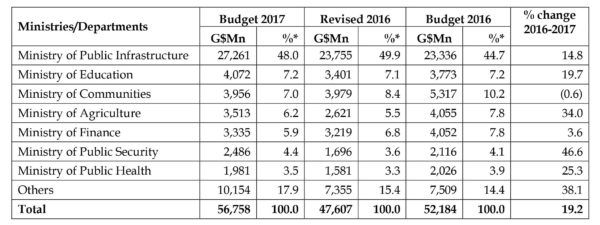

Central Government’s capital expenditure for the year is budgeted at $56.8 billion which is 19.2% above the revised 2016 and 22.7% of total 2017 expenditure. The Ministries/Departments with the most significant capital expenditure allocations are:

Source: Budget Estimates, Volume 1, Table 10.

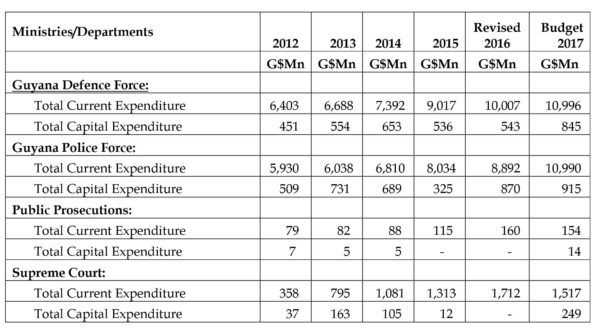

For this Focus, we present the funds expended on the principal law enforcement, maintenance and administrative bodies.

Ram & McRae’s Comments

- Comparatively, the Ministry of the Presidency gets 8.4 times the current allocation of the Office of the Prime Minister.

- Historically, the Guyana Defence Force has enjoyed higher level of funding than the Police Force. That gap is being narrowed in the 2017 budget with an increased funding to the Police of $2 billion over 2016 while the GDF receives only $1 billion more than it did in 2016.

With these additional resources much will be expected of the Police Force not only in addressing crime but also the fear of crime. The question also arises whether the country receives value for money expended on the Guyana Defence Force and whether there are sufficient controls in the GDF to ensure that expenditure and procurement are properly managed.

- During the Minister’s 2017 Budget speech, he mentioned that “money injected into sugar, in its current state, is money wasted.” It was also stated that “As currently structured, the industry would require Government’s support to the tune of $18.6 billion and $21.4 billion for the years 2017 and 2018, respectively.” The Government has held a Commission of Inquiry and has been in charge of GuySuCo for eighteen months. It needs to make a decision on the industry’s future.

- The Minister announced an allocation of $9 billion for the completion of the terminal buildings and the relocations of squatters to conclude the Cheddi Jagan International Airport (CJIA) Expansion project. Over $9.5 billion was spent on expansion of the run way and the commencement of works on the terminal buildings during 2016.

- There is a long list of entities refer to as statutory bodies which are financed in whole or in part by the allocations from the Consolidated Fund. These include the Public Utilities Commission, the Transport and Harbours Department, the National Liberty and the University of Guyana.

In addition to any specific legislation which establishes them, the entities are regulated under, and are required to maintain their books and accounts in accordance with the Financial Management and Accountability Act. The Act also imposes on the head of each budget agency the mandatory duty to manage the affairs of the budget agency in a manner that promotes the proper use of public resources and sets out specific task and functions to enable compliance.

In practice however, there appears to be no sanctions for those budget agencies which fail to provide audited financial statements in a timely manner.